A Bitcoin pockets has moved 57,586 BTC on-chain on Wednesday, as reported by an on-chain knowledgeable indicating a change in conduct of a short-term Bitcoin holder in response to BTC worth motion. The timing of the transfer is a priority because it comes earlier than the $9.4 billion in crypto options expiry, with realised volatility all of a sudden spiking. Is a crypto market selloff forward?

Short-Term Holder Moves 57,586 Bitcoin (BTC)

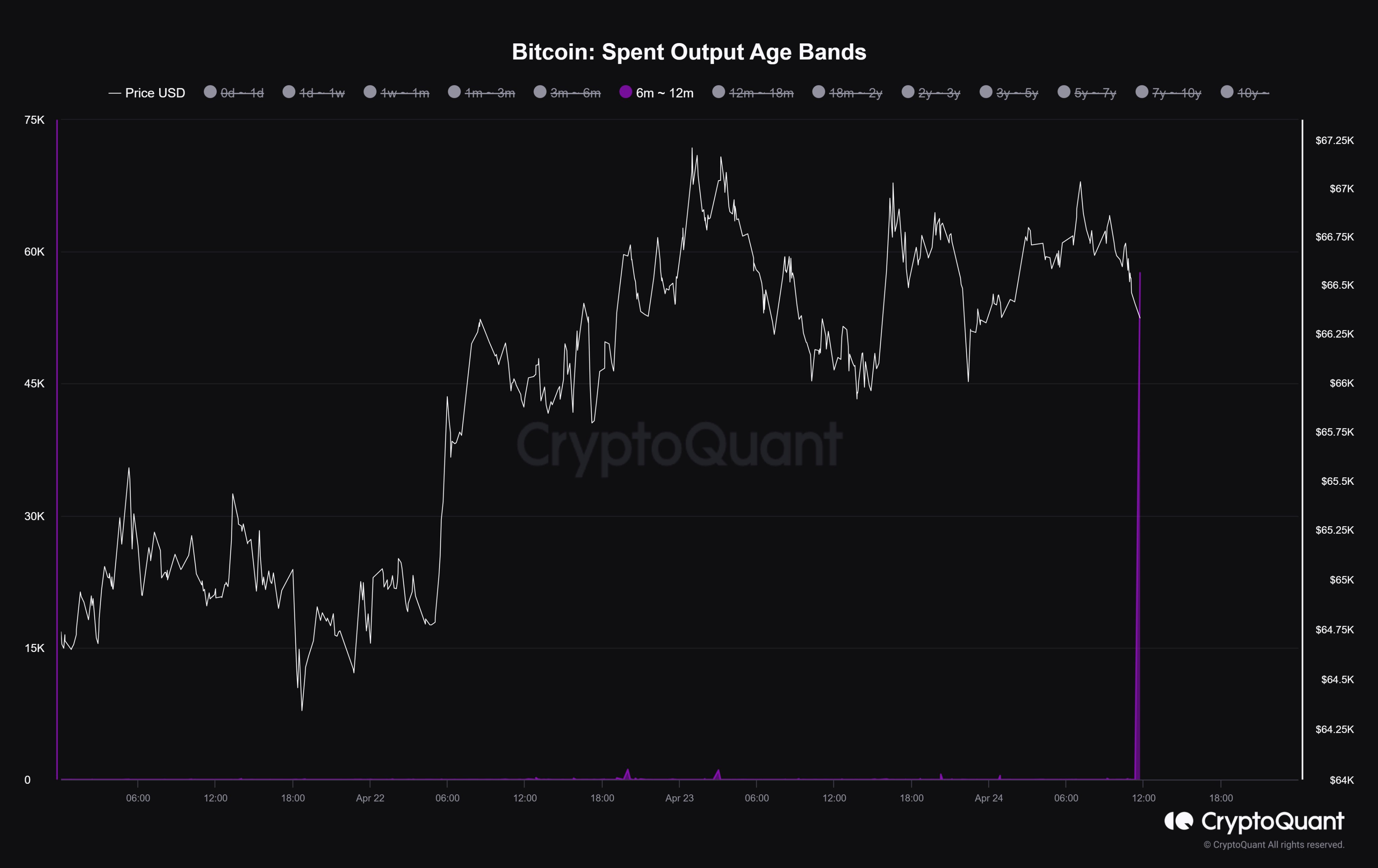

On-chain knowledgeable Maartunn revealed an enormous 57,586 BTC aged between 6 and 12 months transferred on-chain. The Bitcoin transferred is valued at roughly $3.81 billion.

