Bitcoin value has dropped greater than 17% forward of Bitcoin halving, the most-awaited occasion of the 12 months. Experts have identified totally different causes for the drop together with historic pre-halving drop, repricing of US Fed rate of interest reduce expectations, and on-chain information. Top analyst Markus Thielen believes a subsequent week’s information is extra essential for markets than Bitcoin halving.

Bitcoin Correction to Continue Next Week?

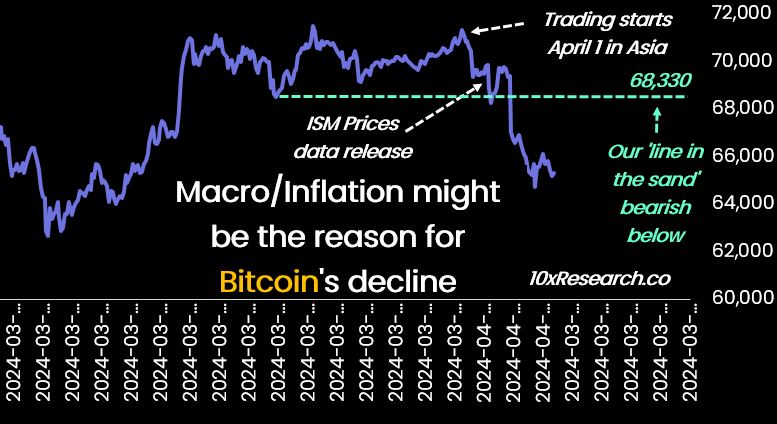

After an pressing replace to its purchasers that Bitcoin and Ethereum are breaking essential assist ranges, Markus Thielen, CEO of crypto analysis agency 10x Research, in a brand new report reveals a key occasion subsequent week to trump Bitcoin halving’s affect.

Crypto returns are sometimes outlined by two vital elements – the cycle and the macro atmosphere. Bitcoin has a four- 12 months cycle and macro elements have actually impacted BTC value course.

In Oct 2022 when Markus Thielen was at crypto companies supplier Matrixport, he forecasted backside in Bitcoin and BTC value prediction of $63,000 in March earlier than Bitcoin halving. Their fashions predicted a pointy decline in CPI inflation that might trigger an enormous rally in Bitcoin and tech shares.

“Although adjustments in progress, inflation, and central financial institution insurance policies didn’t affect Bitcoin crypto costs for the final twelve months, these macro elements would possibly now be probably the most crucial once more, says Markus Thielen.

As CoinGape reported merchants pared some bets after a stronger-than-expected ISM manufacturing PMI, contemplating the Fed will ease financial coverage in June. The US greenback index (DXY) climbed over 105, the best degree since mid-February as a result of ISM manufacturing PMI information. Moreover, the US 10-year Treasury yield additionally elevated to 4.389%, its highest degree since November, and Bitcoin strikes in the other way to DXY and the 10-year treasury yield. Thus, macro elements have now turned essential for predicting Bitcoin value course.

Also Read: BitMEX’s Arthur Hayes Predicts Ethena (ENA) Rally To $10

CPI Data Due Next Week More Crucial

U.S. Bureau of Labor Statistics to launch Consumer Price Index (CPI) information for March, which Thielen believes is extra essential than Bitcoin halving. The CPI rose by 3.2% year-over-year in February, following a 3.1% improve in January and barely exceeding the market consensus of three.1%. CPI information launch subsequent Wednesday, April 10 is essential as PCE and PPI information additionally got here greater just lately.

