The Bitcoin liquidity panorama is experiencing a seismic shift, notably in US crypto exchanges. Notably, latest information reveals a notable surge in liquidity, attributed to the introduction of exchange-traded funds (ETFs) within the United States.

Meanwhile, this shift marks a major evolution in Bitcoin buying and selling dynamics, reshaping investor sentiments and market behaviors. Also, the replace comes amid a time when the market is bullish on the crypto phase, given the latest rally in Bitcoin and crypto costs.

Bitcoin Liquidity Surge In US Exchanges

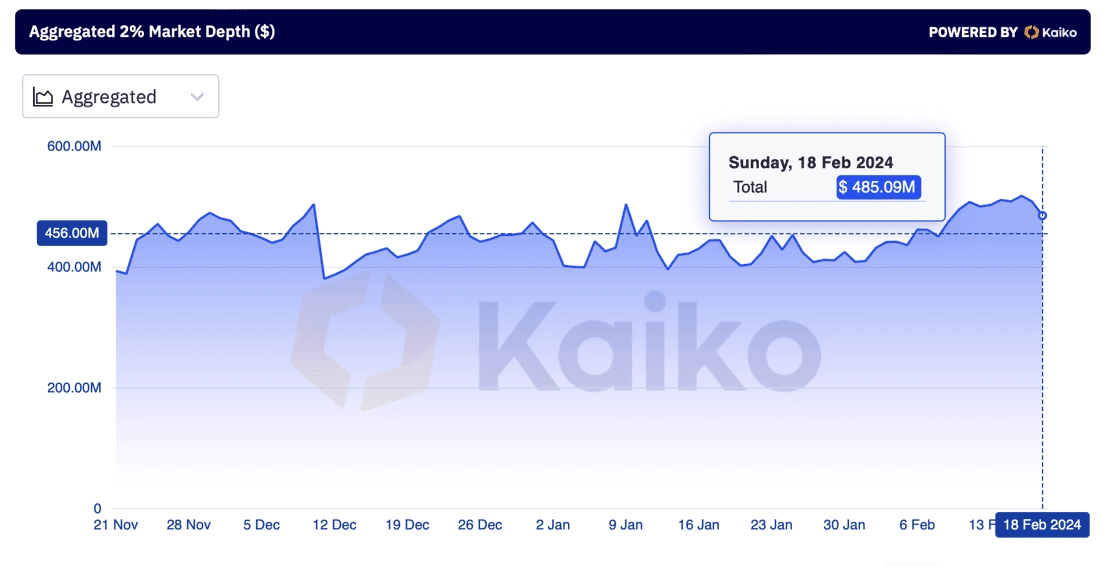

A latest report by analysis firm Kaiko underscores a notable transformation in Bitcoin liquidity dynamics, notably favoring US-based crypto exchanges. Notably, the info reveals that the U.S. crypto exchanges have emerged as dominant gamers in facilitating Bitcoin trades, particularly because the introduction of U.S. Bitcoin Spot ETFs.

Previously, non-US platforms held sway over Bitcoin market depth, however with the appearance of the Bitcoin ETFs, there’s been a notable reversal.

Meanwhile, the report signifies that US buying and selling venues have accounted for practically half of the bids and asks inside 2% of Bitcoin’s mid-price because the inception of US spot ETFs. It’s value noting that this surge in liquidity is a pivotal think about enhancing the effectivity of buying and selling operations, making certain smoother execution of orders with out vital value fluctuations.

Also Read: Starknet’s STRK Token Gains Momentum with Major Market Makers

Impact Of ETF on Market Dynamics

The debut of 9 U.S. Bitcoin ETFs, alongside the transformation of Grayscale Bitcoin Trust into an ETF, has catalyzed a major inflow of roughly $5 billion in investor funds since its launch on January 10. Notably, Matthew Sigel, head of digital-asset analysis at VanEck, notes that the constructive value momentum of Bitcoin has been most pronounced throughout US buying and selling hours, indicating heightened liquidity accessibility.

In addition, optimism surrounding the Bitcoin ETFs serves as an inflection level, with proponents envisioning broader crypto adoption. This sentiment is substantiated by the revival of digital-asset buying and selling volumes, particularly following the subdued ranges after the FTX exchange collapse in the course of the 2022 bear market.

In different phrases, the latest surge in Bitcoin liquidity on US crypto exchanges, fueled by the introduction of Bitcoin ETFs, marks a pivotal juncture within the cryptocurrency panorama. This shift not solely enhances buying and selling effectivity but in addition underscores rising investor confidence in Bitcoin as an asset class.

For context, prior to now 24 hours, Bitcoin Futures Open Interest (OI) elevated by 0.69% to achieve 465.68K BTC or $24.41 billion. According to CoinGlass data, Binance leads in Bitcoin Futures OI, experiencing a 2.31% surge to 116.30K BTC or $6.10 billion.

As of writing, the Bitcoin value traded close to the flatline at $52,310.72, with its final 24 hours buying and selling quantity hovering 24.12% to $23.37 billion. Notably, the flagship crypto has gained practically 26% within the final 30 days.

On the opposite hand, a latest report from CoinShares confirmed that the digital asset funding merchandise noticed weekly inflows hitting $2.45 billion, marking an all-time excessive. On a year-to-date foundation, the crypto-based merchandise witnessed staggering inflows of $5.2 billion, propelling complete belongings underneath administration to $67 billion, the best since December 2021.

Notably, Bitcoin dominated with over 99% of inflows, whereas Ethereum additionally benefited considerably. Despite latest disruptions from Solana, firms like Avalanche, Chainlink, and Polygon noticed constant weekly inflows.

Also Read: Mike Novogratz’s Galaxy Digital Doing Heavy Ethereum (ETH) Buying

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.