BlackRock’s iShares Bitcoin Trust (IBIT) has turn out to be the speak of the monetary world, recording a record-breaking 70 consecutive days of inflows. This unprecedented streak has propelled IBIT into the highest 10 exchange-traded funds (ETFs) for the longest day by day influx run, placing it in league with trade heavyweights. But is IBIT’s success an indication of a resurgent Bitcoin or just a fad capitalizing on present market tendencies?

Bitcoin ETF Landscape Redefined

The arrival of spot Bitcoin ETFs in January 2024 considerably altered the panorama for cryptocurrency funding. These ETFs, in contrast to their futures-based counterparts, enable traders to achieve publicity to the highest crypto asset’s value actions with out instantly proudly owning the cryptocurrency itself. This newfound accessibility has ignited a surge in investor curiosity, with IBIT main the cost.

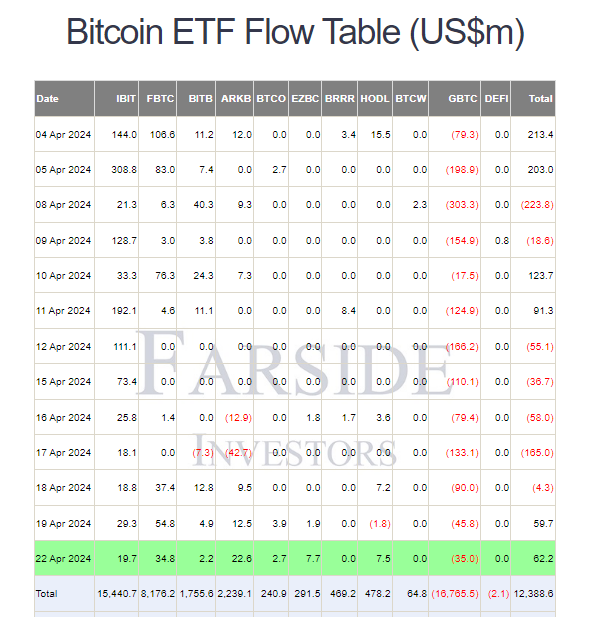

IBIT’s spectacular inflows have translated right into a warfare chest of over $15 billion price of Bitcoin. This rapid accumulation has monetary analysts predicting IBIT’s imminent dethronement of the Grayscale Bitcoin Trust (GBTC) because the world’s largest Bitcoin fund. GBTC, which operates on a distinct construction, has been experiencing constant outflows, additional strengthening IBIT’s place.

Source: Farside Investors

IBIT Vs. FBTC: A Battle For Bitcoin ETF Supremacy

While IBIT reigns supreme when it comes to complete holdings, a brand new challenger has emerged – Fidelity’s Bitcoin ETF (FBTC). Over the previous few buying and selling periods, FBTC has managed to outpace IBIT in day by day inflows. This neck-and-neck race highlights the rising competitors inside the Bitcoin ETF house.

However, IBIT enjoys a definite benefit – the backing of BlackRock, a monetary behemoth with almost $11 trillion asset portfolio. BlackRock’s popularity and attain might show instrumental in attracting additional funding in the direction of IBIT.

BTCUSD now buying and selling at $66.296. Chart: TradingView

Top Analyst Weighs In

Adding gas to the IBIT fireplace is Eric Balchunas, a famend ETF analyst at Bloomberg. Balchunas carefully displays the efficiency of ETFs and has been a vocal supporter of IBIT’s trajectory.

On social media, Balchunas celebrated IBIT’s nearing of the 70-day influx milestone, highlighting its potential to hitch the ranks of a number of the most profitable ETFs ever.

$IBIT influx streak at present at 69 DAYS. yet one more day and it strikes into Top 10 and ties $JETS (a streak I used to be equally as fascinated by) altho streak ending in the present day could be fairly hilarious, present monetary gods have humorousness through @thetrinianalyst pic.twitter.com/niDzfaKqgp

— Eric Balchunas (@EricBalchunas) April 22, 2024

Balchunas even in contrast IBIT’s feat to the spectacular 70-day influx streak achieved by the JETS ETF, which tracks airline trade firms. This comparability underscores the importance of IBIT’s achievement, notably inside the fledgling Bitcoin ETF market.

Is IBIT A Sustainable Investment Option?

Despite IBIT’s meteoric rise, questions linger concerning its long-term viability. The way forward for Bitcoin itself stays shrouded in uncertainty. The cryptocurrency’s risky nature and susceptibility to market fluctuations elevate considerations concerning the stability of Bitcoin-linked investments.

Additionally, regulatory hurdles and potential adjustments in authorities insurance policies might throw a wrench into IBIT’s progress trajectory.

Featured picture from Pexels, chart from TradingView

Source: Farside Investors

Source: Farside Investors