The long-awaited arrival of spot Bitcoin ETFs has ignited a gold rush within the crypto world, attracting each newcomers and seasoned buyers. While these new funding automobiles supply a handy and accessible technique to acquire publicity to Bitcoin, their influence on the cryptocurrency’s core rules and long-term stability stays a fancy query.

Bitcoin ETF: Initial Surge, But Ownership Shift A Concern

The information paints an interesting image. Following the SEC’s approval of 11 ETFs, the variety of non-zero Bitcoin wallets initially soared, reaching a peak of almost 53 million in January. This surge was doubtless fueled by the accessibility and safety supplied by ETFs, attracting people beforehand hesitant to straight interact with the intricacies of crypto wallets and exchanges.

However, in accordance with information offered by Santiment, a regarding development emerged 30 days later: almost 730,000 fewer wallets held any Bitcoin, suggesting a possible shift in direction of holding by means of ETFs as a substitute of straight proudly owning the tokens. This raises questions in regards to the long-term influence on Bitcoin’s decentralized nature and the potential for decreased on-chain exercise.

📊 There are 729.4K much less #Bitcoin wallets holding better than 0 $BTC, in comparison with one month in the past. After the #SEC authorised 11 Spot Bitcoin #ETF‘s, this quantity of non-0 wallets peaked on January twentieth at 52.95M. This is attributed to the elevated curiosity in #hodlers

(Cont) 👇 pic.twitter.com/FThtSDOmk0

— Santiment (@santimentfeed) February 21, 2024

ETF Boom, But Supply/Demand Dynamics Unchanged

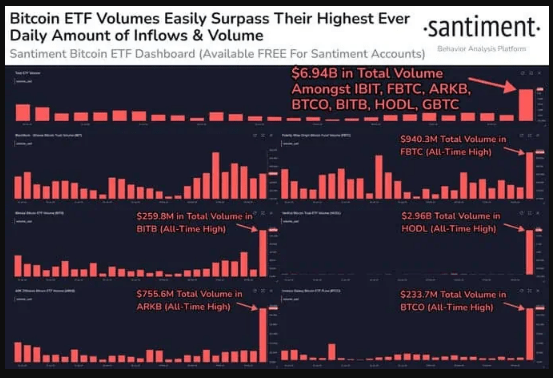

While the ETF market is prospering, its influence on Bitcoin’s core rules is much less clear. The latest document quantity and inflows exceeding $7 billion throughout the highest 7 ETFs spotlight sturdy market curiosity and the potential for mainstream adoption.

Source: Santiment

However, it’s essential to keep in mind that these ETFs can maintain each precise Bitcoin and futures contracts. This means buyers acquire publicity with out straight impacting the underlying provide or demand of the cryptocurrency itself. This raises questions on whether or not ETFs are really driving adoption or just making a derivative-based market with its personal set of dangers and dynamics.

Speculation Surges, Raising Red Flags

Perhaps essentially the most regarding development is the surge in speculative buying and selling utilizing derivatives. Open curiosity on centralized exchanges, significantly for Bitcoin, has reached unprecedented ranges, exceeding $10 billion for the primary time since July 2022.

BTC market cap stays within the $1 trillion area. Chart: TradingView.com

This signifies buyers are taking up extra danger by leveraging derivatives, doubtlessly fueled by the “crowd euphoria” surrounding Bitcoin and the attract of probably fast good points. This echoes the speculative frenzy seen in 2017, elevating issues about potential market volatility and potential crashes. Ethereum, Solana, and Chainlink additionally exhibit vital open curiosity, suggesting broader market-wide traits past simply Bitcoin.

The Verdict: A Double-Edged Sword

The arrival of spot Bitcoin ETFs has undoubtedly opened doorways for brand spanking new buyers, nevertheless it’s essential to acknowledge the potential downsides. While accessibility has elevated, direct possession is likely to be lowering, and the rise of speculative buying and selling utilizing derivatives raises issues about future market stability.

Moving ahead, it will likely be essential to watch how these traits evolve and their long-term influence on the general well being of the crypto ecosystem. Additionally, ongoing regulatory developments surrounding ETFs and derivatives might additional form the panorama.

Featured picture from Nicola Barts/Pexels, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal danger.