The crypto market celebrated the fourth Bitcoin halving on April 20, however Bitcoin and crypto costs didn’t see a major rally or main upside. Traders are literally awaiting the primary crypto market expiry after the Bitcoin halving, which can be a month-to-month expiry and may trigger extra volatility. Deribit reported over $9.4 billion in crypto choices are set to expire this Friday.

$9.4 Billion in Crypto Options Expiry

The general optimism after the Bitcoin halving stays bullish and traders maintain Bitcoin worth above $66,000. As crypto market sentiment by the Fear & Greed Index signifies an uptick in sentiment, with a rise in sentiment from 57 (impartial) to 72 (greed), the market contributors are ready for some headwinds to disappear earlier than taking new positions.

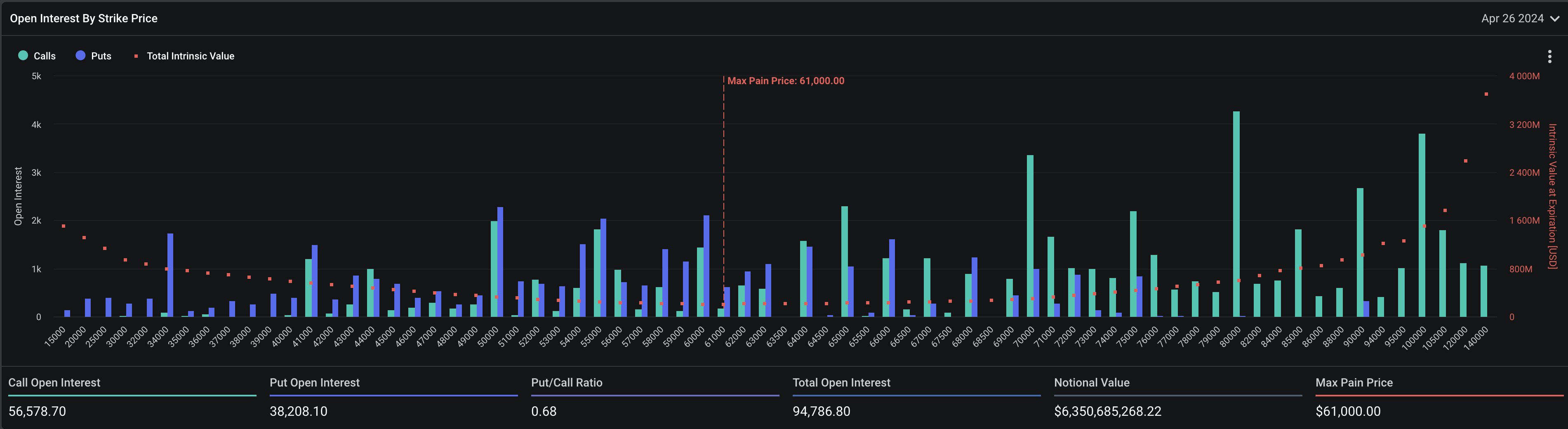

Over 94k Bitcoin choices of $6.3 billion in notional worth are set to expire on Friday. The put-call ratio is 0.68, indicating an increase in put choices lately as month-to-month expiry approaches. The max ache level is $61,000, beneath the present worth. The market can anticipate enormous volatility with a pullback in worth anticipated on the expiry day.

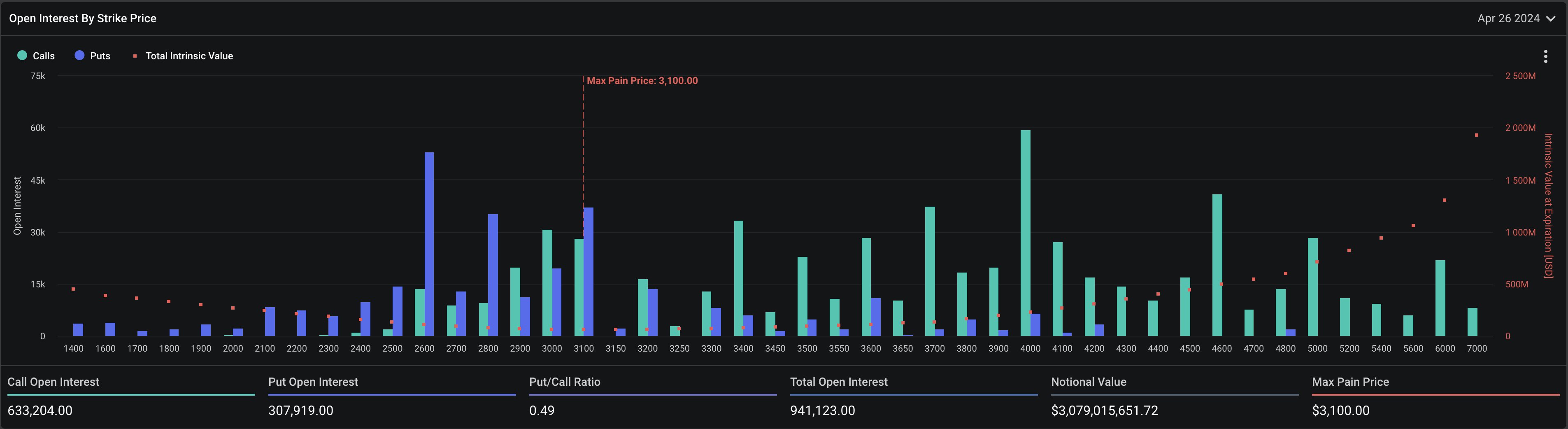

Moreover, 941k Ethereum choices of notional worth $3.1 billion are set to expire, with a put-call ratio of 0.49. The max ache level is $3,100, with the ETH price at the moment buying and selling above the max ache level at additionally greater than the present worth of $3,252.

The trades in the final 24 hours point out a rise in put open curiosity with a put/name ratio of 0.84. The worth might witness a decline to max paint level.

Notably, Deribit in a submit on X revealed that realised volatility has surged as BTC Volatility Index (DVOL) noticed a pointy enhance as crypto choices expiry comes close to.

Furthermore, on-chain analyst IT Tech has warned about potential liquidation in the short-term due to excessive leverage. He mentioned the CVD Perp reveals extra promoting orders have been stuffed, whereas CVD Spot is displaying some early indicators of demand. This will set a possible restoration in BTC worth for an enormous rally.

Also Read: Glassnode Founders Predicts Bitcoin Climbing Back to $72K Soon

Bitcoin Price Performance

BTC price motion stays risky in the previous 24 hours, with the value at the moment buying and selling close to $66,500. The 24-hour high and low are $65,864 and $67,148, respectively. Furthermore, the buying and selling quantity has decreased barely in the final 24 hours.

Total Bitcoin futures open curiosity throughout crypto exchanges has elevated by over 1% in the previous 24 hours, with the shopping for largely coming in the previous couple of hours. The BTC futures OI of 480.07K are price $31.96 billion.

A brand new whale gathered 500 BTC price $33 million amid consolidation for doubtlessly taking BTC worth to $70,000. However, U.S. PCE inflation information can be set to launch on Friday, preserving the buying and selling exercise flat.

US greenback index (DXY) fell just below 106, however nonetheless excessive as in contrast to earlier weeks. Also, the US 10-year Treasury yield (US10Y) has jumped to a 6-month excessive of 4.636%, placing strain on Bitcoin worth.

Also Read: Dogwifhat (WIF) Price Skyrockets Over 20%, Here’s Why

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.