These bitcoins held for a interval between 6 and 12 months increase questions of why somebody determined to maneuver such a lot of Bitcoin on-chain. These high-value transfers may nuke crypto market if it’s a promote transaction.

The motion will also be between Bitcoin between wallets or accounts on the blockchain for a number of functions together with funding technique and liquidation. However, there was no large change BTC worth at present, so it will not be for a selloff.

BTC price at present trades at $66,585, up almost 1% within the final 24 hours. The 24-hour high and low are $65,864 and $67,148, respectively. Moreover, the buying and selling quantity has declined forward of the month-to-month expiry and US PCE inflation knowledge on April 26.

Also Read: How To Trade This Week As $9.4 Billion in Crypto Options Set to Expire

What Actually Happened?

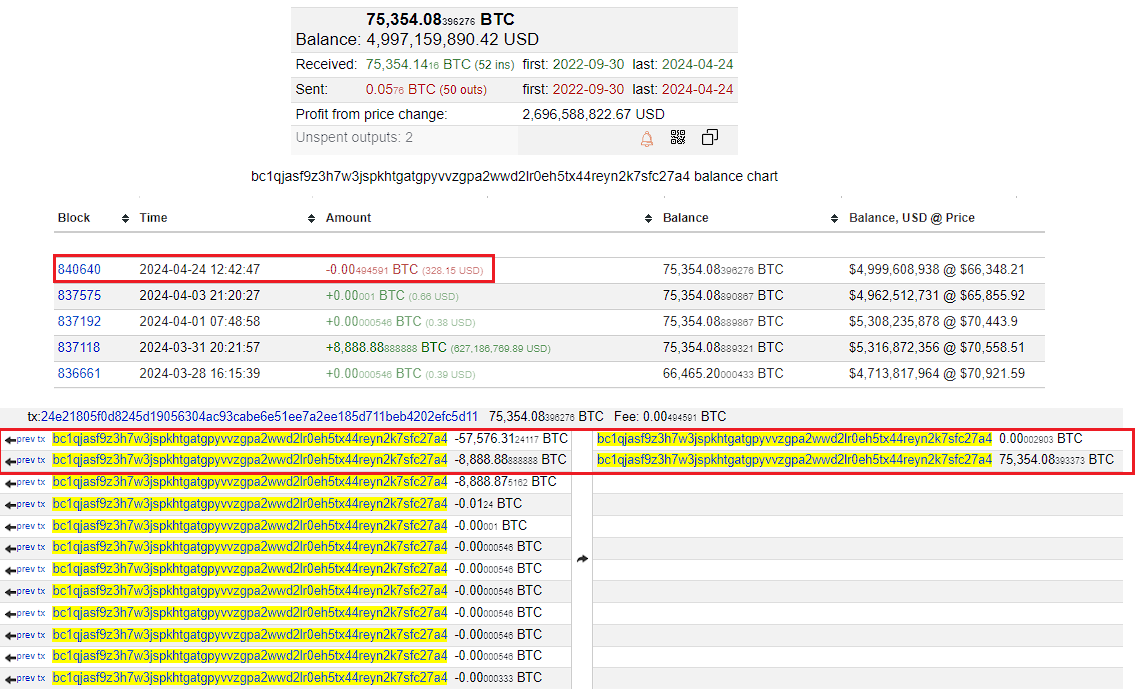

Bitcoin switch value solely $328 befell on block 840640 and the pockets belongs to Tether. According to 21Shares Tom Wan, bc1qjas is the Tether’s Bitcoin holding deal with. The deal with holds 75,354.08 BTC valued at $5.01 billion.

Thus, it was only a pockets and never a Bitcoin selloff by any whale or massive investor. The cause for pockets switch in the identical pockets stays unknown.

Also Read:

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.