Major occasions for the crypto market on Friday will decide the route of the market in the following coming days, forward of Bitcoin halving. The crypto will witness the most important Bitcoin and Ethereum choices expiry, main crypto derivatives alternate Deribit to settle over $15 billion in BTC and ETH choices.

Moreover, the U.S. Bureau of Economic Analysis will launch the U.S. Federal Reserve’s (Fed) most popular inflation gauge PCE and core PCE. Experts estimate inflation to chill additional however, the annual worth could shock the market. U.S. Federal Reserve Chair Jerome Powell to additionally converse on macroeconomics and financial coverage on March 29.

Bitcoin and Ethereum Options Monthly and Quarterly Expiry

Traders are bracing for month-to-month and quarterly expiry, which is the largest crypto expiry in historical past. The Crypto Greed and Fear Index has dropped to 80 (excessive greed) from 83 in the final 24 hours, indicating a drop in shopping for earlier than expiry and PCE inflation information.

Deribit mentioned this Friday marks one of many largest expiry in crypto derivatives alternate’s historical past as $9.5 billion BTC choices open curiosity out of $26.3 billion will expire. Moreover, $5.7 billion ETH choices open curiosity out of a complete of $13.2 billion will expire on March 22 at 8:00 AM UTC. The market might see large shopping for throughout post-expiry, with merchants eyeing a brand new all-time excessive for BTC and ETH costs.

Furthermore, $465 million in BTC March Future and $230 million in the March ETH future will expire, which is roughly $700 million of $1.9 billion.

Notably, 135K BTC choices of notional worth $9.5 billion are set to run out, with a put-call ratio of 0.85. The max ache level is $51,000, indicating large volatility is anticipated amid large supply and reshuffling of positions. Volatile worth actions are all the time anticipated throughout choices expiry, however optimistic sentiment to possible drive upward momentum in BTC worth to $75K.

BTC price at present buying and selling at $71,200, up 2% from the 24-hour low of $68,381.

