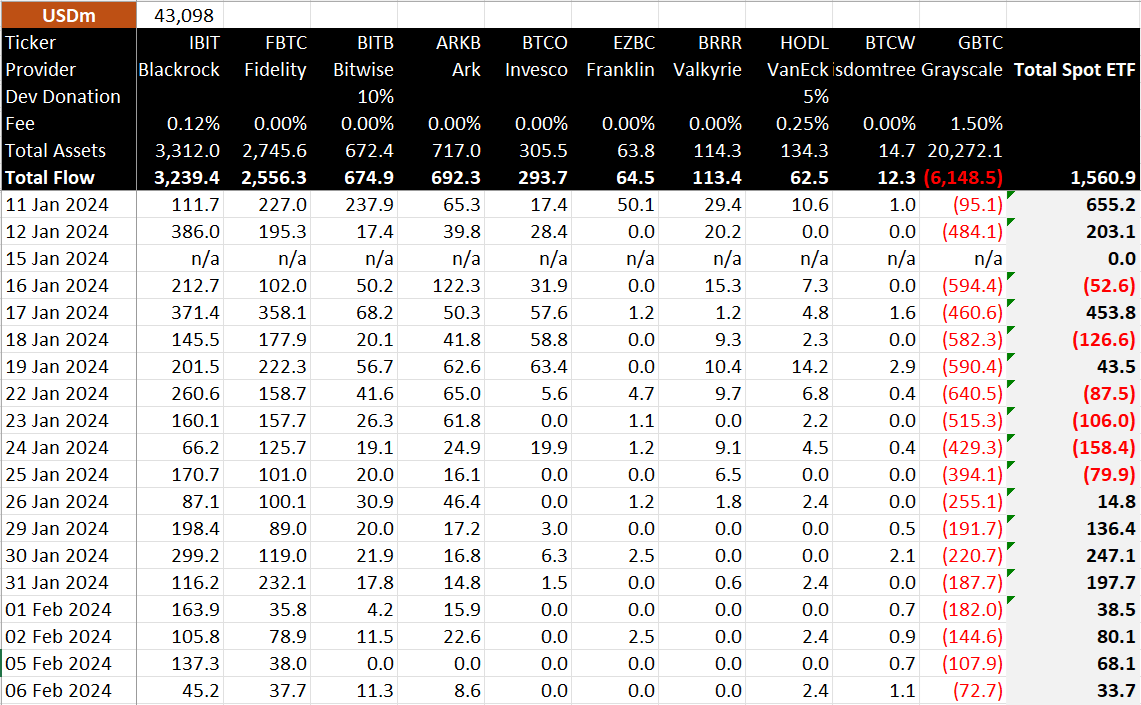

Most spot Bitcoin ETFs noticed a large drop in inflows on Tuesday as demand and liquidity dries up, in accordance to the newest knowledge by BitMEX Research. Interestingly, Grayscale Bitcoin Trust (GBTC) spot Bitcoin ETF outflow drops to a document low.

Spot Bitcoin ETFs Net Inflows Slows to $33 Million

BitMEX Research within the newest spot Bitcoin ETFs influx report on February 7 revealed that complete inflows for 10 Bitcoin ETFs dropped to simply $33.7 million. Despite recording a number of web outflows, that is the second-lowest influx for 10 spot Bitcoin ETFs after a $14.8 million influx on January 26.

Inflows for BlackRock Bitcoin ETF (IBIT) dropped to a brand new low of $45.2 million. BlackRock Bitcoin ETF noticed a $137.3 influx a day earlier, elevating hypothesis of return in demand for the Bitcoin ETF. Fidelity’s FBTC additionally noticed a drop in influx of $37.7 million.

Bitcoin ETFs of Bitwise, Ark 21 Shares, VanEck and WisdomTree recorded rise in inflows of $11.3, $8.6, $2.4, and $1.1, respectively. Bloomberg senior ETF analyst Eric Balchunas mentioned all underperforming Bitcoin ETFs have the potential to carry out sooner or later.

Grayscale Outflow Slows

Outflows from Grayscale’s GBTC slows to a document low of $72.7 million for the reason that approval of spot Bitcoin ETF by the U.S. SEC on January 11. GBTC noticed a $107.9 million outflow on Monday, February 5.

The decline in GBTC outflows signifies an imminent finish to the mass exodus on the Bitcoin ETF. Experts imagine it should positively have an effect on the crypto market and Bitcoin worth. GBTC is the liquidity chief within the class. Grayscale will want a strong derivatives ecosystem developed round underlying ETF in the event that they needs to stay a frontrunner and proceed to cost excessive charges. Currently, GBTC expenses 1.5% administration charges for its spot Bitcoin ETF.

CME Tops Binance Again

Bitcoin Futures open curiosity (OI) on CME has surpassed Binance once more. Crypto trade Binance recently topped CME to develop into a number one Bitcoin futures trade for simply two days.

With a notional open curiosity (OI) of 106,090 BTC valued at $4.55 billion, CME is now the most important Bitcoin futures trade once more after a virtually 5% rise in Bitcoin futures open curiosity. Binance ranks second, with a notional open curiosity of 103,660 value $4.46 billion.

Also Read:

The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.