Bitcoin is edging closer to the $50,000 mark after per week of extreme bullish price action, a degree not seen since December 2021. Amidst this value surge, the variety of Bitcoin addresses in revenue has now crossed over 90%.

According to information from IntoTheBlock, 91% of Bitcoin addresses are at present worthwhile. This means the overwhelming majority of holders and buyers have an incentive to proceed holding, significantly as the subsequent halving for Bitcoin miners approaches.

91% Of Bitcoin Addresses Now In Profit As Price Nears $50,000

Bitcoin has had an eventful week when it comes to value motion. The world’s largest crypto just lately grew by 14.4% to succeed in $48,500 on February 11, its highest level in 26 months. This value spike, though extremely welcome, appeared to have taken most buyers unexpectedly contemplating it was coming off 4 weeks of unimpressive motion after the debut of spot Bitcoin ETFs within the US.

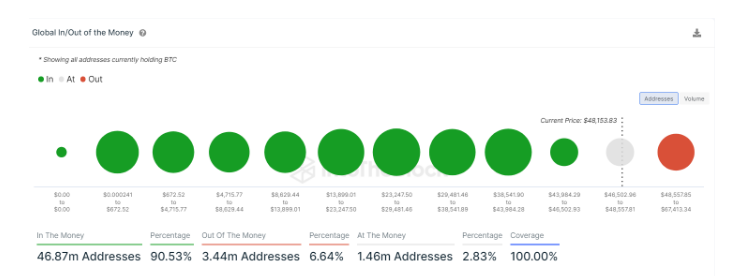

Notably, IntoTheBlock’s “Global In/Out of the Money” profitability metric exhibits that the entire variety of addresses in revenue is now at 46.87 million addresses, representing 90.53% of the entire addresses. At the identical time, 3.44 million addresses representing 6.64% are nonetheless posting losses, whereas 1.46 million addresses representing 2.83% of the entire addresses are on the cash or break-even level.

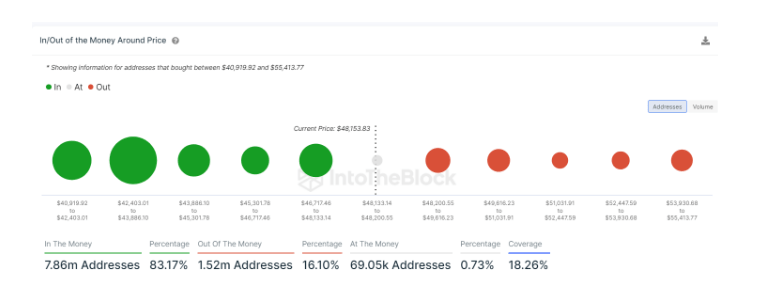

Similarly, IntoTheBlock’s “In/Out of the Money Around Price” metric which follows addresses that purchased between $40,919.92 and $55,413.77, exhibits {that a} majority (83.17%) of addresses are in revenue. This is a vastly bullish sign and exhibits that almost all of Bitcoin holders are nicely within the cash. As the worth continues climbing because the crypto approaches the $50,000 mark, increasingly addresses are prone to transfer into revenue.

Bitcoin Set To Keep Shining

With over 90% of Bitcoin addresses now in revenue and the worth nearing $50,000, it’s clear this bull run nonetheless has room to run. The bullish motion final week noticed BTC closing over $44,000 on the weekly timeframe for the primary time within the present market cycle.

BTCUSD at present buying and selling at $48,354 on the each day chart: TradingView.com

BitMEX Research recently reported that spot Bitcoin ETFs now have over $10 billion price of BTC beneath administration. There is a excessive chance that the worth of the highest coin proceed to surge if the exercise surrounding these exchange-traded funds (ETFs) continues at this tempo.

Bitcoin ETF Flow – ninth Feb

All information out. Strong day at $541.5m of internet influx

Invesco had an outflow, the primary non-GBTC product to have an outflow day pic.twitter.com/UCFDVAaKD3

— BitMEX Research (@BitMEXResearch) February 10, 2024

Another catalyst for a sustained value enhance is the upcoming halving. Historically, Bitcoin bull runs main as much as every halving have all the time trended up and gone parabolic after the halving occasion. The same development might see the crypto asset reaching $60,000 earlier than the subsequent halving in April and $100,000 earlier than the tip of the 12 months.

Featured picture from Adobe Stock, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site solely at your individual threat.