The Solana (SOL) crypto has as soon as once more emerged as a focus within the crypto sphere, with its value hovering by practically 15% to surpass the $170 milestone. This spectacular rally underscores a heightened investor curiosity within the digital asset.

However, amid the unprecedented surge, a cautionary observe from distinguished crypto analyst Ali Martinez is sparking discussions a couple of potential correction in SOL’s value trajectory.

Analyst Signals Potential Correction in SOL Price

The Solana’s rally over $170 has renewed hopes amongst traders, with a number of market watchers anticipating the rally to maintain. However, a warning from the distinguished crypto analyst Ali Martinez has sparked speculations within the crypto market.

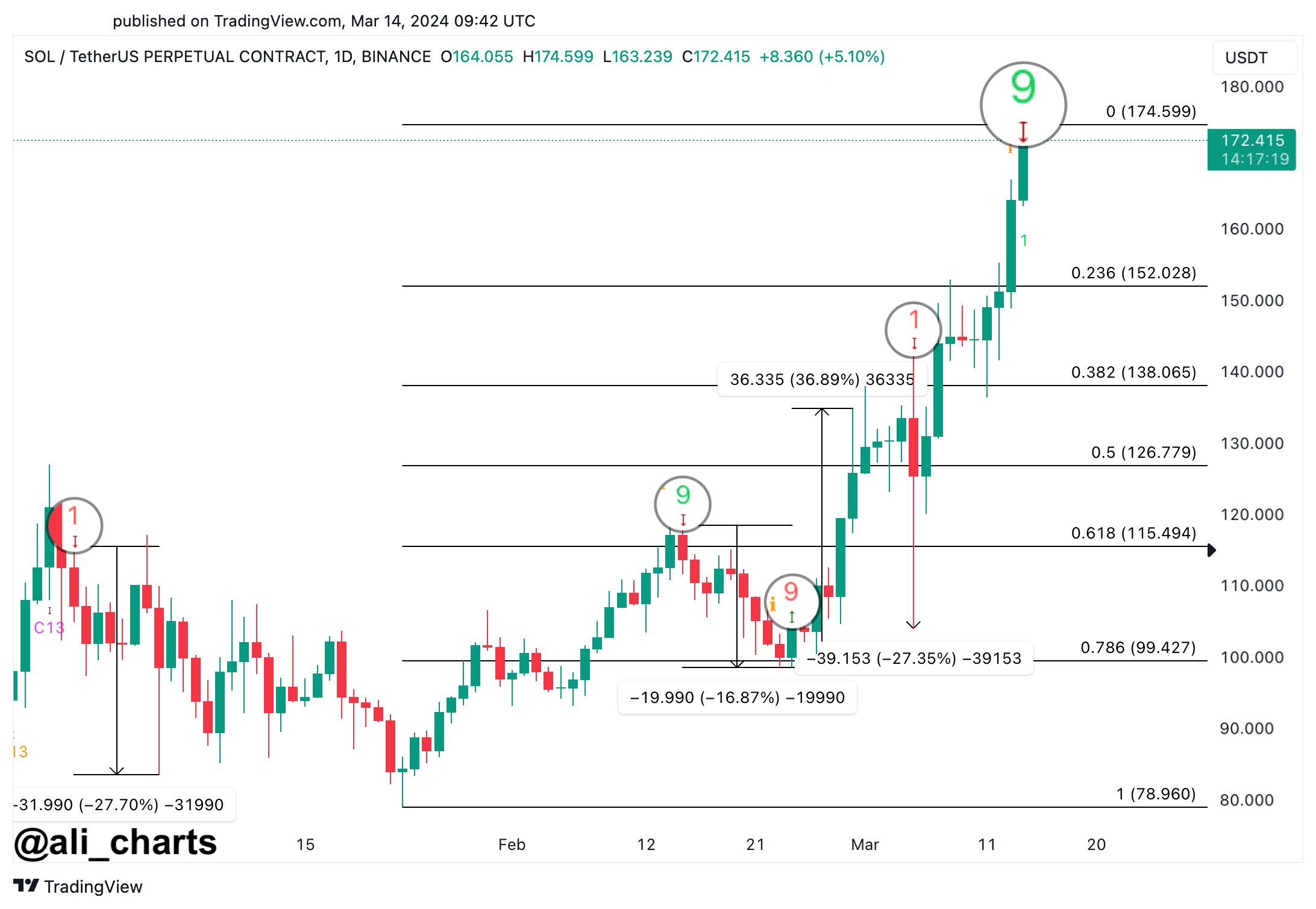

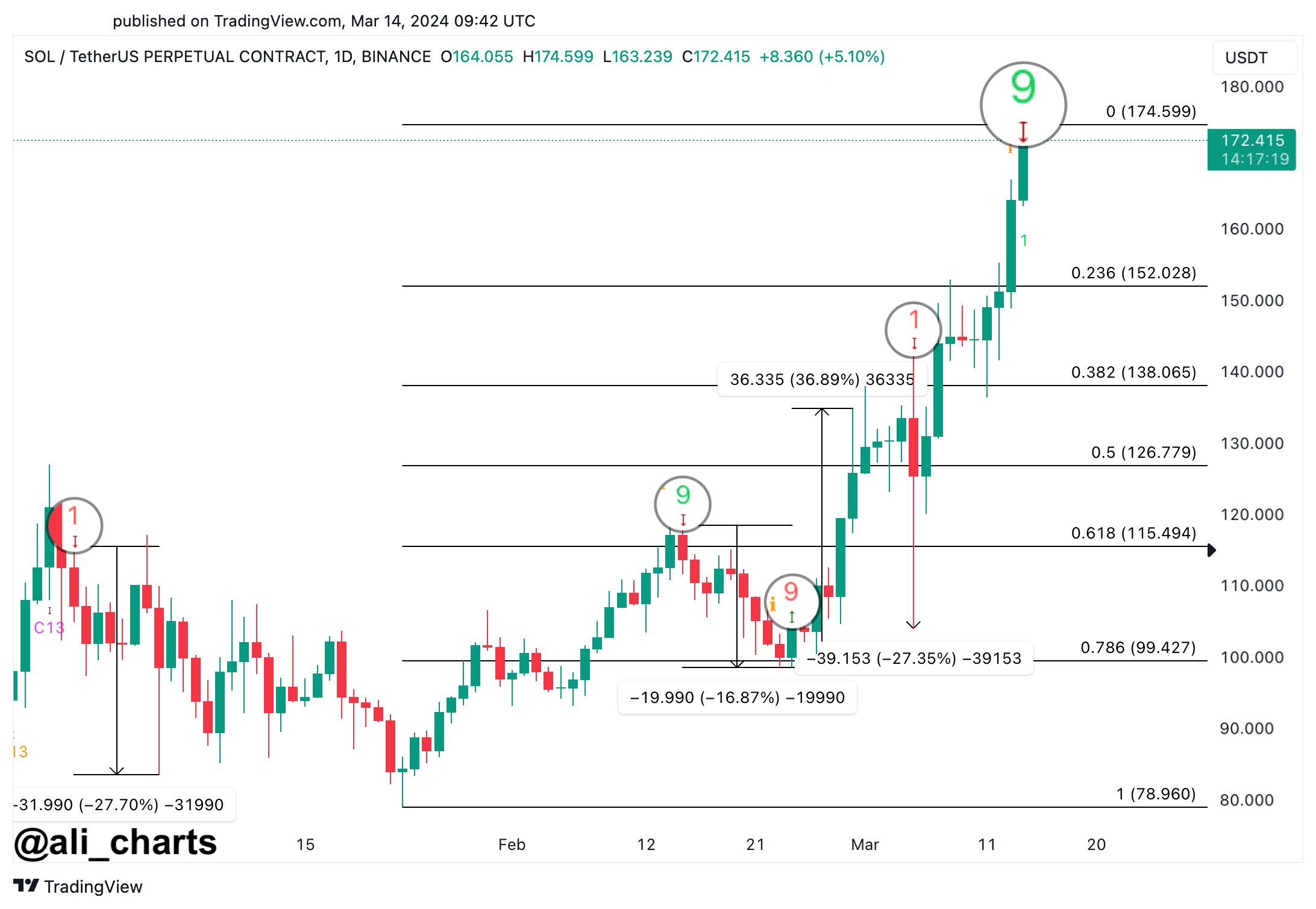

Meanwhile, in a current publish on the X platform, crypto analyst Ali Martinez sounded the alarm relating to Solana’s value outlook. Martinez pointed to the TD Sequential indicator, which has traditionally signaled sell-offs at any time when SOL reached sure ranges since December 2023. Notably, Martinez mentioned:

“Since December 2023, every time this indicator suggested selling, the price of SOL dropped by 17% to 28%.”

Notably, the warning suggests a potential retracement for SOL, probably dipping to $152 and even $127. Subsequently, Martinez’s cautionary message has injected a way of prudence into the cryptocurrency market, prompting traders to reassess their methods amid the continued rally.

However, regardless of this warning, Solana’s derivatives knowledge paints a conflicting image, indicating a bullish sentiment and hinting at the potential for additional upward motion in SOL’s value.

Also Read: Why AI Coins May Skyrocket In March?

Market Indicators Amid Price Rally

