Crypto market noticed one other sudden market-wide selloff within the early US hours, with greater than $30 million liquidated in an hour. Bitcoin price slipped from $63,340 to a low of $61,600, extending the intraday drop to six%.

Ethereum price additionally briefly fell under $3,000 amid quite a few liquidation orders, triggered by weak sentiment forward of Bitcoin halving. Other prime altcoins together with BNB, SOL, XRP, DOGE, TON, ADA, and SHIB witnessed a 2-3% fall in costs inside an hour. Solana and Toncoin costs have tumbled 14% and 15% within the final 24 hours.

Why Bitcoin Price Fell Suddenly

The pre-halving correction in Bitcoin worth coupled with macro and geopolitical elements pulls down BTC worth, with no main shopping for from whales and enormous traders.

Coinglass information exhibits greater than $330 million have been liquidated throughout the crypto market amid this robust correction. Of these, $260 million lengthy positions have been liquidated and practically $70 million brief positions have been liquidated on Tuesday.

Over 109K merchants have been liquidated and the biggest single liquidation order occurred on crypto change OKX as somebody swapped ETH to USD valued at $5.97 million.

Bollinger bands (blue) indicator reveals BTC worth is in a draw back pattern, failing to interrupt above the 20-simple shifting common (orange). Ichimoku Cloud exhibits worth proceed to maneuver underneath assist and the promoting strain is rising as pattern reversed, with the cloud widening.

Also Read: BlackRock Co-founder Predicts Market Comeback

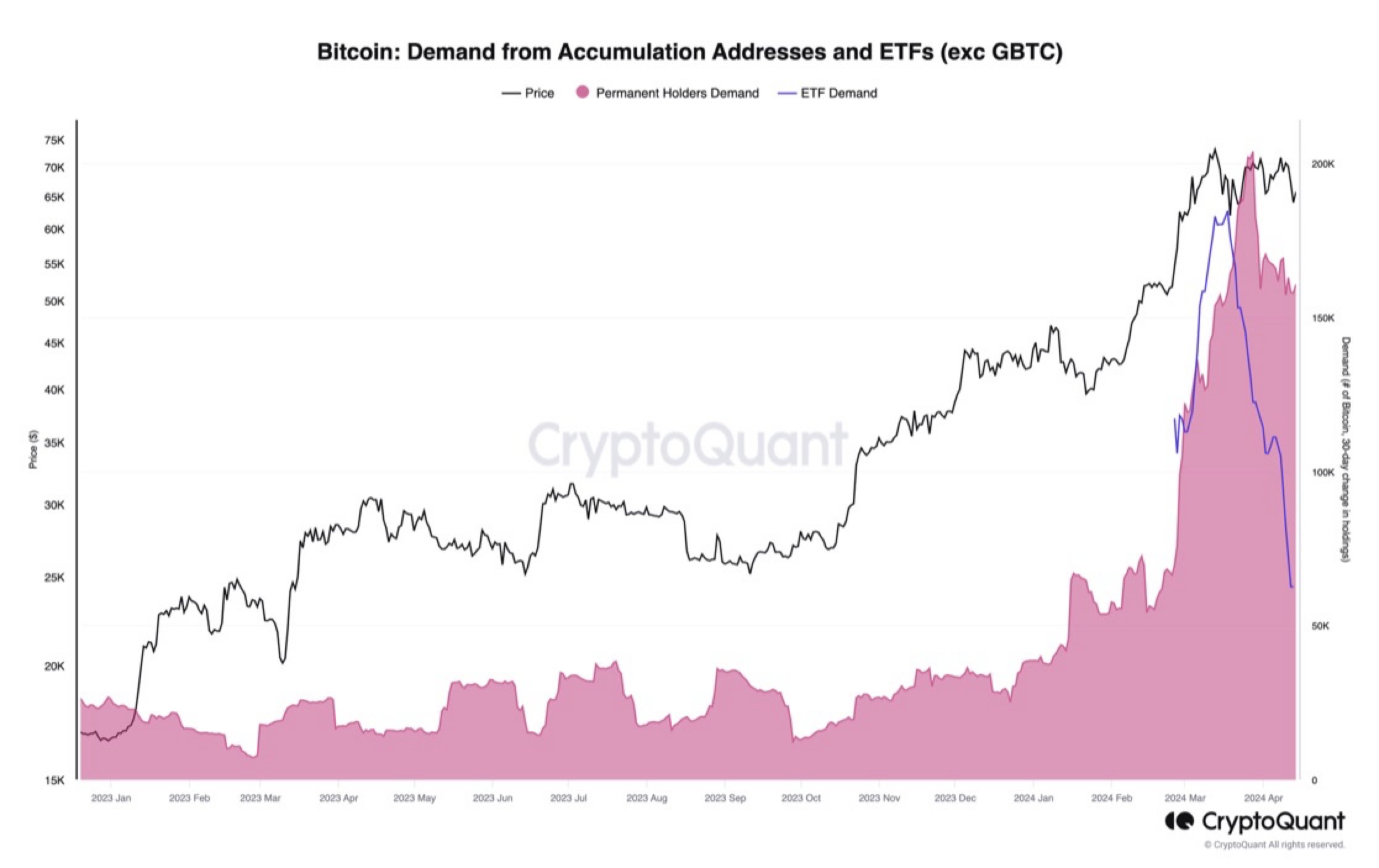

CryptoQuant head of analysis Julio Moreno joined different specialists corresponding to analyst Markus Thielen to precise bearish sentiment creating on BTC. “Bitcoin demand growth has slowed down significantly, both from ETFs and other permanent holders,” mentioned Moreno. Bitcoin demand from accumulation addresses and ETFs has pale forward halving.

Analyst Predicts A Fall to $55K

Popular analyst Michael van de Poppe predicts a $55K degree is probably going as BTC worth holds up on assist after a decrease timeframe rejection. However, he believes Bitcoin will maintain close to present ranges and begin a gradual upward momentum. The bearish divergence stays legitimate as consolidation for the post-halving rally builds up.

The international macroeconomic occasions brought on US greenback index (DXY) to climb above 106.23, persevering with to rise larger. Whereas, the US 10-year Treasury yield jumped to a excessive of 4.663% at the moment on open. As Bitcoin strikes reverse to DXY and Treasury yields, an increase in each DXY and 10-yr treasury yield has brought on a sudden fall in Bitcoin worth under $62k, triggering a crypto market selloff.

Also Read: Ripple Vs SEC Lawsuit — Settlement Debates & XRP Price Fall Concerns

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.