Bitcoin (BTC) is poised for a possible surge after forming a bullish technical sample and attracting a wave of institutional funding. The world’s main cryptocurrency not too long ago surpassed the $70,000 mark, setting the stage for a potential breakout that would eclipse its present all-time excessive of $73,750.

This optimistic outlook comes from analyst Ali Martinez, who recognized a bull flag sample on Bitcoin’s 4-hour chart. This technical indicator sometimes follows a big worth improve and signifies a consolidation interval with a slight downward pattern. However, the lowering buying and selling quantity throughout this part suggests a brief pause reasonably than a reversal, probably resulting in a renewed uptrend.

Validating The Bull Flag Pattern: Bitcoin Consolidation Phase Analysis

Bitcoin’s latest dip under $61,000 served as a testing floor for this principle. The cryptocurrency demonstrated resilience by rebounding into the $67,000-$70,000 vary, solidifying the potential validity of the bull flag sample. This consolidation part is essential for market contributors to reassess their positions and gauge total investor sentiment.

#Bitcoin seems to be breaking out of a bull flag on the 4-hour chart! If $BTC holds above $70,000, we may see a surge of almost 10% to a brand new all-time excessive of $77,000! pic.twitter.com/MPVB70p9DU

— Ali (@ali_charts) March 28, 2024

The latest dip wasn’t essentially a trigger for alarm, defined Martinez. In truth, it may very well be interpreted as a wholesome consolidation that strengthens the muse for additional development.

Beyond technical evaluation, a big shift in Bitcoin’s possession construction is fueling optimism. The long-awaited launch of spot Bitcoin Exchange Traded Funds (ETFs) within the United States has opened the door for institutional traders. These professionally managed funds, backed by main monetary establishments, are estimated to carry a mixed 5% of the overall Bitcoin provide.

Total crypto market cap is presently at $2.545 trillion. Chart: TradingView

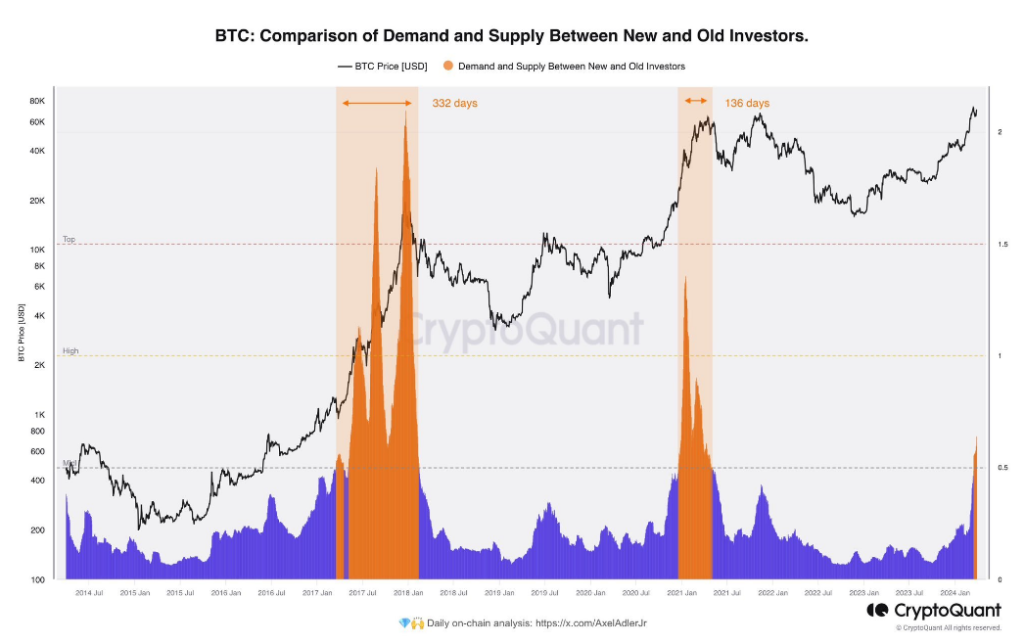

On-chain knowledge additional corroborates this institutional inflow. CryptoQuant, a blockchain analytics agency, experiences a deviation from previous bull cycles. Traditionally, Bitcoin possession flowed from present massive holders (“whales”) to retail traders. However, the present market cycle seems to be witnessing a switch from these whales to new whales – conventional monetary establishments.

Bitcoin’s Bullish Price Predictions

The inflow of institutional capital has emboldened some analysts to make bullish worth predictions. While Martinez shunned providing a particular timeframe for the anticipated breakout above $73,750, others are extra forthcoming. Optimistic forecasts vary from $100,000 to $150,000 for Bitcoin by the top of 2024, with some even predicting a staggering worth of $500,000 by 2025.

Related Reading: Fantom: Market Slowdown Chops Off 10% From Gains – Here’s Why

However, specialists warning in opposition to blindly following such excessive predictions. The cryptocurrency market stays inherently unstable, and technical evaluation will not be a foolproof technique for guaranteeing future worth actions. The long-term affect of institutional involvement on market dynamics can be but to be totally understood.

Despite these phrases of warning, the confluence of a bullish technical sample and a surge in institutional funding has undeniably created a way of pleasure surrounding Bitcoin. As the world’s main cryptocurrency continues its ascent in direction of uncharted territory, all eyes are on whether or not it might probably certainly break new floor and set up a brand new all-time excessive.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal danger.