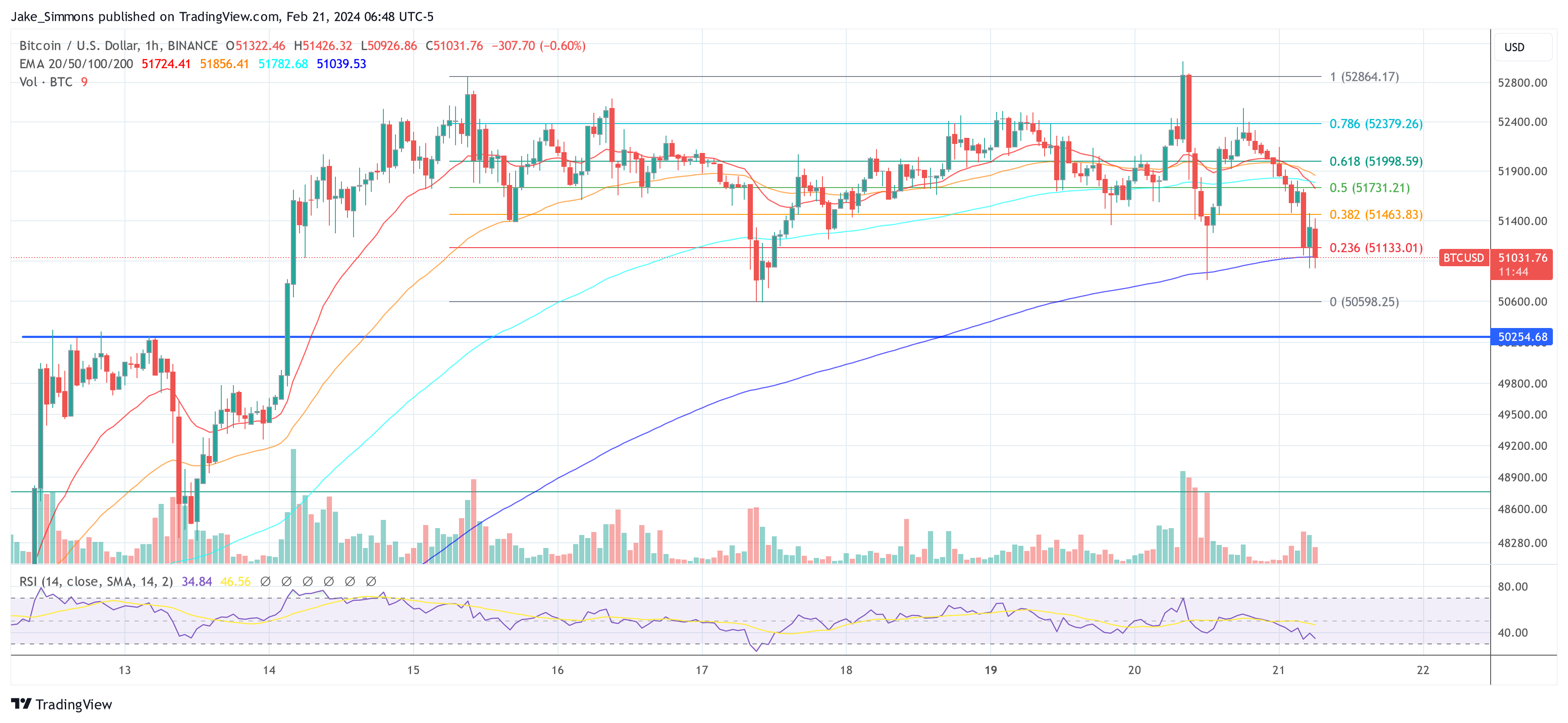

Bitcoin skilled a tumultuous day yesterday, with its worth briefly touching $53,000 earlier than plummeting to a low of $50,820. Amid this worth volatility, an sudden phenomenon caught the attention of market analysts: a dramatic surge in buying and selling volumes for sure Bitcoin ETFs.

Bloomberg’s Eric Balchunas offered a detailed account of this anomaly on X, notably specializing in the VanEck Bitcoin ETF (HODL) and its astonishing enhance in buying and selling quantity. He remarked, “HODL is going wild today with $258m in volume already, a 14x jump over its daily average, and it’s not one big investor… but rather 32,000 individual trades, which is 60x its avg.”