The ongoing rally in Solana value and the current warning have sparked discussions among the many crypto market fans. However, the derivatives knowledge means that the SOL value might maintain the rally, given the sturdy confidence of the traders.

For occasion, the Solana Futures Open Interest (OI) surged by 16.74% to achieve $2.83 billion, with the very best OI recorded on Binance at roughly $1.18 billion, trailed by Bybit at $775.27 million, the CoinGlass knowledge showed. sure traders view the surge in cryptocurrency costs as an opportunity to safe income, prompting a cautious strategy for the market members.

Meanwhile, in keeping with CoinGlass knowledge, over 80,000 merchants confronted liquidations within the crypto market totaling $237.78 million during the last 24 hours. Notably, Solana skilled a complete liquidation of $17.43 million, break up between $3.85 million in lengthy positions and $13.56 million briefly positions inside a 24-hour interval.

On the opposite hand, Solana’s relative strength index (RSI) signaled an overbought situation at 84.16. So, traders are suggested to train diligence and warning in navigating the risky crypto panorama. As Solana continues to seize consideration with its value actions, prudent danger administration stays essential for traders trying to capitalize on alternatives within the dynamic crypto market.

Meanwhile, as of writing, the Solana price was up 14.50% to $173.78, whereas its buying and selling quantity soared 26% to $7.04 billion during the last 24 hours. Notably, the crypto has touched a excessive of $173.81 and a low of $150.46 within the final 24 hours, suggesting the risky nature of the crypto market.

Also Read: Ripple Partner Tranglo’s XRP Use In ODL Ignites Controversy

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.