As the Federal Open Market Committee (FOMC) convenes in the present day, Bitcoin’s value trajectory is beneath scrutiny, with buyers bracing for potential volatility. Amid inflation considerations and anticipation over the FOMC’s determination, analysts predict a attainable dip in Bitcoin’s value, notably highlighting the $60K mark as a pivotal degree.

So, let’s delve into the insights driving these forecasts and what buyers can count on within the crypto market panorama.

Analyst Predicts Bitcoin Price To Dip Below $60K

Ahead of the Federal Reserve’s financial coverage determination, Bitcoin’s latest retreat has stirred hypothesis amongst buyers and analysts alike. While expectations lean in direction of the Fed sustaining its coverage charges, consideration pivots in direction of cues embedded within the dot plot, notably amid lingering inflationary pressures.

For context, the most recent U.S. Consumer Price Index (CPI) and Producer Price Index knowledge confirmed that inflation remains to be at a better degree than market expectation, not to mention the Fed’s 2% goal vary. This hotter-than-inflation knowledge has raised considerations amongst buyers, probably signaling a hawkish stance by the central financial institution.

However, in accordance with the CME FedWatch Tool, the Fed is more likely to maintain the rates of interest unchanged on the upcoming FOMC announcement, with a 99% chance. But the buyers would maintain a detailed observe of the Fed’s potential future plan throughout FOMC and Fed Chair Jerome Powell’s speech for cues on future stance.

