The U.S. Spot Bitcoin ETF market stays a hotspot for traders, accumulating a staggering round 175,000 BTC since its launch regardless of Grayscale’s heavy outflow. Notably, the Bitcoin ETFs additionally continued their strong momentum this week, whereas Fidelity FBTC recorded its highest influx on March 7 since its launch. However, the newest knowledge additionally means that the BlackRock inflow has cooled this week, sparking curiosity amongst traders.

U.S. Bitcoin ETF Accumulates 175K BTC

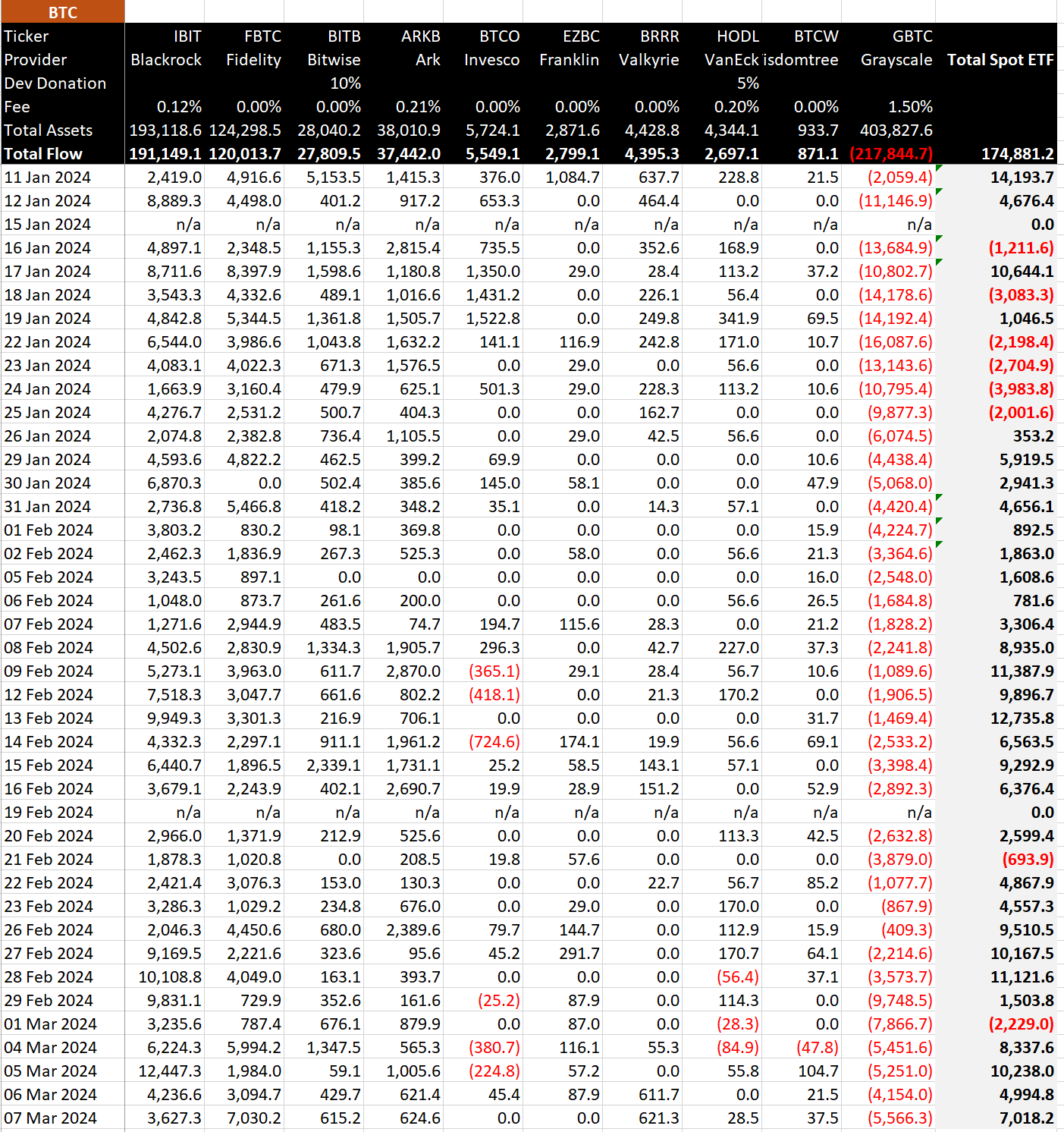

Since the inception of the U.S. Spot Bitcoin ETF, investor curiosity has skyrocketed, with whole inflows reaching $9.36 billion, equal to 174,881.2 BTC. On March 7 alone, these ETFs gathered 7,018.2 BTC, underscoring the rising demand for Bitcoin funding devices.

Meanwhile, Fidelity’s FBTC led the pack, which attracted a whopping $473.4 million influx or 7,030.2 BTC, adopted by BlackRock’s $244.2 million inflow or 3,627.3 BTC on March 7. However, whereas Fidelity’s influx surged, BlackRock’s IBIT skilled a cooling pattern.

In distinction, Grayscale’s GBTC confronted important outflows, recording $374.8 million on the identical day. Since the launch of the U.S. Spot BTC ETFs in January 2024, Grayscale’s whole outflux has hit $10.25 billion or 217,844.7 BTC.

Commenting on this surge, James Butterfill, CoinShares’ Head of Research, highlighted the relentless momentum, stating, “US Bitcoin ETF Issuers are not showing any signs of inflows slowing down.” This sentiment displays the bullish outlook of traders in the direction of Spot Bitcoin ETFs and the broader digital asset market.

Also Read: Blur, Sei, and Uniswap Prices Likely to Rally Next Week, Here’s Why

Global Digital Asset Sector Witnesses Remarkable Growth

The Bitcoin ETF has fuelled confidence of the traders within the digital asset sector. Notably, past BTC ETFs, the worldwide digital asset sector is experiencing a outstanding surge in investments.

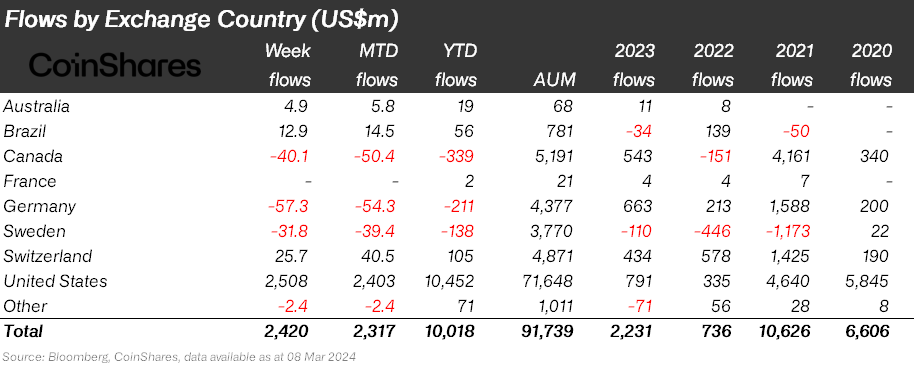

James Butterfill shared insights, revealing a complete fund stream exceeding $10 billion year-to-date (YTD) within the Digital Asset sector as of March 7, nearing the $10.6 billion mark noticed in 2021.

The United States emerges as a key participant on this surge, with a big influx of $10.45 billion in 2024, in comparison with simply $4.64 billion in 2021. This exponential progress underscores the rising confidence of traders in digital belongings and their potential for long-term worth appreciation.

Also Read: Solana Co-founder Praises Brian Armstrong Over Coinbase’s Hiring Policy

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.