Ethereum worth is presently buying and selling above the $3000 psychological degree after almost 2 years, backed by large spikes in buying and selling volumes. Experts predict spot Ether ETFs, rising open pursuits, and different causes make a rally to $4,000 imminent, abandoning Bitcoin.

Ethereum Price Gains Momentum Above $3,000

ETH worth has rallied almost 3% within the final 24 hours, defying broader crypto market correction. Bloomberg famous a shift in developments noticed in 2023, the place Bitcoin sometimes led the market. Ethereum (ETH) outpacing Bitcoin (BTC) this 12 months with a outstanding 28% climb in comparison with Bitcoin’s 21% advance.

Bitcoin dominance has once more declined to 51% as Ethereum features momentum, triggering an upsurge in altcoins. Whale and crypto companies are primarily driving this upside momentum. Whales accrued important ETH when worth breakout above the $2600 degree after a retest to $2250.

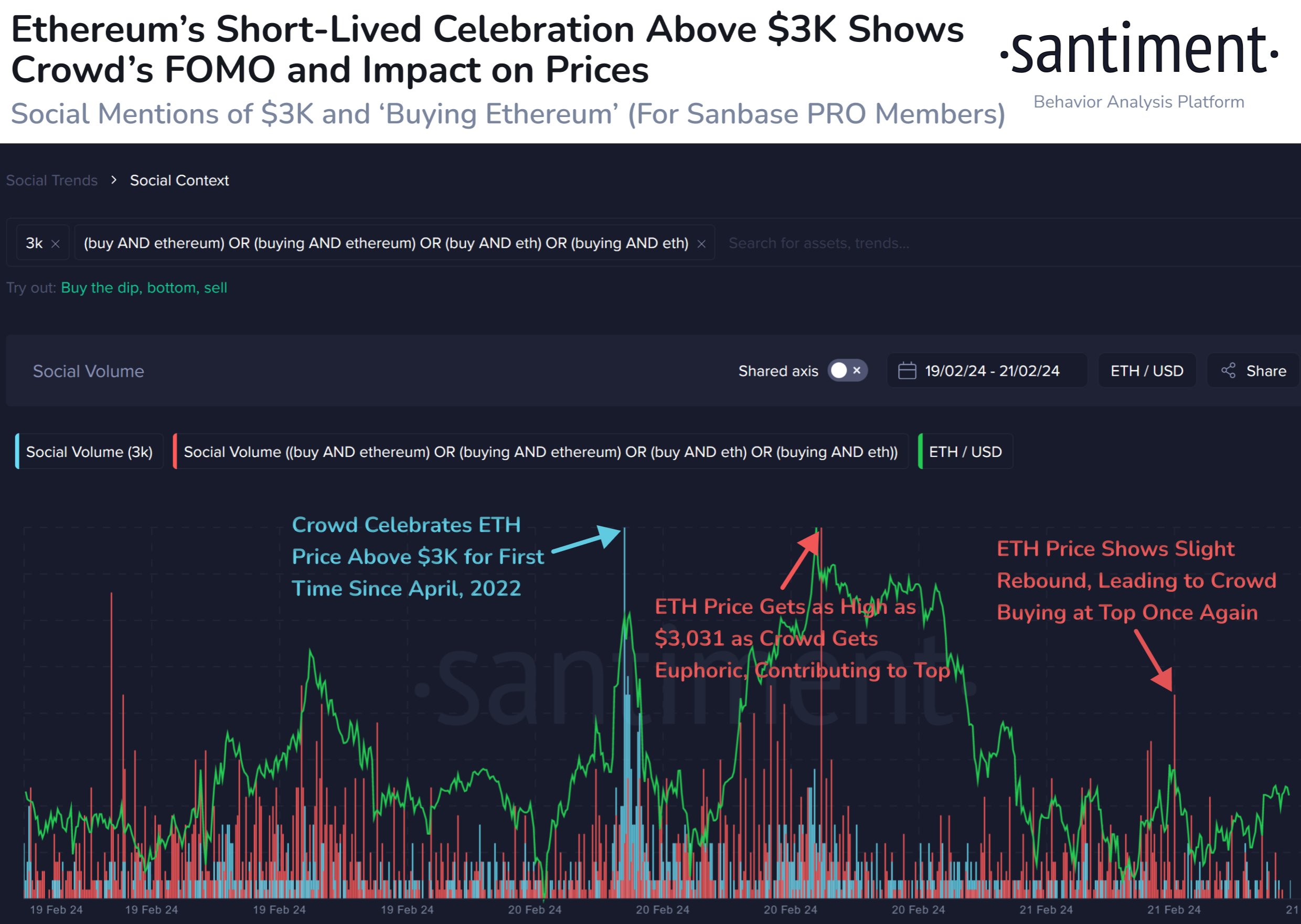

Sentiment information revealed an increase in ‘Social mentions of $3K and buying Ethereum’ on this week. While Ethereum worth dipped amid the crypto market selloff yesterday, FOMO and its affect on costs are clearly seen. Meanwhile, Ethereum has an all-time excessive of 114.95 million holders as in comparison with 5.22 million holders of Tether (USDT)

