The value efficiency of Bitcoin over the previous week has been a supply of concern for almost all of the crypto group. This has just about been the case for different cryptocurrencies available in the market, with a number of large-cap tokens reversing their recently-accrued income.

However, some buyers are treating the latest value decline as a rare opportunity in the bull market as they proceed to load their luggage with belongings of their selection. Specifically, the newest on-chain information exhibits vital shopping for exercise amongst a sure class of buyers.

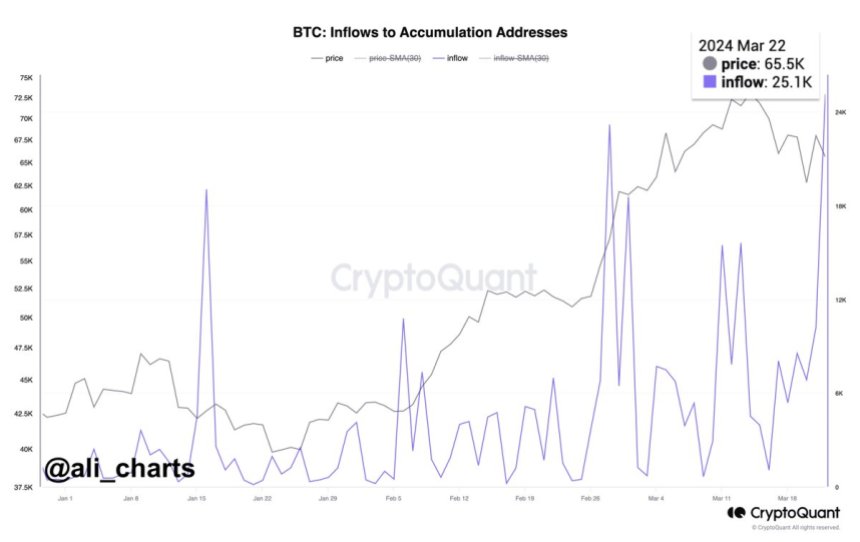

25,000 BTC Flow Into Accumulation Addresses In One Day

Prominent crypto pundit Ali Martinez revealed, by way of a post on X, that greater than 25,000 BTC (valued at roughly $1.6 billion) was moved to accumulation addresses on Friday, March 22. This determine represents the very best quantity transferred to those wallets in a single day up to now in 2023.

The metric of curiosity right here is the Inflow to Accumulation Addresses on the Bitcoin blockchain. For context, a Bitcoin accumulation handle refers to an handle that has zero outgoing transactions and maintains a stability of at the very least 10 BTC.

A chart exhibiting the inflows to Bitcoin accumulation addresses | Source: Ali_charts/X

This classification, nonetheless, excludes digital wallets linked to centralized exchanges and miners and has lower than 2 non-dust incoming transfers. Also, it doesn’t embrace addresses that haven’t seen any exercise in additional than seven years.

The elevated circulate of cash into this class of pockets addresses is proof of substantial BTC accumulation by entities who view the crypto as a long-term funding. It alerts that sure big-money gamers are amassing Bitcoin in anticipation of potential worth appreciation.

What’s extra, this vital acquisition by long-term investors emphasizes the growing adoption of Bitcoin as a retailer of worth. Meanwhile, it is likely to be an indicator of bullish value motion within the brief time period.

Bitcoin Price Overview

As of this writing, Bitcoin is valued at $64,636, reflecting a mere 1% value improve up to now 24 hours. This value change is considerably negligible, contemplating the deep retracement of the premier cryptocurrency earlier within the week.

According to information from CoinGecko, the value of BTC is down by 2.4% over the previous week. Meanwhile, the market chief is at present about 13% from its document excessive of $73,798.

However, it has been an total optimistic efficiency for the Bitcoin value in March, having surpassed this earlier all-time excessive of $69,000 just a little over every week in the past. And, with a market cap of $1.26 trillion, BTC retains its place as the biggest cryptocurrency within the sector.

The value of Bitcoin struggles to carry above $64,000 on the day by day timeframe | Source: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site fully at your personal threat.