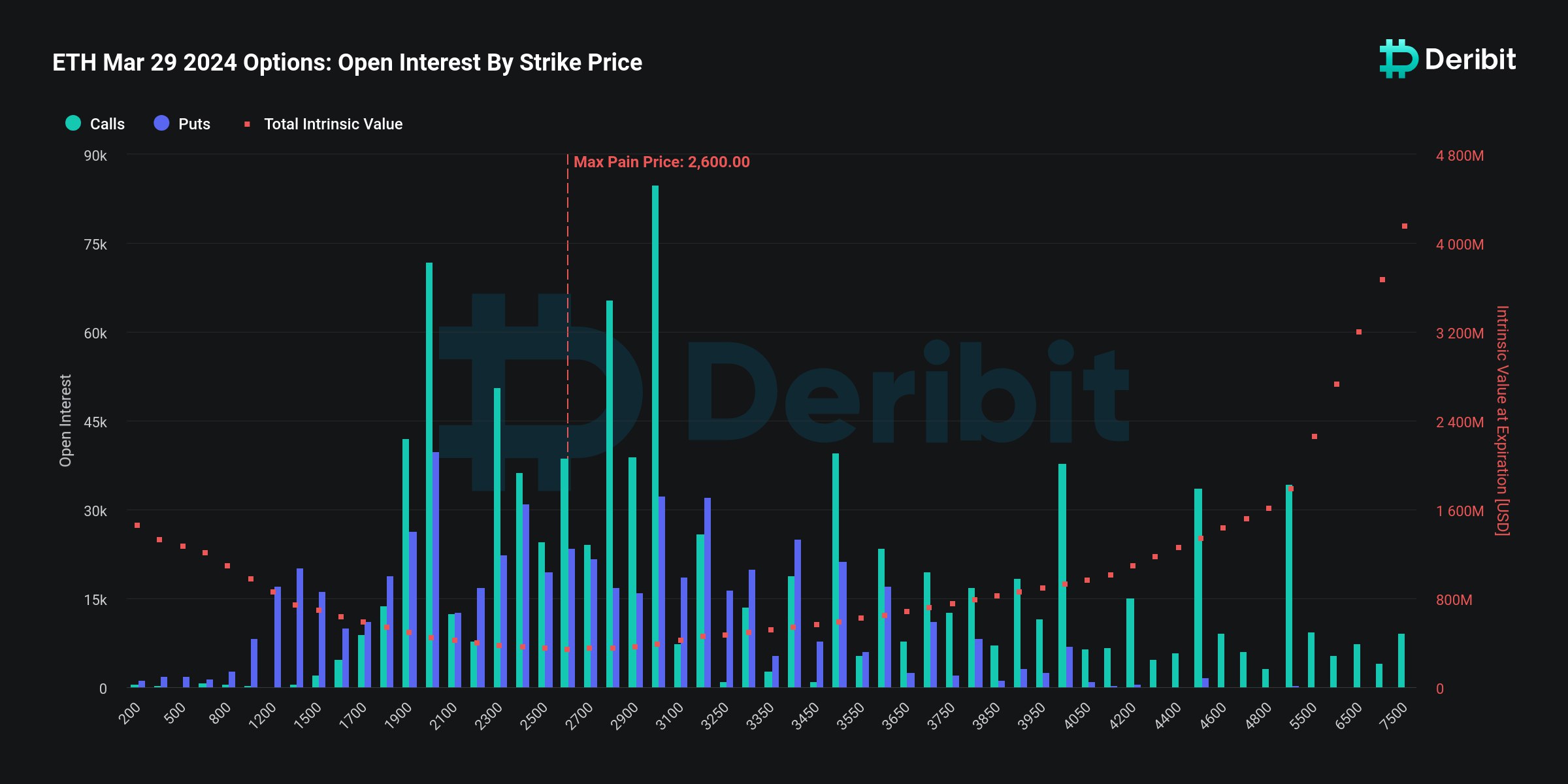

Moreover, 1,575K ETH choices of notional worth of just about $5.6 billion are set to run out, with a put-call ratio of 0.63. The max ache level is $2,600, which can also be increased than the present worth of $3,560. Traders should keep watch over drastic adjustments in buying and selling volumes for affirmation on restoration or fall in ETH costs.

Meanwhile, the decision quantity is increased than put quantity forward of the main expiry day, with the put/name ratio of 0.68. ETH price trades at $3,581, up 3% from a 24-hour low of $3,460.

GreeksLive market researcher Adam in a publish on X mentioned the hedging prices of market makers have elevated considerably as in comparison with final week, with positions additionally accelerating. He added that the Matthew impact of buying and selling enthusiasm can also be an influencing issue for fluctuations in buying and selling throughout US hours.

Read More: Bitcoin Option Selling Likely Before Quarter End, BTC Price Rejected At $72,000

Can a Rally Start Immediately After Expiry?

Investors anticipating a rally in the crypto market will probably be upset because the PCE inflation information and Fed Chair Jerome Powell’s speech will possible exert strain on the BTC worth.

In the final bull market, Deribit noticed its largest expiry of 100K BTC choices of notional worth of $3.1 billion. BTC worth crashed after the expiry. However, demand from spot Bitcoin ETFs will assist scale back some impression of the choices expiry.

We are far-off from the “Max pain” worth for each $BTC & $ETH. These are normally the degrees at which choice sellers attempt to pin costs in the spot market to inflict losses on the patrons.

With the expiry settling the Q1 choices, sellers will shut out their hedges and cease…

