Spot Bitcoin ETFs recorded one other staggering influx on Wednesday, breaking the file of the biggest influx of $677 million since launch final month. It follows amid an enormous BTC value rally in direction of ATH because of demand outpacing provide making a “supply shock“.

Bitcoin ETFs Saw $677 Million in Net Inflow

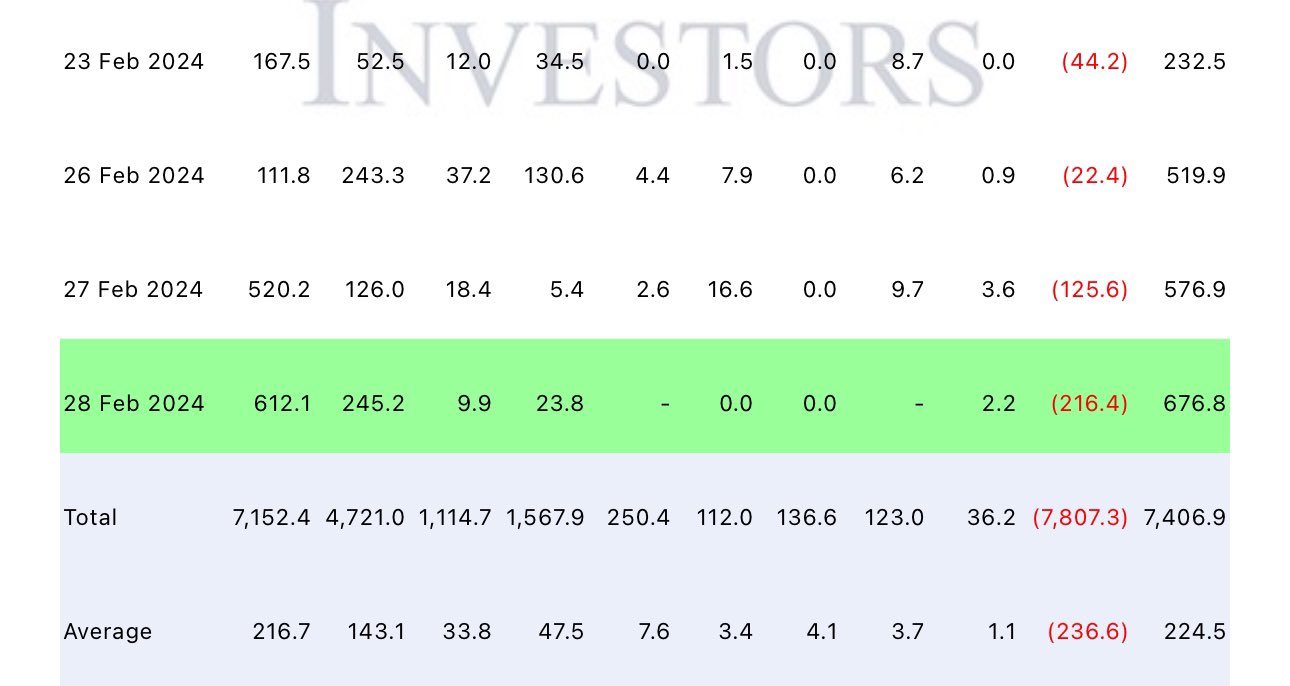

Spot Bitcoin exchange-traded funds (ETF) witnessed $677 million internet influx on February 28, in line with information by Bloomberg and Farside. This was the biggest influx because the U.S. SEC accepted spot Bitcoin ETFs in January, mentioned Bloomberg ETF analyst James Seyffart. All spot Bitcoin ETFs recorded large buying and selling volumes of $8 billion, with BlackRock main the pack.

BlackRock iShares Bitcoin ETF (IBIT) recorded $612 million, breaking its largest influx thus far file. IBIT additionally shattered its buying and selling quantity file of $1.3 billion, with $3.2 billion, exceeding the every day commerce quantity of most large-cap US shares. Following the newest influx, BlackRock’s internet influx hit over $7.15 billion and asset holdings jumped over $9 billion.

Fidelity Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF noticed $245.2 million and $23.8 million, respectively. Bitwise (BITB), VanEck (HODL), and others spot Bitcoin additionally noticed marginally low inflows, regardless of robust sentiment amongst retail and institutional traders.

Notably, GBTC noticed a $216.4 million outflow, a rise from Tuesday’s $125.6 million outflow, indicative of traders exodus because of excessive charges. Bloomberg senior ETF analyst Eric Balchunas mentioned the every day buying and selling quantity of 9 new spot Bitcoin ETFs besides GBTC destroyed the previous file as FOMO drives robust BTC value rally above $63K.

Also Read: Bitcoin ETF Trading Volumes Double At $6 Billion, $70,000 BTC Price Coming?

BTC Price Moving Towards $70,000

As reported by CoinGape earlier, Wall Street investors are poring cash into Bitcoin ETFs as each Bitcoin and Ethereum ROI are larger than oil, inventory exchanges, gold, and different property.

Meanwhile, Crypto Fear & Greed Index has reached a 4-year excessive close to 80, with the market sentiment at present within the ‘Extreme Greed’ zone.

BTC price skyrocketed over $63,000, lower than a couple of p.c away from the $68.7K excessive established 27 months in the past. The 24-hour high and low are $57,093 and $63,913, respectively. Furthermore, the buying and selling quantity has elevated by 150% within the final 24 hours, indicating an increase in curiosity amongst merchants.

Futures and choices open pursuits (OI) rising to file ranges, with complete choices OI rising over 8% to $33.79 billion, as per Coinglass information. FOMO continues to push Bitcoin price to $100K prediction by a number of specialists regardless of sky-high funding charges.

Also Read: Bitcoin Surge Triggers Record Funding Rates on Binance and OKX

The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.