The VanEck Bitcoin exchange-traded fund (ETF) has witnessed a surge in investments, surpassing $200 million, following the choice to waive charges for the primary $1.5 billion in belongings till March subsequent 12 months. This transfer comes amid intensifying competitors within the crypto ETF area, pushed by hovering investor demand for Bitcoin publicity.

Meanwhile, with the latest surge in Bitcoin worth which sends its worth to a brand new all-time excessive, the race amongst ETF issuers to draw traders has escalated.

VanEck Bitcoin ETF Notes $200M Inflow Amid Competitive Landscape

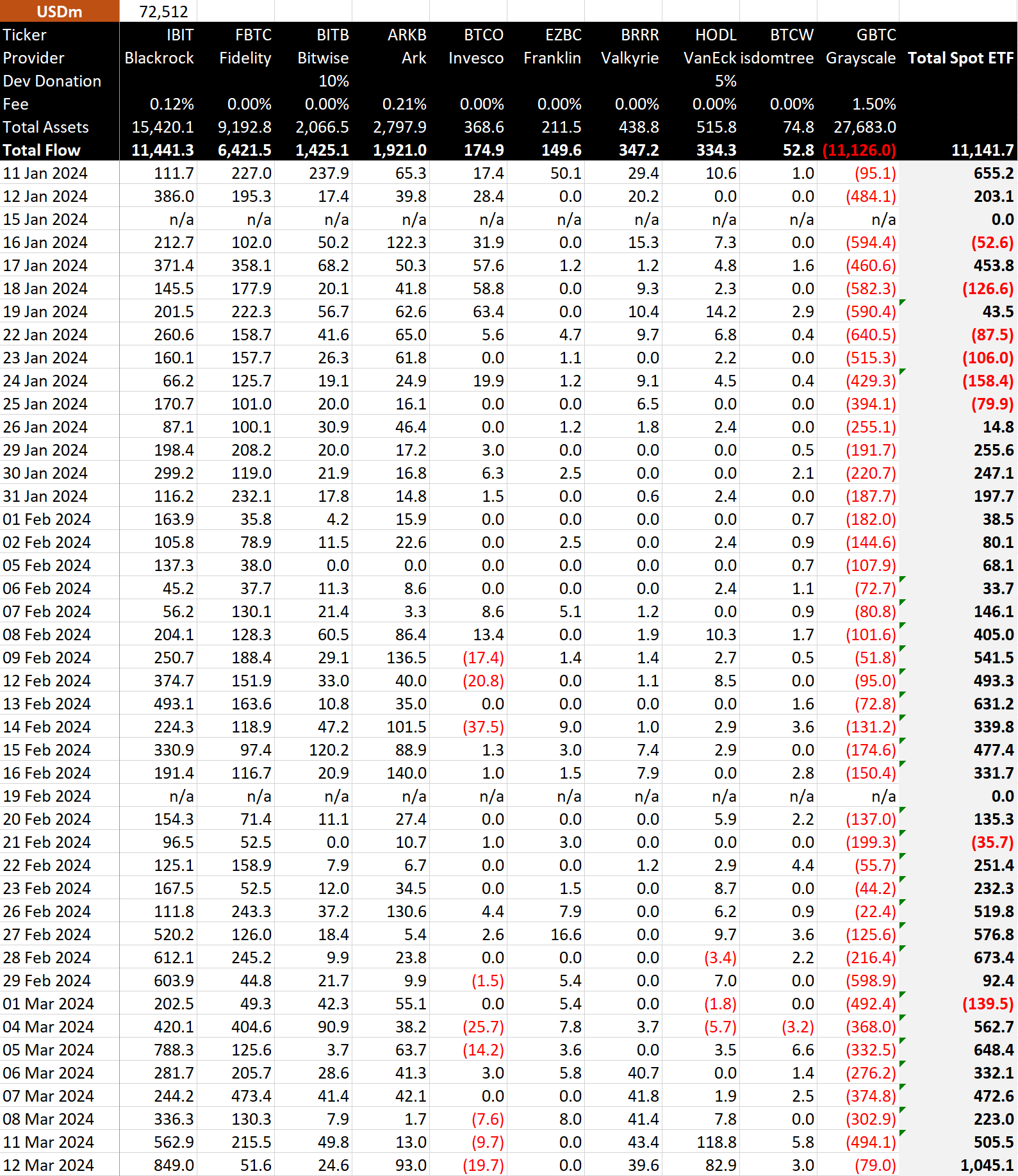

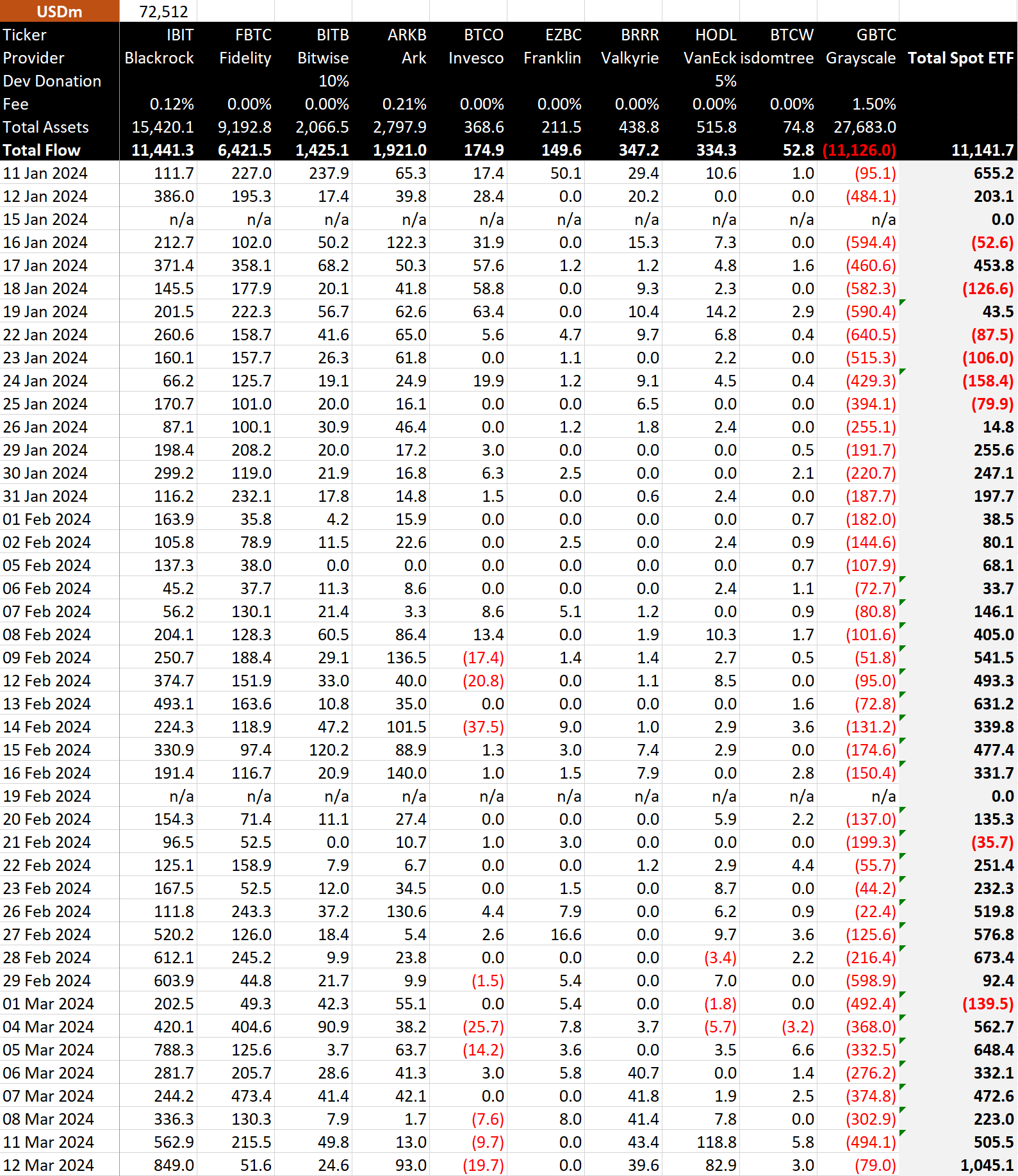

VanEck’s Spot Bitcoin ETF has garnered vital consideration from traders, with inflows exceeding $200 million in simply two days, propelled by payment waivers till March 2025. Since its launch in January, the VanEck Bitcoin Trust (HODL) has skilled strong progress, managing roughly $516 million in belongings, as reported by Bloomberg.

Meanwhile, the strong influx follows the latest payment discount, from 0.20% to 0%, additional bolstering investor confidence and leading to a web influx of $333 million, significantly notable over the previous two days. This growth underscores the growing urge for food for Bitcoin publicity amongst institutional and retail traders alike.

It’s value noting that the market contributors are maintaining an in depth watch on the U.S. Spot Bitcoin ETF, amid strong influx into the funding devices. Besides, the numerous influx additionally displays the rising confidence of the Wall Street gamers in direction of the crypto, which has additionally contributed to the latest rally in Bitcoin worth.