— Nic (@nicrypto) March 28, 2024

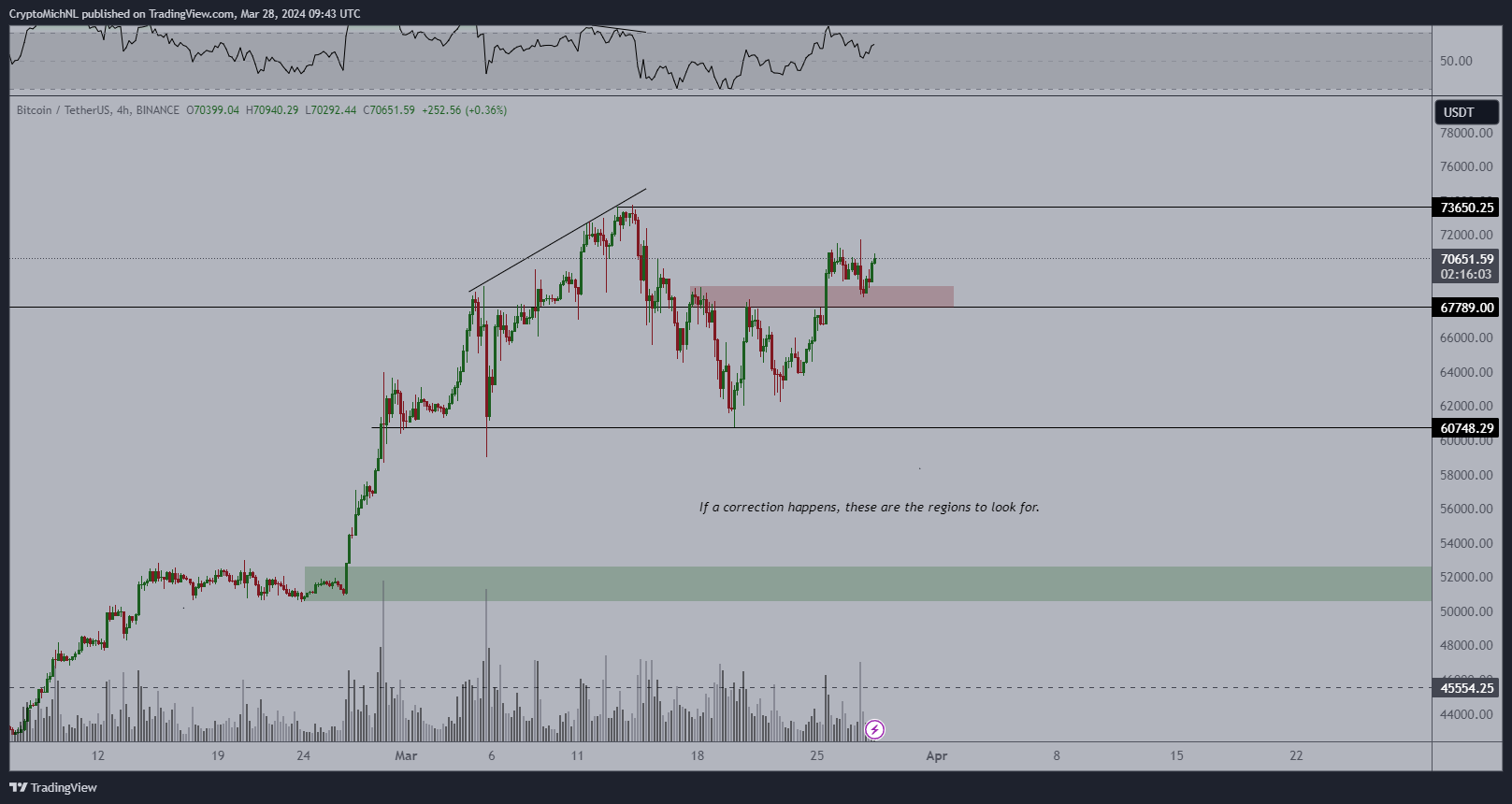

Analyst Michael van de Poppe mentioned Bitcoin is holding above essential ranges and one other ATH is anticipated if it stays above $67K. “Overall, upwards returns seem relatively skewed for Bitcoin pre-halving.” Correction in BTC worth is anticipated to be instantly purchased by whales and traders.

Top analyst Markus Thielen is bullish on Bitcoin worth rising above $100K and reaching $140K after the bitcoin halving. However, he additionally warned that it could nullify if Bitcoin trades under $68,000 as a consequence of market volatility earlier than the month’s finish.

Also Read:

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.