Also Read: Terra Vs SEC: Court Sets Pretrial Deadline As Do Kwon Set for US Extradition

ETH Price Rally to $4,000

Experts together with analyst Michael van de Poppe predict a consolidation in Bitcoin for the subsequent coming months and recommend rotating a lot cash to the Ethereum ecosystem. People will make earnings simply by holding ETH moderately than day buying and selling as a possible approval of spot Ether ETF looms in May.

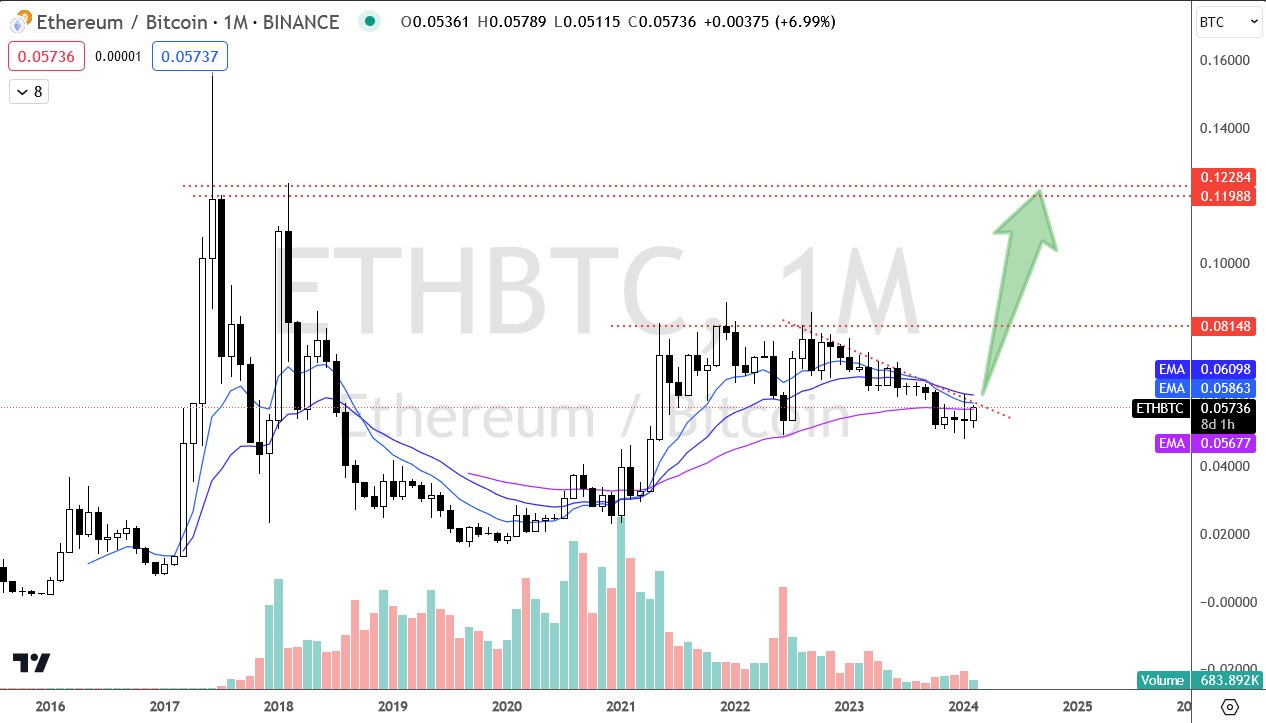

Combining spot Ether ETF narrative, Dencun upgrade, demand facet for restaking airdrop farming, and robust ETHBTC charts in all timeframes, Ethereum worth rally will proceed for many weeks forward.

ETH price jumped over 3% previously 24 hours, with the worth presently buying and selling at $3,017. The 24-hour high and low are $2,875 and $3,021, respectively. However, the buying and selling quantity has declined barely within the final 24 hours. As per a CoinGape Markets evaluation, an ETH rally to $4000 is imminent.

Moreover, 792K ETH choices of notional worth $2.4 billion are set to run out, with a put name ratio of 0.49. The max ache level is $2,400. Options and futures merchants are bullish on Ethereum, making greater bets

Also Read: Ethereum’s Vitalik Buterin Highlights Permanent Money Loss Risk in L2

The offered content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability for your private monetary loss.