Just beneath the all-time excessive of $69,000, the Bitcoin worth has proven extra volatility in latest days, solely to now tread water round $67,000. But this boredom might quickly be over. Following the latest price movements, a notable sample has emerged on the Bitcoin (BTC) worth chart, as recognized by the seasoned crypto analyst Josh Olszewicz.

Bitcoin Price Rallye To $76,000 Next?

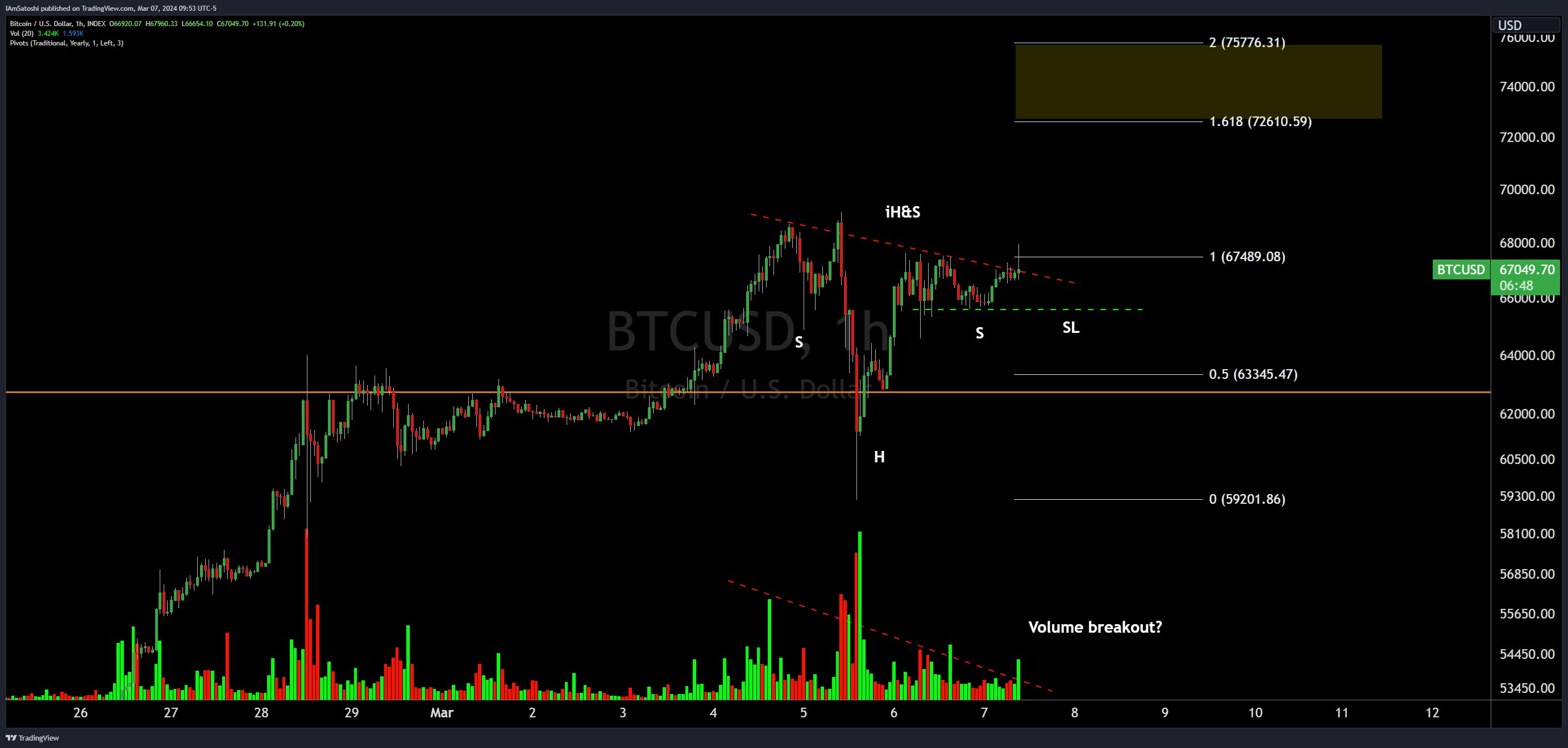

An inverse head and shoulders (iH&S) sample, usually seen as a bullish indicator, has fashioned on the Bitcoin 1-hour chart, suggesting a possible upward worth motion. This sample, whereas admittedly imperfect as per Olszewicz, is taken into account tradeable in his view. “[The] pattern is definitely not perfect but still tradeable imo,” he remarked.

An Inverse Head and Shoulders (iH&S) sample is a bullish reversal pattern in technical evaluation, signaling a possible upward reversal in worth tendencies. It consists of three troughs with the center trough being the bottom, resembling the form of a head and two shoulders, however flipped the other way up.

In this situation, Bitcoin’s chart reveals the formation with a head at roughly $59,000 and shoulders forming across the $65,000 and $65,700 mark. The sample suggests {that a} bullish transfer is brewing. Traders usually use iH&S patterns to determine potential buying opportunities, with entry factors sometimes close to the neckline breakout.

The analyst’s chart factors to a neckline (dotted pink line) slanting downward, intersecting with the appropriate shoulder within the coming days. A breakout above this line is usually required to substantiate the sample. At the present worth, Bitcoin is buying and selling slightly below the neckline.

For merchants eyeing potential targets, Olszewicz’s evaluation tasks an formidable objective of $73,000 to $76,000, aligned with the Fibonacci extension ranges of 1.618 ($72,610.59) and a pair of ($75,776.31). These ranges signify vital worth factors that Bitcoin would possibly check if the sample is confirmed with a strong breakout.

One component that would fortify the potential upward journey is a quantity breakout, which the analyst has hinted at with a query mark. The quantity indicator on the chart reveals an rising development, however a decisive surge in quantity is usually wanted to substantiate an iH&S sample.

Moreover, Olszewicz has marked a possible cease loss (SL) stage with a dashed inexperienced line. This stage round $65,680 serves as a danger administration device for merchants ought to the sample fail to appreciate the upward breakout.

At press time, BTC traded at $67,124.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site solely at your personal danger.