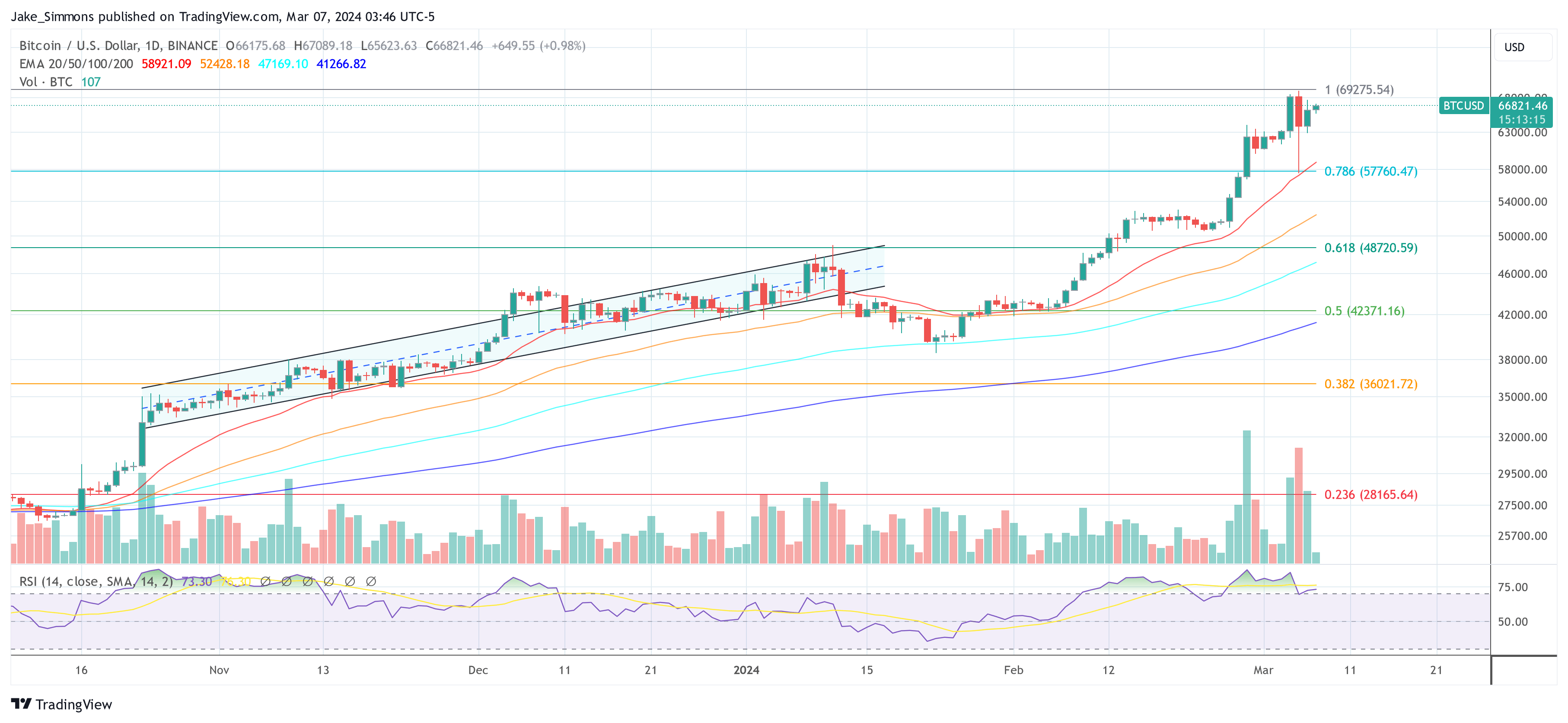

As Bitcoin hovers close to its all-time excessive, business specialists and buyers are keenly anticipating indicators of its subsequent main transfer. Alex Thorn, the Head of Research at Galaxy, not too long ago shared his perspective on the Bitcoin value trajectory and the components influencing its potential breakout. In an in depth post on X (previously Twitter), Thorn offered insights grounded in historic knowledge and present market dynamics.

“We Will Climb the Wall of Worry,” Thorn proclaimed, setting the tone for his evaluation. Bitcoin’s latest value motion noticed it reaching $69,324 on Coinbase on Tuesday, marking its first all-time high since November 10, 2021. This milestone got here after an 846-day interval of anticipation and hypothesis, just for the worth to retract 14.3% to an intraday low of $59,224. This volatility, exacerbated by $400 million in lengthy liquidations inside an hour, underscores the cryptocurrency’s unpredictable nature.

Despite the pullback, Bitcoin recovered, buying and selling again at $67,000. Thorn remarked, “Volatility is back, and it’s likely to remain as we scale the wall of worry.” He in contrast the present state of affairs to 2020 when Bitcoin first approached its then all-time excessive of roughly $20,000 from December 2017.

BTC confronted preliminary resistance, experiencing a 12.33% drop after tapping the barrier twice, earlier than finally surging forward. This sample highlights the psychological and technical challenges at earlier all-time highs, a pure resistance level for any asset class. An identical (second) transfer might be vital this time to shake all sellers out of the market.

Describing the “Wall of Worry,” Thorn defined, “By my count, from Jan. 1, 2017 to the Dec. 17, 2017 all-time high of ~$20k, Bitcoin experienced 13 drawdowns of 12%+ (12 were 15%+, and 8 were 25%+). The same story played out in 2020. Between the Mar. 12, 2020 Covid low ($3858) and the Apr. 14. 2021 ATH of $64,899, there were 13 drawdowns of 10% or more (7 of them were 15% or more).”

Notably, Bitcoin already had two 15%+ retracements for the reason that spot ETFs launched on January 11. This week was the second, the primary main drawdown was straight after the ETF launch, with value plunging roughly 20%.

Why Bitcoin Is Just Getting Started

In his evaluation, Thorn additionally touched upon the function of ‘old coins’ or long-held Bitcoin in shaping market actions. “Some old coins did revive and probably sell, possibly helping to create the intraday top,” he defined, pointing to blockchain knowledge that indicated motion of cash mined way back to 2010. This shift from previous to new fingers is attribute of bull markets in Bitcoin, facilitating its broader distribution and acceptance.

Highlighting the importance of market sentiment and funding flows, Thorn famous, “And Tuesday was the Bitcoin ETFs largest ever day of inflows and second largest day of net inflows (+$648m) since DAY 1.” This spectacular inflow of capital into Bitcoin ETFs underscores the rising curiosity and confidence within the cryptocurrency, even amidst volatility.

Thorn stays bullish on Bitcoin’s future, suggesting that the present value dynamics are typical of the cryptocurrency’s bull markets, identified for his or her non-linear development and quite a few corrections. He underscored the resilience and potential for development regardless of the hurdles, stating, “nothing about yesterday’s price action makes me think we aren’t going higher.”

In conclusion, Thorn’s evaluation offers a nuanced view of Bitcoin’s journey in direction of breaking its all-time excessive. By evaluating present occasions with previous market behaviors, Thorn presents a compelling case for Bitcoin’s continued ascent, however after a possible part of consolidation with a number of faucets of the all-time excessive earlier than a definitive breakout. “Buckle up, folks. We are still just getting started,” he advises.

At press time, BTC stood at $66,821.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual danger.