Bitcoin News: Whale accumulation is the primary signal of an upcoming rally or upside transfer in a crypto and Bitcoin and a few altcoins are beginning to witness an increase in shopping for from whales. On Tuesday, a whale bought 500 BTC from crypto trade Binance as Bitcoin worth holds sturdy above the $66,000 help degree. Is a BTC worth rally to $70k imminent this week?

Bitcoin Whale Buys 500 BTC

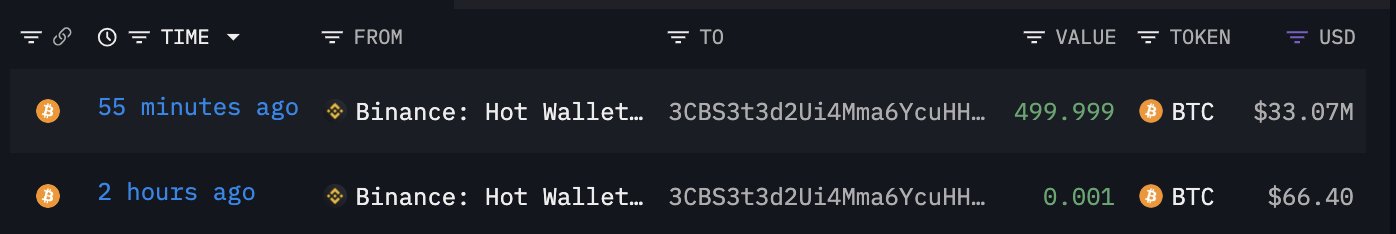

On-chain knowledgeable Lookonchain on April 23 revealed a big switch of 500 BTC from crypto trade Binance to a contemporary pockets handle. The giant switch of BTC sparked buzz within the crypto group, with hypothesis of a take a look at of BTC worth to its all-time excessive of $73,750.

“We noticed a fresh wallet withdrew 500 BTC ($33.07M) from) Binance,” stated Lookonchain. This is without doubt one of the giant transfers after Bitcoin halving that noticed transaction charge rising to all-time excessive of $128.45. Nearly, $2.4 million in charges have been paid for transactions in Bitcoin block 840,000 to mark the the halving, stated CryptoQuant CEO Ki Young Ju.

The giant Bitcoin purchase raised pleasure and doubts similtaneously specialists level to a slight fall in costs as month-to-month expiry looms this week.

Also Read: Pendle Price Eyes New All-Time High Above $7.5, What’s Behind the Rally?

Matrixport Hints At Slow Buying within the Derivatives Market

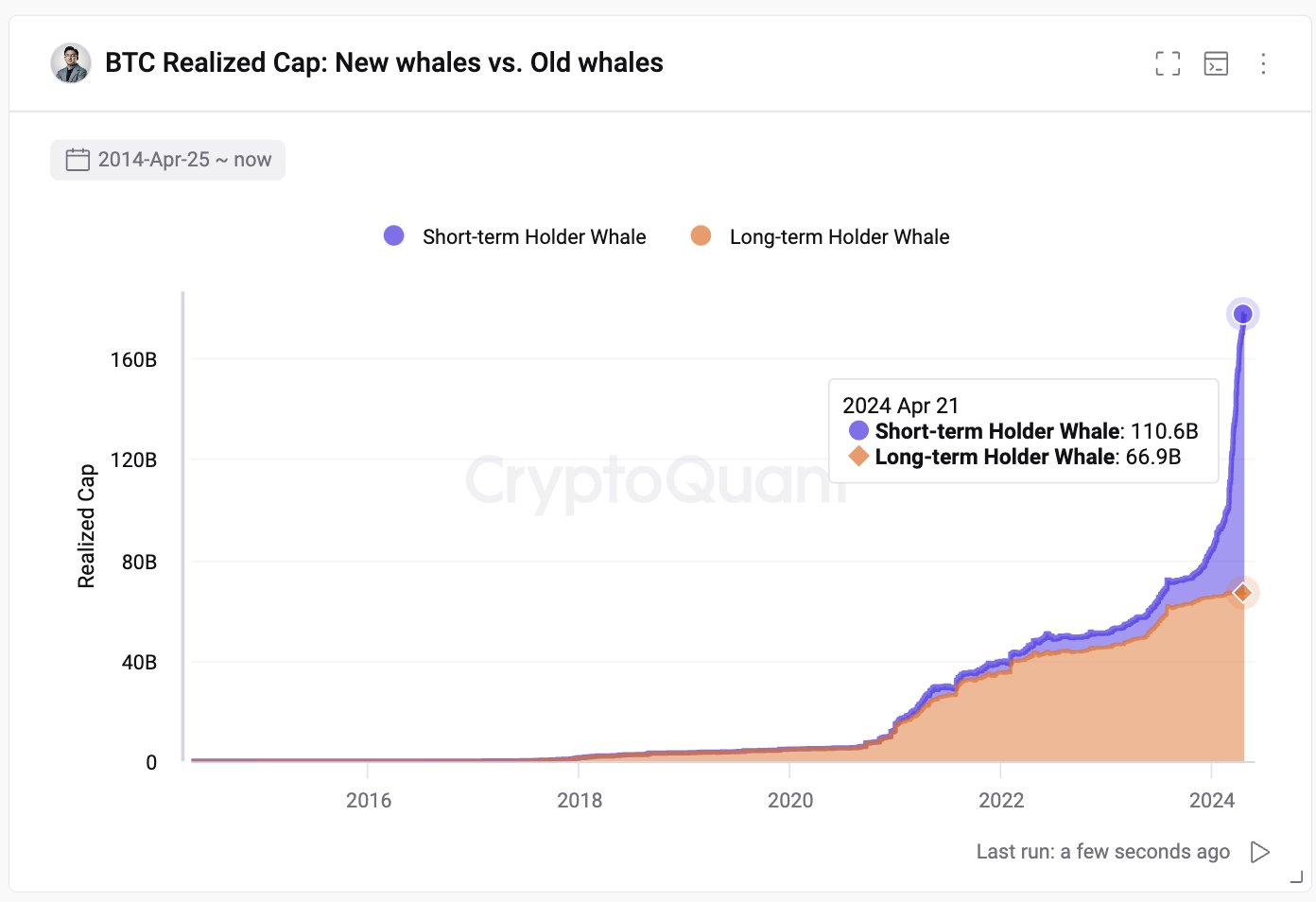

The new whales’ preliminary funding in Bitcoin are nearly twice the outdated whales’ cumulative complete, stated CryptoQuant CEO Ki Young Ju. Long-term holders are taking earnings and the probability of long-term traders capitalizing on worth ascents to appreciate earnings is excessive sufficient as extra variety of wallets are in revenue.

“A reason could be that futures traders have become uncertain about the upside in the current environment,” said Matrixport. CME BTC Futures Open Interest fell over 1% prior to now 24 hours, with a promoting seen in the previous few hours, as per Coinglass information.

BTC price is consolidating close to $66,000 as anticipated, with the value at the moment buying and selling at $66,009. The 24-hour high and low are $65,705 and $67,233, respectively. Furthermore, the buying and selling quantity has decreased barely within the final 24 hours.

Also Read: Ripple Accuses SEC of Violation, Lawyers Unveil End Date

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.