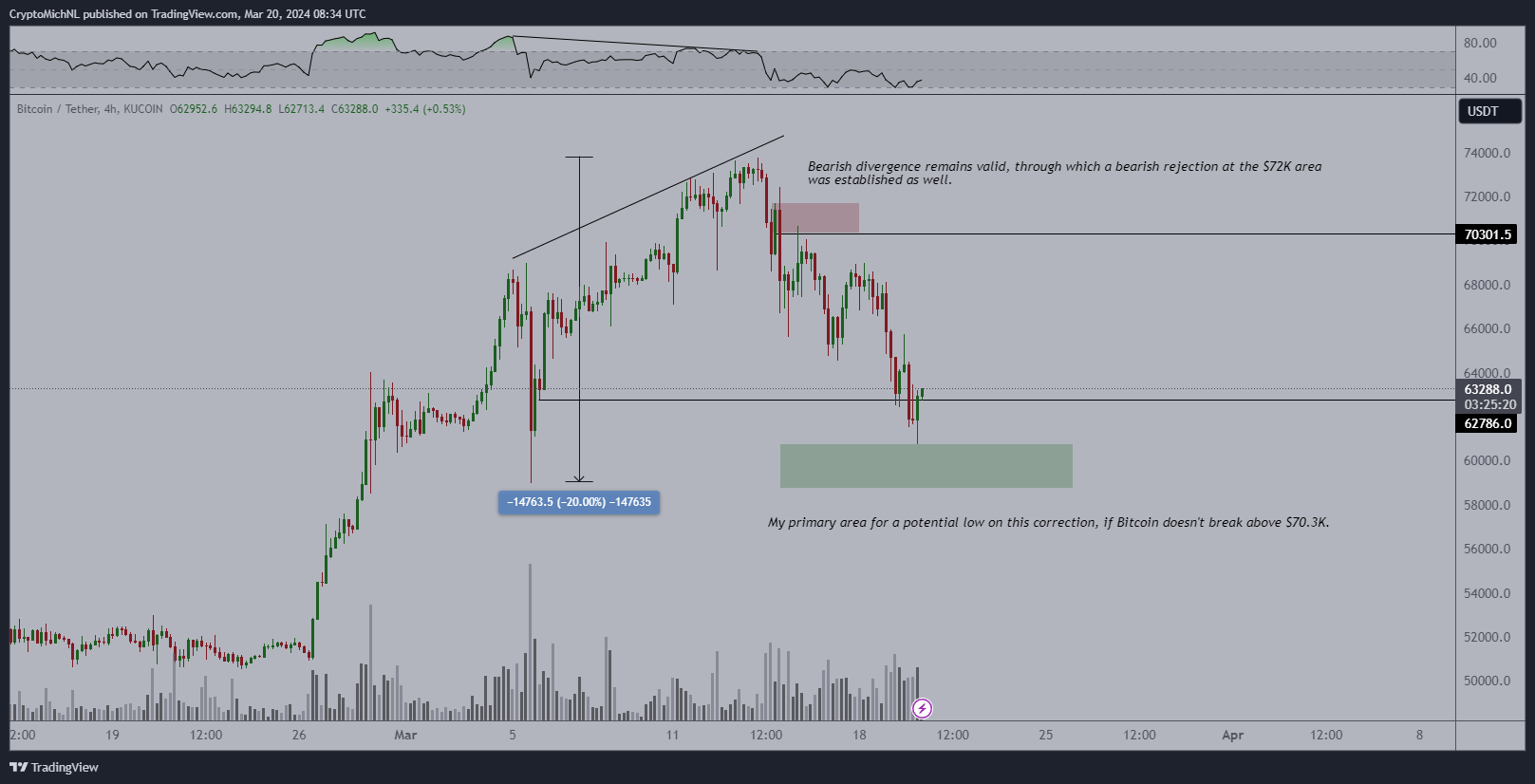

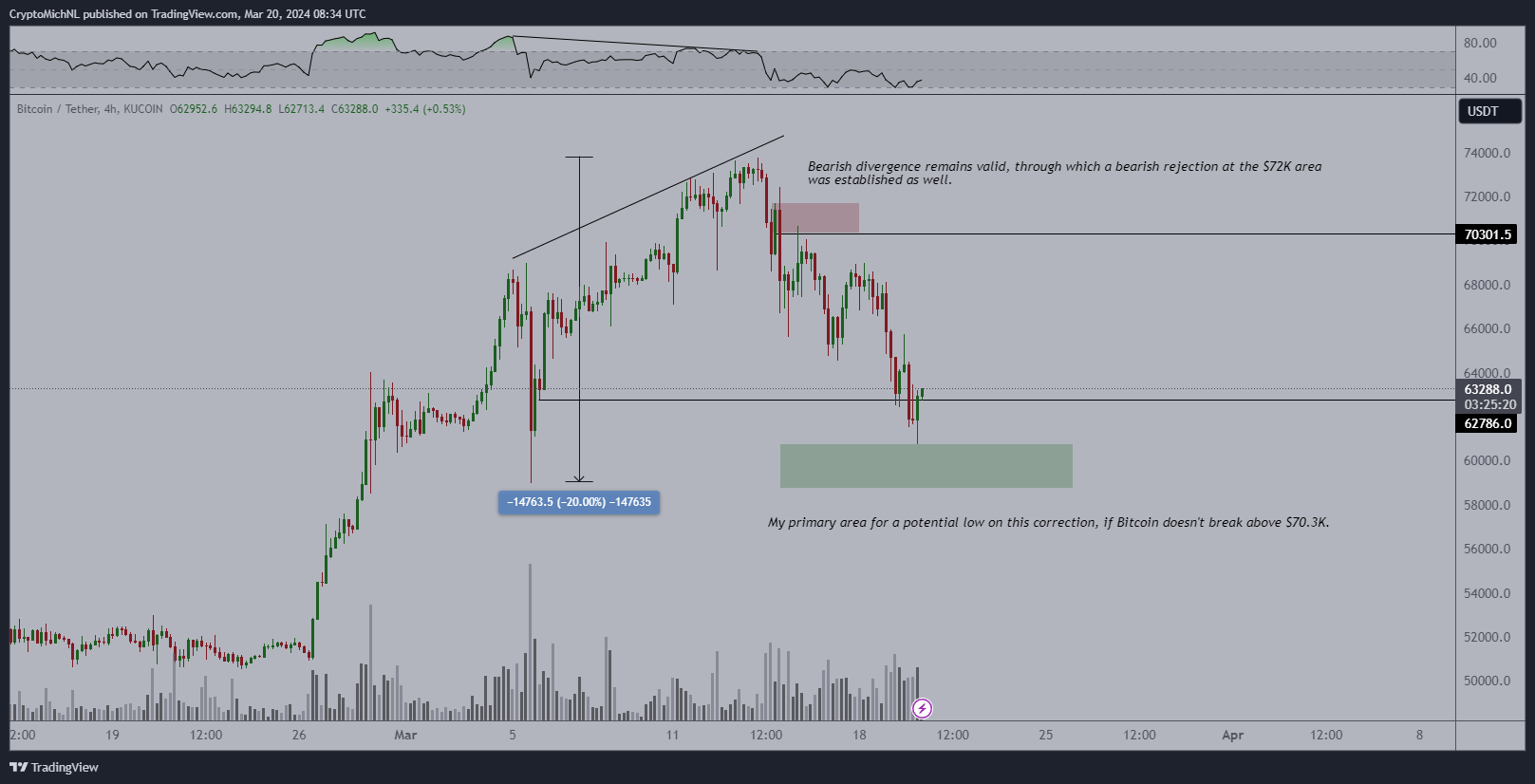

Meanwhile, amid the risky buying and selling situation, distinguished crypto market Michael van de Poppe suggests a possible downturn for Bitcoin, eyeing a check across the $60K mark amidst FOMC deliberations. The analyst cited historic patterns and present market sentiments whereas predicting the downturn.

Notably, Van de Poppe’s forecast hints at a strategic inflection level, marking a attainable low earlier than a potential rebound, contingent on the central financial institution’s tone and coverage outlook. However, regardless of the bearish sentiment, the analyst stated that Bitcoin would possibly attain a brand new excessive earlier than the Bitcoin Halving occasion.

Also Read: CoinShares Aims To Diversify US Offerings With New Bitcoin Products

FOMC Impact Market Sentiment Amid Halving Anticipation

Amid the FOMC anticipation, broader market sentiment stays cautious, with analysts highlighting the importance of pre-halving retracements in Bitcoin’s value trajectory. While previous traits supply insights, market dynamics stay fluid, prompting buyers to remain vigilant for potential shifts in sentiment and value motion because the FOMC determination unfolds.

For occasion, widespread crypto professional Rekt Capital stated that Bitcoin would possibly face correction within the coming days. He cited that historic knowledge means that the BTC tends to enter a pre-halving retracement part forward of the Bitcoin Halving occasion, earlier than making an additional rally to new highs.

Meanwhile, as of writing, the Bitcoin price was up 0.20% to $63,211.99, with its buying and selling quantity slipping 6% to $63.66 billion. Over the final 24 hours, the crypto has touched a excessive of $65,757.83 and a low of $60,807.79, suggesting the risky buying and selling situation within the digital asset area forward of the FOMC.

Also Read: Shiba Inu Team Hints At “Secret” Strategy To Eclipse Dogecoin

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.