Investor sentiment within the cryptocurrency market takes successful because the U.S. Spot Bitcoin ETF witnesses a considerable drop in inflows, falling by 80.6% to $133 million on Thursday, March 14. Notably, this marks the bottom influx during the last eight buying and selling days, which have sparked discussions over a possible cooling curiosity from the Wall Street gamers.

Meanwhile, this decline comes amid a broader downturn within the crypto market, with Bitcoin costs retreating from current highs.

Bitcoin ETF Inflow Plunges Amid Bitcoin Sell-Off

The current droop in Bitcoin, coupled with heightened market volatility, has sparked market considerations amid a major discount in inflows to the U.S. Spot Bitcoin ETF. Following a record-breaking surge that propelled Bitcoin to surpass $73,000, the cryptocurrency confronted a pointy decline, dipping under the $67,000 mark.

Notably, this present decline displays the allaying risk-bet urge for food of the buyers, particularly earlier than the upcoming FOMC meeting. The FOMC assembly subsequent week might shed some gentle on the potential transfer by the Federal Reserve in direction of their rate-cut plans.

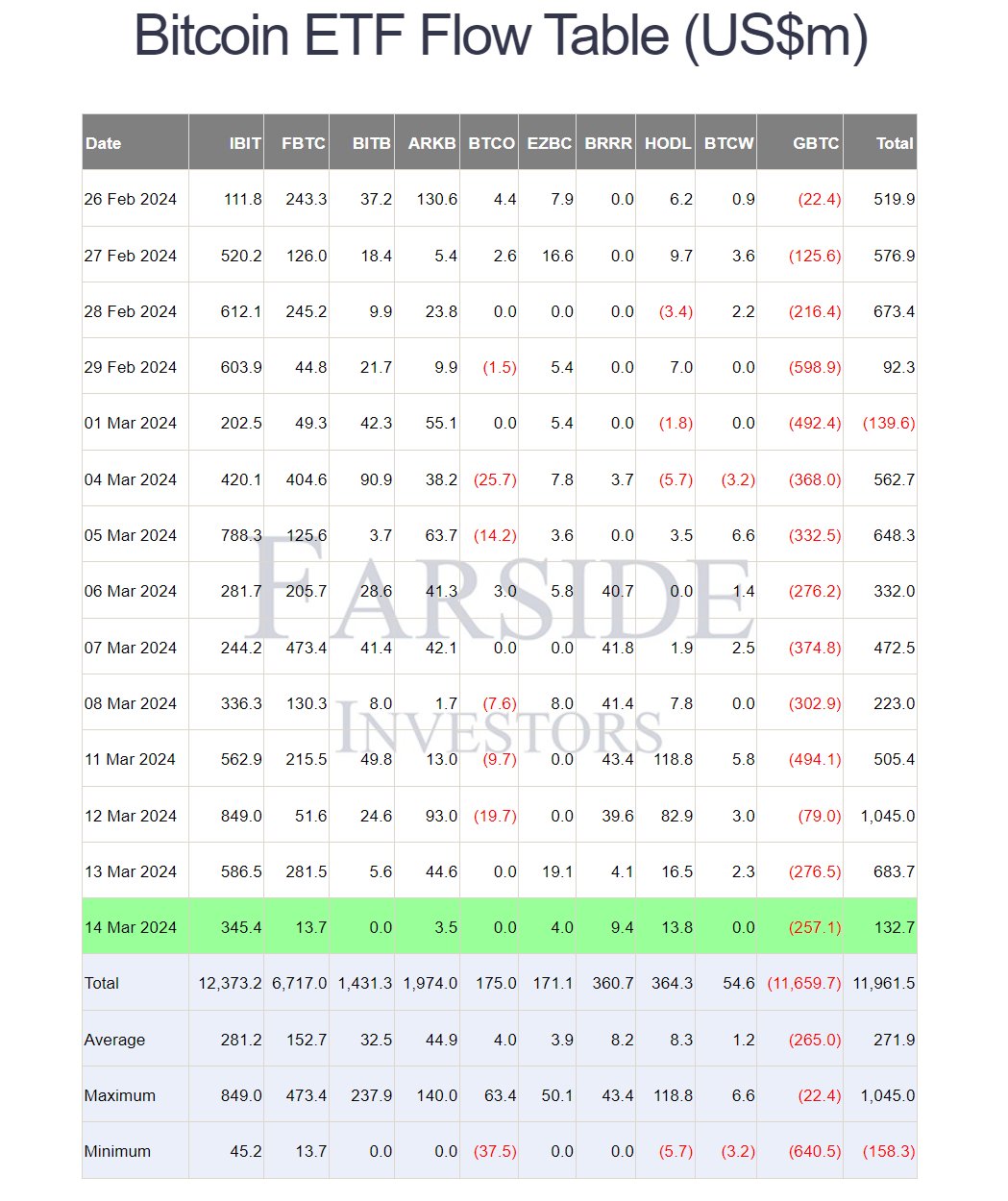

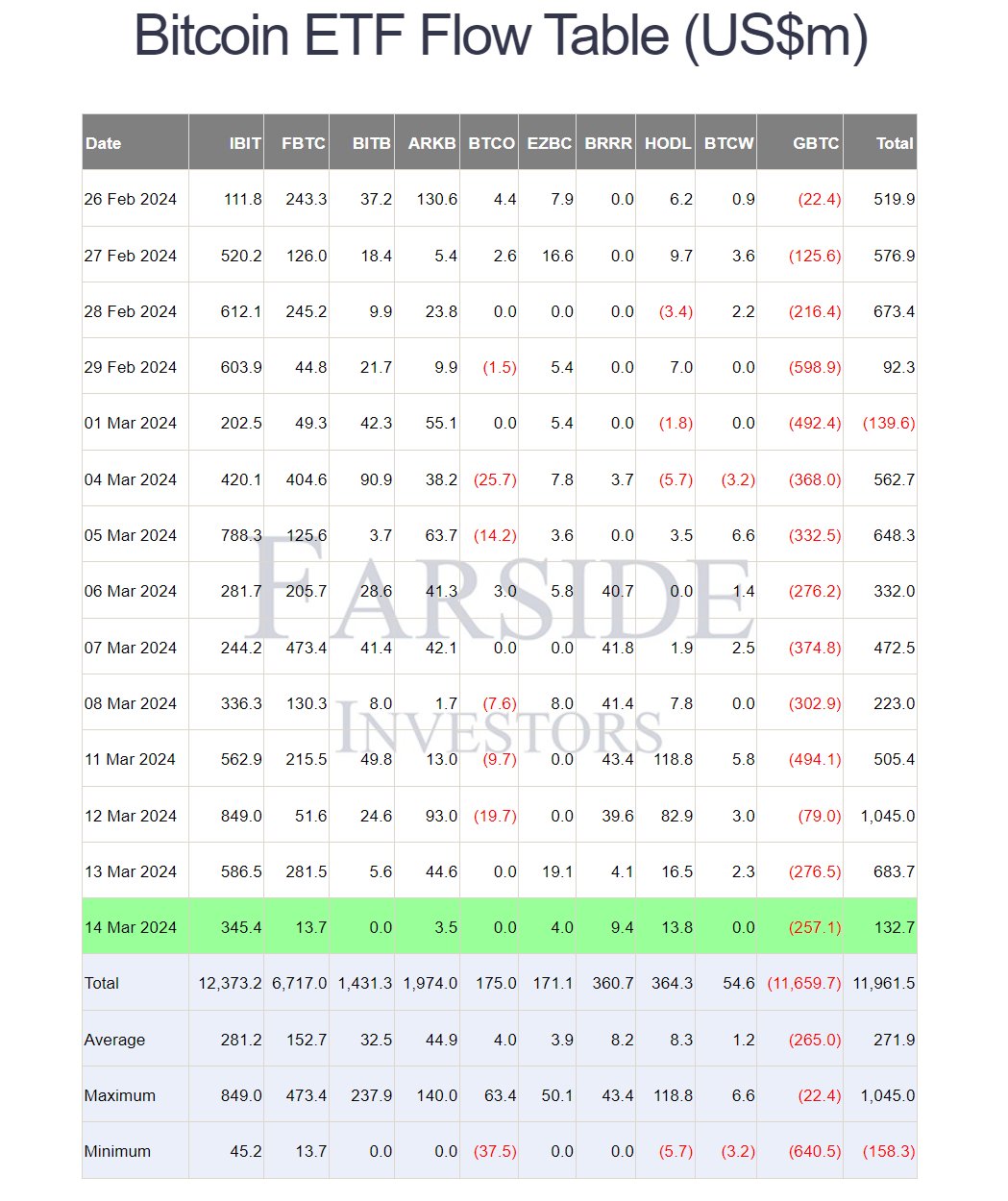

However, reports from Farside Investors point out that the U.S. Spot Bitcoin ETF skilled an influx of $132.7 million on Thursday, March 14, marking a stark distinction to earlier days’ $586.5 million inflow. Notably, BlackRock’s IBIT, one of many distinguished ETF issuers, noticed an influx of $345.4 million, down from $586.5 million the day earlier than.

