Spot Bitcoin ETFs noticed one other large influx of greater than $477 million — the fifteenth consecutive influx as demand continues to develop towards provide. BlackRock’s iShares Bitcoin ETF holdings surpassed $6 billion and Bitwise Bitcoin ETF noticed 2nd largest day because the spot Bitcoin ETF launch.

BlackRock Leads Spot Bitcoin ETF Records Net Inflow

According to the newest knowledge by BitMEX Research, spot Bitcoin ETFs noticed $477.4 million web influx on Thursday. With the newest influx, Bitcoin ETFs have now recorded a web influx of over 61,800 BTC within the final 7 days.

BlackRock’s iShares Bitcoin ETF (IBIT) registered a staggering influx of $339.9 million on Thursday. Bitwise Bitcoin ETF (BITB) comes subsequent with a $120.2 million influx. However, Fidelity Bitcoin ETF (FBTC) influx has additional slowed to $97.4 million on Thursday.

BlackRock has been main all its rivals by a large margin, with complete influx crossing $5.17 billion and BTC holdings of 115,991.3 valued over $6 billion.

GBTC noticed a $174.6 million outflow, a rise from Wednesday’s $131.2 million outflow. As a outcome, the web influx for spot Bitcoin ETFs, excluding GBTC, was truly $652 million.

BlackRock and Fidelity Wise Origin Bitcoin ETFs now maintain over $10.3 billion price BTCs. The ETFs are shopping for 10k Bitcoin per day on high of the usual equilibrium and that is mirrored within the value appreciation. However, the provision stays fairly decrease than the provision.

Also Read: Jupiter Faces Crypto Investment Woes Amid EU’s Divergent Approach

Bitcoin High Demand Concerns

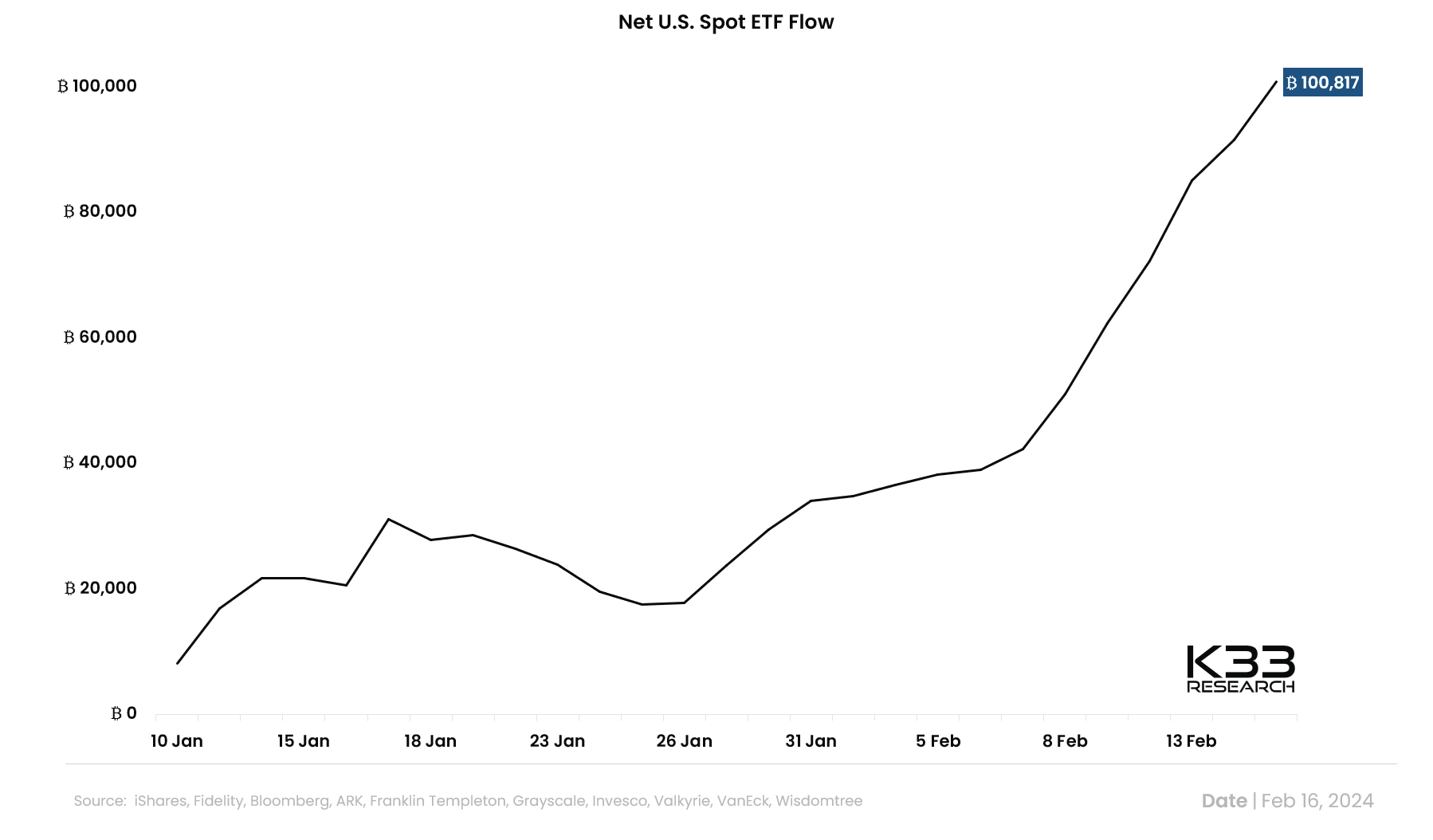

Vetle Lunde, senior analyst at K33 Research on Friday mentioned the web U.S. spot ETF circulation has now surpassed 100,000 BTC. This is the same as two-thirds of the annualized discount in BTC issuance after the upcoming halving.

Bitcoin maximalist Samson Mow raised issues over excessive demand from spot Bitcoin ETFs. He mentioned “This level of demand is not sustainable at current Bitcoin prices.”

The demand has crossed 10x provide, with extra from different sources. MicroStrategy’s Michael Saylor additionally identified 10x demand than provide dynamics in a current interview.

BTC price fell 1% prior to now 24 hours, with the value at the moment buying and selling at $51,787. The 24-hour high and low are $51,371 and $52,820, respectively. Furthermore, the buying and selling quantity has decreased by 13% within the final 24 hours, indicating a decline in curiosity amongst merchants.

Also Read: Cathie Wood Ark Offloads $31M Coinbase Shares Post-Earnings As Price Hit 2-Yr High

The introduced content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.