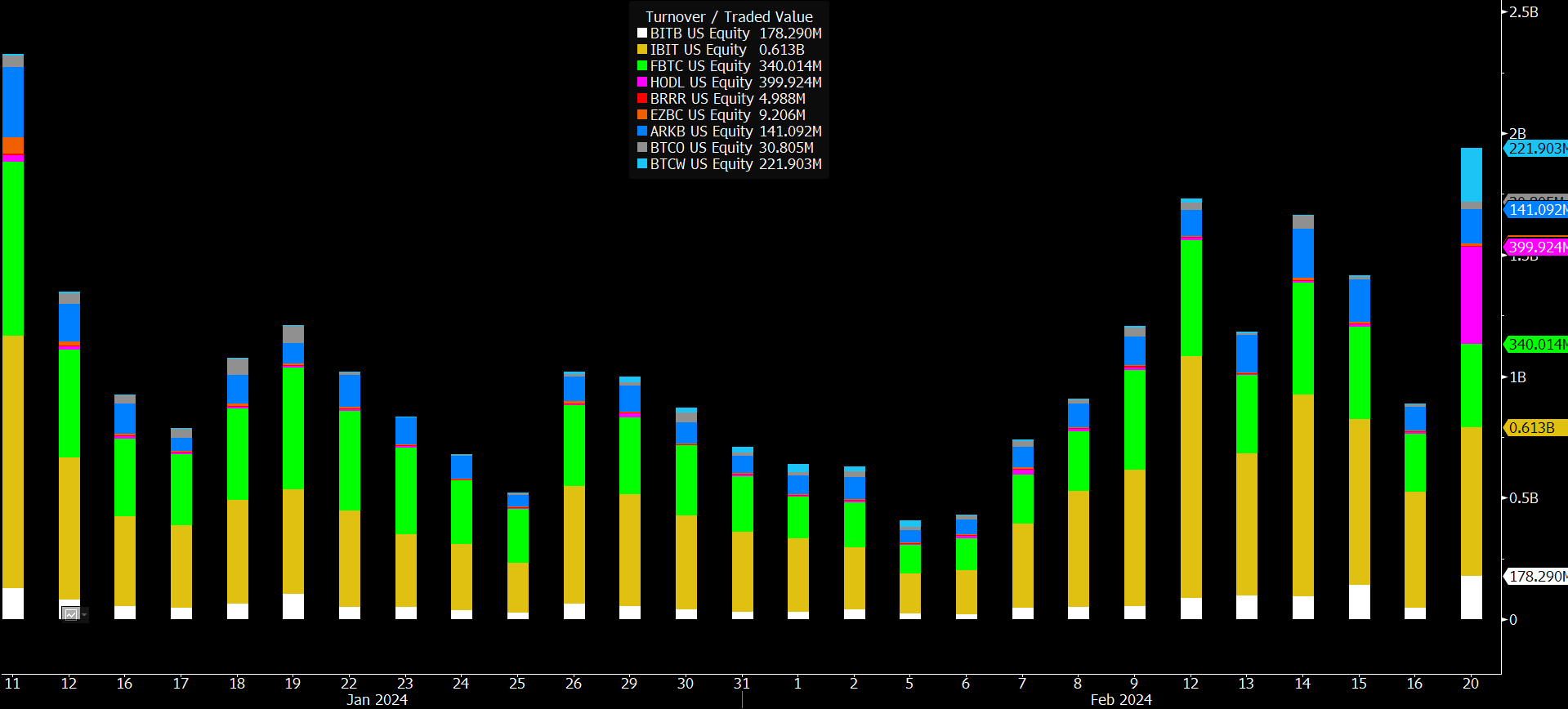

This stage of exercise was not solely sudden but additionally unprecedented, sparking widespread hypothesis and evaluation inside the monetary neighborhood. The uncommon buying and selling quantity wasn’t remoted to HODL alone. Wisdom Tree’s Bitcoin ETF (BTCW) and BlackRock’s Bitcoin ETF (IBIT) additionally noticed vital upticks in buying and selling exercise, albeit to various levels.

Balchunas identified, “BTCW also popping off, $154m trades, 12x its avg and 25x its assets via 23,000 indiv trades.” However, he famous that the amount enhance in IBIT, whereas elevated, didn’t attain the “extraordinary levels” noticed in HODL and BTCW.

What’s Behind The Sudden Spike In Bitcoin ETF Volumes?

Addressing theories that the ETF quantity surge was driving Bitcoin’s worth drop, Balchunas provided a rebuttal, “To the ‘bruh volume must be selling bc btc is dumping’ crowd: a) that makes no sense given how little these ETFs had in existing aum/shareholders b) plus you never see ton of outflows in brand new ETF that is in rally mode c) there are so many other holders of btc besides ETFs! d) how can you call it ‘dumping’ when it is down 1% after 20% rally in two weeks?”

However, the supply of this sudden and explosive enhance in buying and selling quantity stays a thriller, with Balchunas speculating, “Still haven’t figured out what happened. No one knows. Given how sudden and explosive the increase in number of trades was… I’m wondering if some Reddit or TikTok influencer type recommended them to their followers. Feels retail army-ish.”

He additionally thought of the potential for market makers buying and selling amongst one another however discovered it an unlikely clarification given the liquidity of different Bitcoin ETFs like IBIT and BITO.

The buying and selling day concluded with “The Nine” attaining a record-breaking quantity day, because of vital contributions from HODL, BTCW, and BITB, which all shattered their earlier data. Balchunas highlighted the importance of this buying and selling quantity, stating, “For context $2b in trading would put them in Top 10ish among ETFs and Top 20ish among stocks. It’s a lot.”

As the mud settles on this unprecedented day of buying and selling, the Bitcoin neighborhood continues to grapple with the implications of this quantity surge on Bitcoin ETFs and its potential affect in the marketplace. The actual catalyst behind this phenomenon stays elusive, with analysts and traders alike keenly awaiting additional developments.

At the time of going to press, BTC fell beneath the $51,000 mark once more and initially discovered help on the EMA100 on the 1-hour chart.

Featured picture created with DALL·E , chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site totally at your individual threat.