Also Read: ETH Price Set for $5000 After Ethereum Dencun Upgrade- Derivatives Data

Intensified Competition In The Market

The competitors within the crypto ETF area intensifies as issuers vie for investor consideration. Notably, BlackRock Inc. and Fidelity Investments have emerged as formidable contenders, attracting web inflows of $11.4 billion and $6.4 billion, respectively.

To keep aggressive within the area, numerous different ETF issuers like VanEck, which incorporates Bitwise and Invesco Ltd., have opted for non permanent payment waivers or reductions. On the opposite hand, Grayscale Investments LLC, going through strain from low-cost rivals, just lately launched the Grayscale Bitcoin Mini Trust, following substantial outflows from its present Bitcoin Trust.

Despite charging the market’s highest payment of 1.5%, the Grayscale Bitcoin Trust has skilled vital web outflows, amounting to over $11 billion since January 11. However, latest information signifies a decline in outflows, signaling potential stabilization for Grayscale’s choices amid the evolving panorama of crypto ETFs.

Meanwhile, the payment wavering of VanEck appears to have fuelled confidence among the many traders, as seen by the strong influx following the strategic transfer.

Notably, as of writing, the Bitcoin price was up 2.02% to $73,298.80, with its one-day buying and selling quantity hovering 18% to $64.16 billion. The flagship crypto has touched a excessive of $73,637.47 within the final 24 hours, suggesting the robust confidence of the traders in direction of the crypto.

Also Read: Bitcoin Price- Smart Whale Nabs Colossal Profits As BTC Tops $73K

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.