The U.S. Bureau of Labor Statistics launched the much-awaited Consumer Price Index (CPI) inflation knowledge for February, which confirmed that US inflation is available in hotter at 3.2%. The crypto and inventory market traders frightened as they regarded for additional cues on Fed charge cuts.

After a stunning hotter CPI inflation final month of three.1%, the chance of Fed charge cuts was pushed to June, with consultants even predicting charge cuts beginning in September. The CME FedWatch data signifies over 60% odds of 25 bps charge cuts in June and an additional 25 bps charge lower in July.

US CPI Comes in Hot in February

The US annual inflation charge within the US got here in at 3.2%, in opposition to the anticipated 3.1%, increased than January’s figures and sustaining ranges not seen since 2021. However, client costs elevated by 0.4% from the earlier month, a slight uptick from 0.3%, primarily pushed by a surge in gasoline costs.

Meanwhile, annual core CPI inflation additional slowed to 3.8%, down from 3.9% final month, however increased than anticipated 3.7%. The month-to-month charge comes increased than market expectation at 0.4%, consistent with 0.4% in January. The February report displays a continued gradual disinflation course of within the US, though the inflation charge stays excessive.

US fairness futures and European shares are regular after the important thing CPI knowledge, with merchants anticipating market volatility. US greenback index (DXY) transferring close to 102.85 however volatility is predicted. Moreover, the US 10-year Treasury yield that fell to 4.087% has elevated to 4.110% after CPI.

https://www.marketwatch.com/story/jamie-dimon-says-fed-should-hold-off-on-cutting-interest-rates-5eb2df6a

Also Read: Binance Waives Fees For DOGE, SHIB, PEPE, BONK, WIF, FLOKI Meme Coins

BTC Price to $75K?

BTC price stays risky after the CPI launch, with with the worth presently buying and selling below $72K. The 24-hour high and low are $71,339 and $72,850, respectively. Furthermore, the buying and selling quantity has elevated barely in the previous few hours.

Meanwhile, JPMorgan CEO Jamie Dimon says the Fed ought to maintain off on chopping rates of interest amid lack of readability on the state of the economic system. “I think the chance of a soft landing in the next year or two is half,” Dimon stated. “The worse case would be stagflation.”

While the fairness market stays below stress, merchants can eye for Bitcoin as an inflation hedge and BTC worth can maintain with an additional rally.

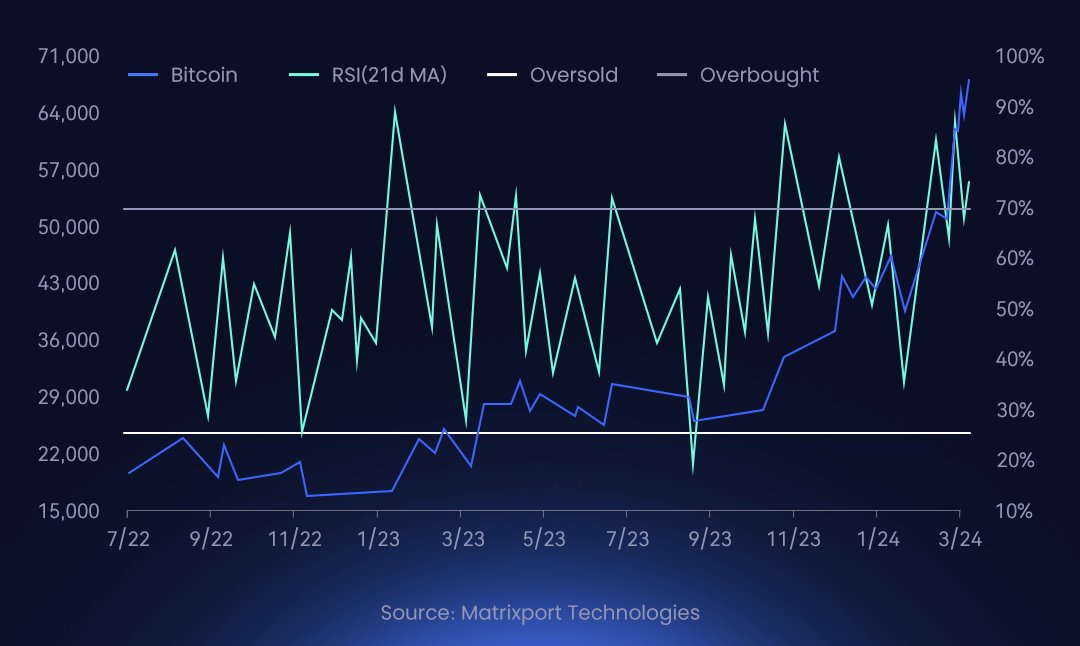

However, Matrixport predicts consolidation within the subsequent few weeks, as per the risk-reward evaluation. They added that bull market will proceed however divergence between a declining RSI and better Bitcoin worth indicators want for a consolidation earlier than a rally.

Also Read: CoinShares Acquires Valkyrie Bitcoin ETF To Strengthen US Presence

- Breaking: US CPI Comes Hotter at 3.2%, Bitcoin Price to Fall?

- Binance Unveils Key Update For XRP, WIF, FLOKI, NEAR, GRT

- Binance Waives Fees For DOGE, SHIB, PEPE, BONK, WIF, FLOKI Meme Coins

- Shiba Inu Community Burns 383 Mln SHIB, Price To Reach $0.000045?

- XRP, MATIC, SOL Options Goes Live on Deribit, Here Are Pre-Bitcoin Halving Target Price

The offered content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.