On-chain information exhibits that Ethereum transaction charges have dropped to their lowest degree since January, an indication {that a} backside might be shut.

Ethereum Transfer Fees Has Plunged As Network Has Gone Cold

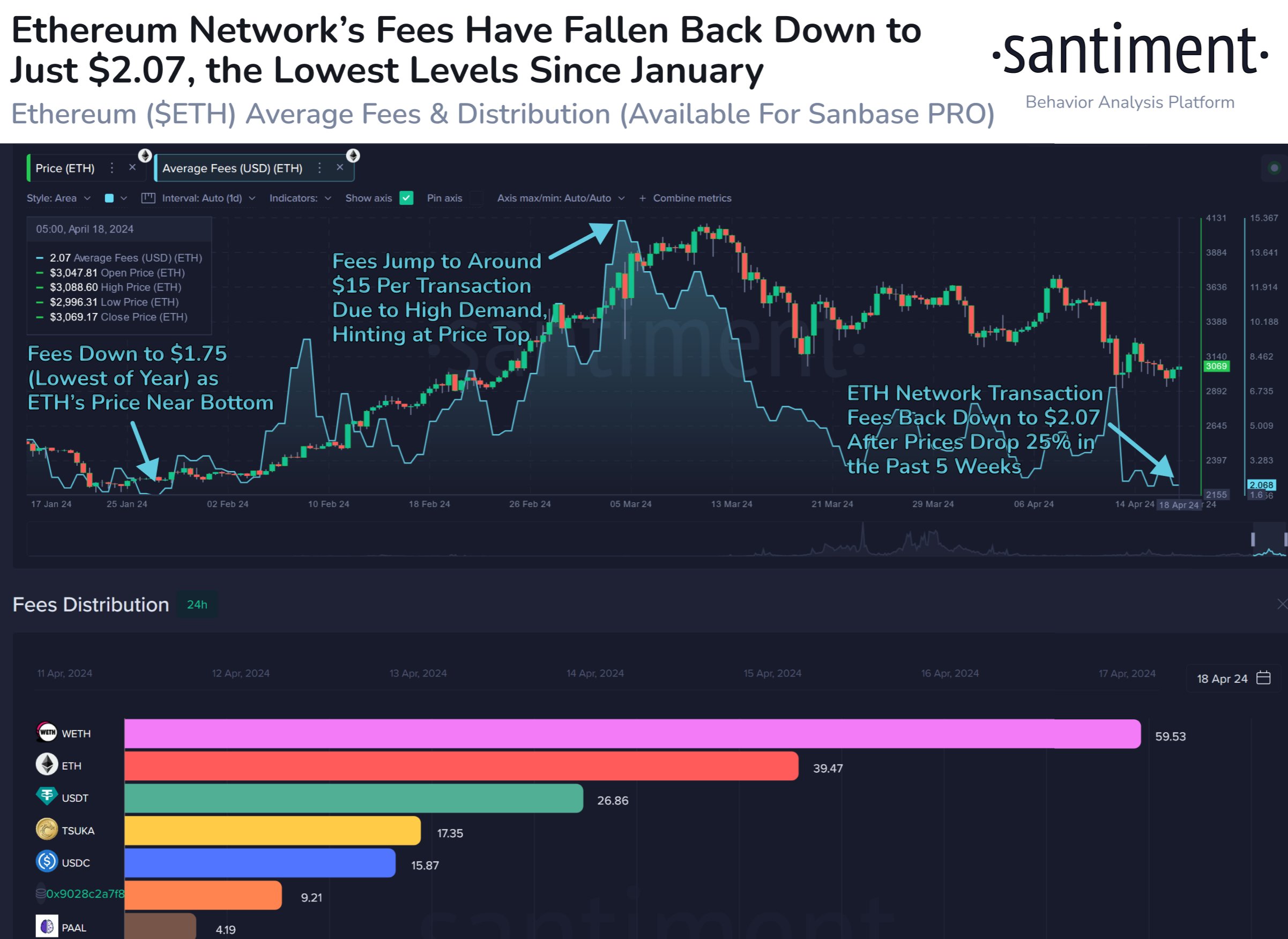

According to information from the on-chain analytics agency Santiment, Ethereum transaction charges have taken a notable hit just lately. The “transaction fees” right here seek advice from the typical charges (in USD) that senders on the ETH community are at the moment attaching to their transfers.

This metric’s worth typically displays the visitors situations the blockchain is witnessing. When many customers are making strikes on the community, the typical charges are likely to go up.

This is a results of the blockchain’s restricted capability to course of transactions, which might trigger the community to get clogged in periods of excessive exercise and trigger transactions to attend for some time.

Users who don’t need to cope with the wait occasions connect a excessive payment to their transfers, permitting the validators to prioritize their strikes. As many senders compete towards one another like this, the typical can rapidly blow up, and blockspace can develop into extra valuable.

When the Ethereum blockchain is observing little exercise, although, the transaction charges could stay low, because the customers wouldn’t have a lot incentive to go for any important charges.

Now, here’s a chart that exhibits the pattern within the Ethereum common charges over the previous few months:

The worth of the metric appears to have been fairly low in current days | Source: Santiment on X

As displayed within the above graph, Ethereum transaction charges have slumped just lately and hit a low of simply $2.07. This is the bottom worth that the metric has touched since January of this yr.

This cooldown in charges would suggest that the community exercise for cryptocurrency has dissipated. Traffic is often interlinked with the mood across the asset; as Santiment explains:

The market traditionally strikes between sentimental cycles of feeling that crypto goes “To the Moon” or feeling that “Crypto is Dead”, which can fairly often be noticed by means of transaction charges.

A lack of exercise on the community suggests the traders might not be too within the coin in the mean time. This, nevertheless, might not be dangerous information for the asset’s worth.

According to the analytics agency, low common charges are likely to coincide with bottoms in Ethereum, whereas peaks of the metric could happen alongside high formations.

As the chart exhibits, ETH’s worth was close to a backside in January when the charges final hit a low of $1.75. Similarly, the indicator spiked to $15 within the leadup to the highest final month.

It now stays to be seen if an identical sample will play out this time round, and whether or not Ethereum will now method a backside.

ETH Price

Ethereum had plunged beneath $2,900 earlier, however the asset appears to have rebounded as its worth recovered to $3,100.

Looks like the worth of the coin has been general shifting sideways just lately | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Santiment.web, chart from TradingView.com