Bitcoin worth fell under $60,000 right now after studies of Israel missile assault on Iran surfaced, which had been later confirmed to be Iran’s protection programs taking down drones. Meanwhile, Bitcoin and Ethereum costs rebound attributable to quick squeezes, however merchants brace for the final crypto choices expiry forward of this Bitcoin halving as volatility prevails in markets.

Bitcoin and Ethereum Options Worth $2.2 Billion Set To Expire

Crypto market stays risky forward of Bitcoin halving and as tensions escalate between Israel and Iran. Stock markets globally noticed inventory costs plunge as oil worth jumps on studies of Middle East conflicts.

Over 21,845 BTC choices of notional worth $1.35 billion are set to run out, with a put-call ratio of 0.63. The max ache level is $65,000, as per Deribit information. Most merchants have put bets at a strike worth of $60,000, believing that Bitcoin worth stays underneath promoting stress.

In the final 24 hours, BTC name quantity is greater at 16,450 than put quantity of 11,429. The put-call ratio is 0.69.

Meanwhile, 297,818 ETH choices of notional worth of $0.90 billion are set to run out, with a put-call ratio of 0.42. The max ache level is $3,125, which can be greater than the present worth of $3,045. This signifies ETH worth dangers liquidation if worth fails to rebound above max ache level the place most calls are.

In the final 24 hours, ETH name quantity are additionally greater at 386,859 than put quantity of 109,907. The put-call ratio is simply 0.28, however merchants stay skeptical over a possible drop in ETH worth additional.

Greeks.dwell revealed that main time period choices IVs are falling considerably regardless of excessive panic promoting taking down Bitcoin under the $60,000 mark and ETH under the $3,000 mark. There is a pointy drop in name possibility costs, with the month-to-month skew now at a brand new low within the present bull market. Adam from GreeksStay stated places are priced a lot greater than calls.

Also Read: Bitcoin (BTC) Price Cracks Under $60,000 As Iran-Israel Conflict Escalates, What’s Next?

Short Squeeze in Crypto Market Recovers Bitcoin Price

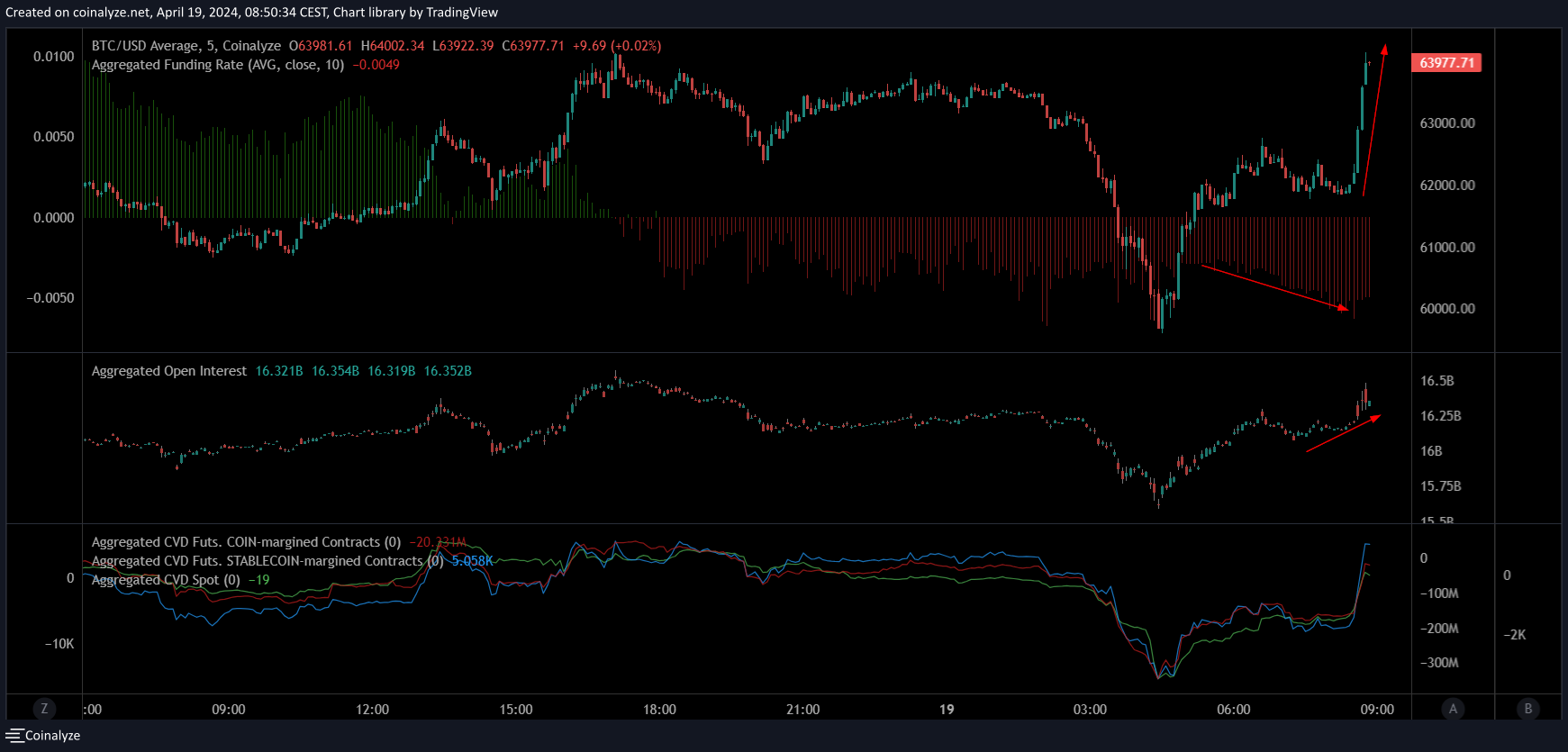

Bitcoin worth recovers like all the time forward choices expiry as damaging funding charges led merchants to take lengthy positions. On-chain analyst IT Tech reported a number of occasions of “short squeeze” occurring because the Bitcoin worth jumped over 4% to hit $65,000.

Popular analyst Skew famous that shorts are getting liquidated and now seeing extra curiosity from longs. He added that “Aggregate CVDs & Delta Spot driven rebound so far for the most part & large deltas / volume in perps due to unwinding of shorts.”

However, merchants ought to look forward to buying and selling within the US periods for additional readability in the marketplace course. Support ranges shall be watched out amid volatility.

US greenback index (DXY) fell barely to 106.11, however nonetheless excessive as in comparison with earlier weeks. Also, the US 10-year Treasury yield (US10Y) has jumped to a 6-month excessive of 4.622%, however fell to 4.606% amid flawed studies of assault. As Bitcoin strikes reverse to DXY and Treasury yields, an increase in each may cause a downfall in Bitcoin worth to $60K.

Also Read: Here’s Why Bitcoin Price and Altcoins Could Crash After Halving?

The offered content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.