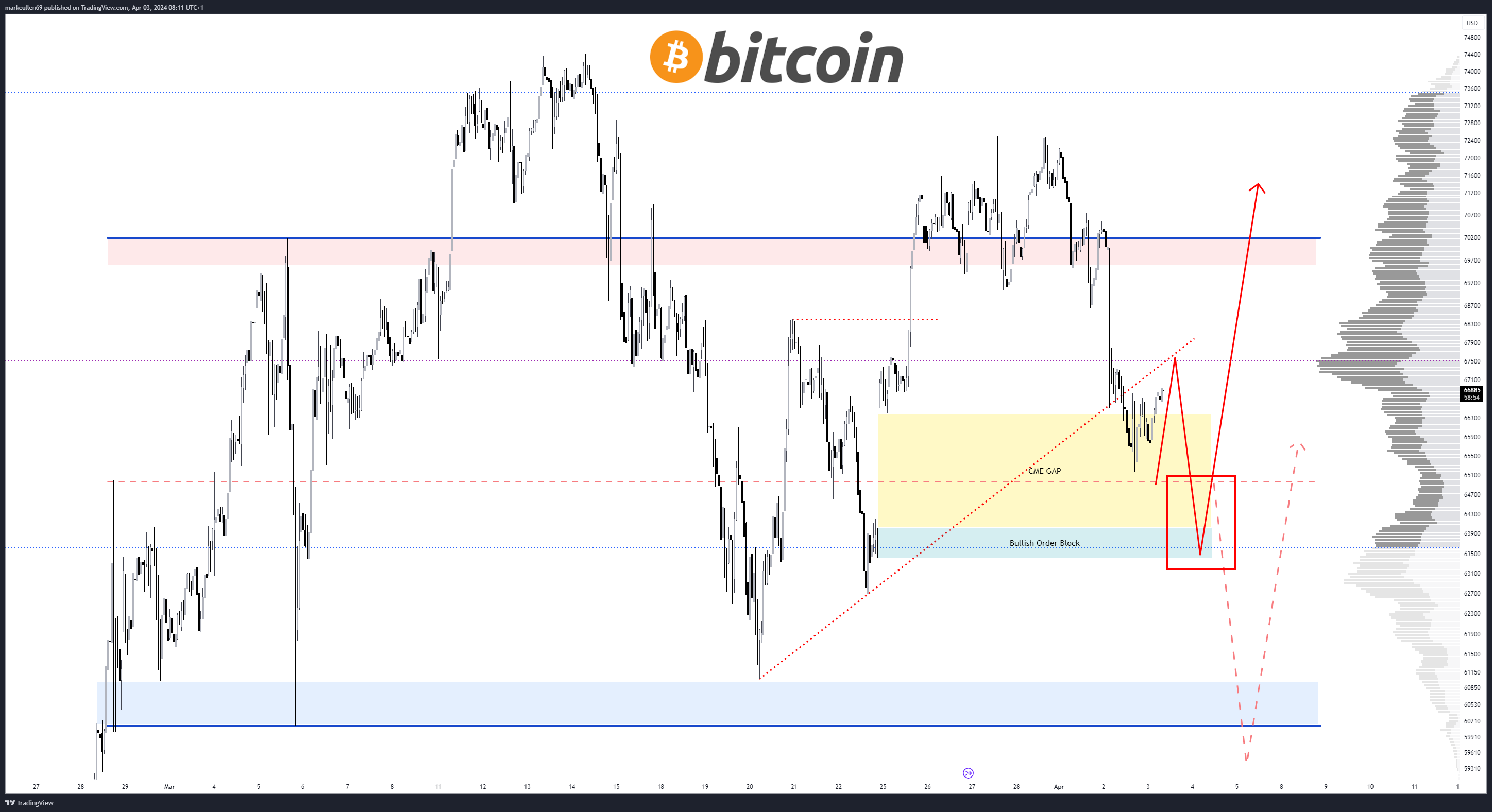

10x Research predicts BTC value to fall again to $62,000 and ETH value to $3,100 amid an absence of buying and selling volumes. Traders should keep watch over main ranges for Bitcoin at $68,330 and Ethereum at $3,460. Moreover, Bitcoin has a CME hole to shut close to $63,500 for bullish order ebook. BTC price presently trades at $66,386 and ETH price is buying and selling at $3,342, on the time of publishing.

#Bitcoin stock, together with paper BTC, continues to pattern the suitable method for long term bullishness.

I’m trying ahead to May, as soon as we clear the halvening volatility. pic.twitter.com/8OZG3AScBu

— Willy Woo (@woonomic) April 3, 2024

Also Read: XRP-Linked Flare Network (FLR) Open Interest Shoots 45%, Here’s Why

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.