Michael Sonnenshein, chief govt provide of crypto asset supervisor Grayscale, discloses that charges on its flagship Grayscale Bitcoin Trust (GBTC) Bitcoin ETF will cut back progressively over time. Sonnenshein stated the charges will drop after GBTC outflows reached over $12 billion, backtracking from defending its increased prices.

Grayscale to Reduce GBTC Fees

Grayscale CEO Michael Sonnenshein stated the corporate expects to cut back charges on its GBTC Bitcoin ETF within the months forward. The transfer probably comes as GBTC continues to witness outflows whereas different rivals corresponding to BlackRock and Fidelity seize huge market share from Grayscale.

“I’ll happily confirm that, over time, as this market matures, the fees on GBTC will come down,” Sonnenshein told CNBC in an interview on March 18. He added that charges have a tendency to be increased in the course of the preliminary phases and progressively come down because the market matures and demand for the merchandise rises.

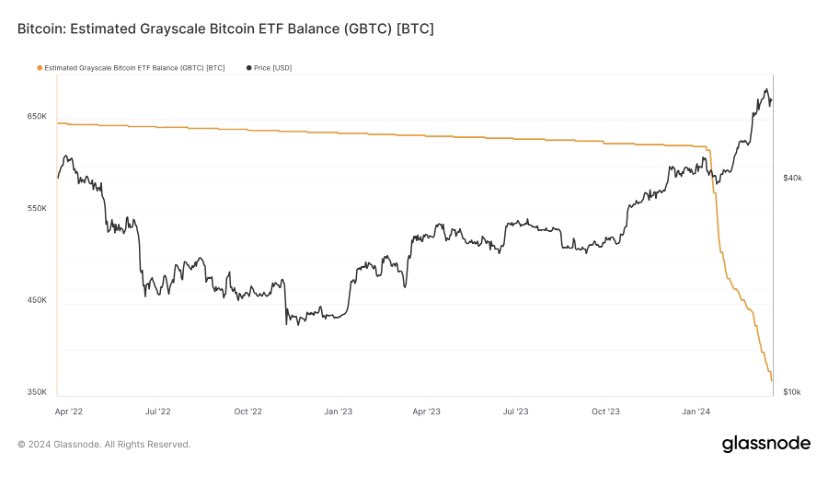

GBTC has witnessed over $12 billion in internet outflows for the reason that conversion to spot Bitcoin ETF. GBTC noticed its highest-ever outflow of $643 million on Monday, with a complete spot Bitcoin ETF outflow of $154.4 million regardless of BlackRock iShares Bitcoin ETF’s (IBIT) $451.5 million influx.

Also Read: Empower Oversight Sues SEC Over Refusing FOIA Compliance, ETHGate

GBTC prices a 1.5% administration payment for holders, which is considerably increased than different Bitcoin ETF suppliers, together with BlackRock and Fidelity. Meanwhile, VanEck has waived charges on its Bitcoin ETF amid fierce competitors within the BTC ETF market.

Vetle Lunde, senior analyst at K33 analysis, stated GBTC nonetheless holds 368,600 BTC. “Going to stabilize eventually, there are def. idle holders not aware of the massive fee premium compared to other issuers.”

Grayscale softening from its earlier stance of defending its increased charges may undoubtedly have an effect on Bitcoin ETF inflows and BTC worth within the coming months.

BTC price at present trades at $62,891, down over 8% within the final 24 hours. The 24-hour high and low are $62,478 and $68,552, respectively. However, buying and selling quantity has elevated by 62% in previous 24 hours, indicating merchants actively reshuffling their positions.

Top analyst Markus Thielen earlier predicted additional correction in Bitcoin and Ethereum costs, with meme cash rally has topped.

Also Read: Ripple, Coinbase CLO Call Out SEC for “Misleading” Courts In Other Crypto Suits

The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.