In addition, Vaneck Bitcoin Trust ETF (HODL) and Fidelity’s FBTC managed to file inflows of $13.8 million and $13.7 million, respectively. Conversely, Grayscale’s GBTC witnessed an outflow of $257.1 million, though marking an enchancment from the $276.5 million outflux reported on March 13.

Also Read: Bitcoin Maxi Pushes for El Salvador Credit Rating Upgrade Amid Cold Storage Move

Price Performance Amid Volatile Market

The diminishing influx into Bitcoin ETFs has raised considerations amongst buyers, contributing to the sell-off noticed within the broader crypto market in the present day. However, regardless of the current downturn, the cumulative internet influx into the U.S. Spot Bitcoin ETF stays substantial, nearing the $12 billion mark after 44 days of buying and selling.

Meanwhile, a number of market pundits recommend that the volatility within the cryptocurrency market, coupled with regulatory uncertainties and macroeconomic elements, has prompted buyers to undertake a cautious strategy. While Bitcoin’s long-term prospects stay favorable, short-term fluctuations might proceed to affect investor sentiment and ETF exercise.

As the cryptocurrency panorama evolves, market members will intently monitor developments in regulatory frameworks and institutional adoption, which might considerably affect Bitcoin’s trajectory. Amid the present market turbulence, strategic decision-making and threat administration might be essential for buyers navigating the crypto area.

Meanwhile, the Bitcoin price was down 7.72% to $67,483.45, with its buying and selling quantity hovering 54.20% to $74.48 million. Over the final 24 hours, the BTC worth noticed a excessive of $73,750.07 and a low of $66,855.76, suggesting the risky situation available in the market.

Also Read: Shiba Inu Community Burns 25 Mln Coins, What’s Next For SHIB?

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.