Bitcoin’s Price Response to Powell’s Statements

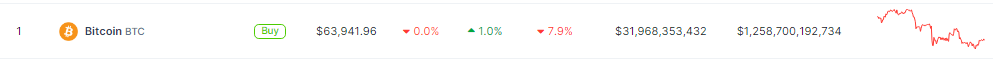

Bitcoin, the main cryptocurrency by market capitalization, noticed a virtually 8% decline in its value within the weekly chart, settling at roughly $63,941. This dip coincided with Powell’s statements relating to the long run trajectory of rates of interest.

Source: Coingecko

Historically, Bitcoin has exhibited sensitivity to rate of interest actions, with buyers usually deciphering increased charges as a sign of a much less favorable funding setting for riskier property like cryptocurrencies.

⚠️SUMMARY OF POWELL’S SPEECH AT THE WASHINGTON FORUM:

1. Powell warned that latest knowledge present lack of additional progress on inflation.

2. It will probably take longer than anticipated to attain confidence that inflation will return to 2%.

3. Powell is ready to depart charges at… pic.twitter.com/AB4BypYWLl

— Jesse Cohen (@JesseCohenInv) April 16, 2024

Investors and analysts had anticipated potential rate cuts in response to sturdy financial numbers, reminiscent of strong job progress and higher-than-expected retail gross sales. However, Powell’s assertion that charges might stay elevated for an extended length than beforehand anticipated dashed hopes of quick financial easing, impacting market sentiments.

BTC market cap now at $2.249 trillion. Chart: TradingView

Bitcoin’s Volatility Amidst Fed Policy Outlook

The response from the cryptocurrency market, significantly Bitcoin, underscores its volatility and susceptibility to macroeconomic components. While some buyers could view the crypto as a hedge in opposition to conventional monetary devices, its value actions in response to statements from central bankers spotlight the interconnectedness between conventional and digital asset markets.

Powell’s indication that charge cuts might not occur until later within the 12 months, if in any respect, has prompted a reevaluation of funding methods. The approaching Bitcoin halving occasion, which usually impacts provide dynamics and investor sentiment, has been overshadowed by bearish sentiment pushed by the Fed’s coverage outlook.

Market Uncertainty Surrounding Bitcoin’s Future

As the Federal Reserve’s subsequent assembly approaches on April 30 and May 1, buyers are intently monitoring developments for clues concerning the central financial institution’s future actions. Analysts have revised their forecasts, pushing again expectations for charge cuts and decreasing the chance of a number of cuts inside the 12 months.

The absence of point out of charge cuts in latest statements by Fed Vice Chair Philip Jefferson additional reinforces the cautious method adopted by the central financial institution. Jefferson emphasised the significance of sustaining tight financial coverage and reiterated the Fed’s dedication to data-dependent decision-making.

Powell’s remarks on the central financial institution’s financial coverage stance have reverberated throughout monetary markets, together with the cryptocurrency area. Bitcoin’s value response to Powell’s statements underscores its sensitivity to macroeconomic components and highlights the continued uncertainty surrounding its future trajectory.

Featured picture from Pexels, chart from TradingView