XRP Ledger, created by Ripple Labs Inc., is an open-source blockchain expertise and digital asset. This implies that builders can contribute to its growth and improve its performance. XRP serves because the native cryptocurrency of the XRP Ledger and is the generally acknowledged title for it. The XRP Ledger is purposefully designed to allow swift, cost-effective, and safe transactions. It capabilities as a distributed ledger, the place transaction information are saved throughout a community of validators, that are taking part computer systems, making certain the integrity of the ledger.

XRP has garnered important recognition for its capability to facilitate expeditious and streamlined cross-border funds. Its major goal is to reinforce liquidity and set up connections between numerous currencies, enabling seamless worth transfers for each monetary establishments and people throughout worldwide borders. Ripple, the entity liable for XRP, has solid partnerships with quite a few monetary establishments to analyze the potential of XRP within the realms of remittances and worldwide settlements.

It is crucial to emphasise that though XRP is usually linked with Ripple, the XRP Ledger capabilities autonomously, separate from the corporate. XRP could be exchanged on totally different cryptocurrency platforms and saved in digital wallets which are appropriate with the XRP Ledger.

Additionally, there’s a numerous vary of cryptocurrency exchanges that assist the XRP Ledger (XRP) for people interested by shopping for, promoting, or buying and selling XRP. Some notable examples embrace Binance, Coinbase, Kraken, BitStamp, Huobi, and extra.

Founders Of XRP Ledger (XRP)

In early 2011, builders David Schwartz, Jed McCaleb, and Arthur Britto had been intrigued by Bitcoin however involved about its vitality consumption and scalability points. They aimed to create a extra sustainable system for worth switch. Their predictions about Bitcoin’s vitality utilization had been confirmed proper when estimates revealed that Bitcoin mining consumed extra vitality than Portugal in 2019. They additionally foresaw the dangers of 1 miner or collusion of miners gaining over 50% of the mining energy, which stays a priority immediately as mining energy concentrates in China.

Undeterred, the builders continued their work and created a distributed ledger referred to as Ripple, with a digital asset initially referred to as “ripples” (later known as XRP). The title Ripple encompassed the open-source mission, the distinctive consensus ledger (Ripple Consensus Ledger), the transaction protocol (Ripple Transaction Protocol or RTXP), the community, and the digital asset.

To get rid of confusion, the group began referring to the digital asset as “XRP.” By June 2012, Schwartz, McCaleb, and Britto accomplished the code growth and finalized the Ledger.

How XRP Ledger (XRP) Works

The XRP Ledger represents a pioneering blockchain expertise that locations a powerful emphasis on scalability and interoperability. This focus permits the ledger to supply a wide selection of potentialities for numerous functions that surpass the realms of conventional monetary techniques.

By demonstrating the capability to deal with substantial transaction volumes and foster seamless connectivity amongst totally different property, the XRP Ledger stands poised to deliver a few revolution throughout a number of industries and ignite innovation. Its scalable and interoperable nature creates alternatives for novel use circumstances and transformative options inside the blockchain ecosystem.

Prominent Features Of XRP Ledger

Consensus Ledger

Functioning as a distributed and decentralized ledger, the XRP Ledger shops the transaction historical past throughout an impartial community of validators. Every validator preserves a replica of the ledger, and transactions bear validation and settlement through the consensus algorithm. This strategy ensures that the ledger’s transaction historical past is securely saved and that transactions are verified and accepted by means of a collaborative course of amongst validators. By using this distributed and decentralized framework, the XRP Ledger establishes a dependable and clear system for recording and validating transactions.

Gateways and Interoperability

The XRP Ledger permits the institution of gateways, that are entities liable for issuing and redeeming property on the ledger. These gateways play a vital position in bridging varied currencies and property, fostering seamless interoperability throughout totally different monetary techniques.

By facilitating the switch and trade of numerous property, the gateways improve the connectivity and compatibility between totally different types of worth illustration. This function of the XRP Ledger promotes larger effectivity and accessibility in cross-border transactions and opens up alternatives for enhanced liquidity and streamlined monetary operations.

Transaction Speed and Scalability

Engineered with scalability and fast transaction settlement in thoughts, the XRP Ledger (XRP) is adept at processing a considerable variety of transactions per second. With the aptitude to settle transactions inside a matter of seconds, the ledger is well-suited for a variety of use circumstances that demand swift and environment friendly transaction execution.

Its excessive scalability and speedy transaction settlement empower companies and people alike to conduct seamless and well timed transactions, fostering enhanced productiveness and responsiveness in varied functions and industries.

Consensus Algorithm

Within the XRP Ledger, a particular consensus algorithm often known as the Ripple Protocol Consensus Algorithm (RPCA) is employed. Diverging from standard proof-of-work (PoW) or proof-of-stake (PoS) algorithms, RPCA depends on a bunch of trusted validators to authenticate and validate transactions. These validators assume the essential position of collectively establishing consensus concerning the sequence and legitimacy of transactions on the community. By leveraging this progressive consensus mechanism, the XRP Ledger ensures the integrity and reliability of its transaction validation course of, offering a safe and environment friendly setting for conducting enterprise.

Native Cryptocurrency (XRP)

XRP operates because the inherent digital foreign money of the XRP Ledger, serving a number of functions, resembling facilitating transactions, providing liquidity, and bridging numerous currencies. As a medium of worth trade, XRP could be transferred between varied entities on the XRP Ledger, enabling seamless transactions and facilitating the trade of worth. This versatile cryptocurrency performs an important position in supporting the performance and effectivity of the XRP Ledger ecosystem.

The Impact Of XRP On The Financial Industry

Undoubtedly, the XRP Ledger, together with its native foreign money XRP, has made a notable affect on the monetary trade, bringing forth a variety of optimistic improvements throughout varied essential points resembling:

Decentralized Finance (DeFi)

The XRP Ledger’s utilization of good contracts and tokenization creates potentialities for decentralized finance (DeFi) functions, paving the best way for the event of groundbreaking monetary providers like lending, borrowing, and decentralized exchanges. With its fast and scalable nature, the XRP Ledger supplies a perfect basis for setting up DeFi functions, probably extending monetary providers to underserved communities and diminishing dependence on standard intermediaries.

Asset Tokenization

The capability of the XRP Ledger to tokenize tangible property like actual property, artwork, and commodities has the potential to unleash liquidity for property which have traditionally lacked it. Through the illustration of those property as digital tokens on the ledger, fractional possession turns into possible, enabling enhanced accessibility and transferability. This breakthrough can introduce contemporary funding prospects and improve market effectivity.

Cross-Border Payments

The swift transaction settlement and economical charges provided by the XRP Ledger make it a lovely alternative for cross-border funds. Its environment friendly currency-bridging capabilities simplify and expedite worldwide transactions, probably lowering bills and enhancing liquidity for monetary establishments. This may end up in expedited and cost-effective remittances, benefiting each companies and people.

Liquidity and Market Efficiency

The XRP Ledger’s utilization of XRP as a bridge foreign money and liquidity instrument has the potential to bolster market effectivity and improve liquidity for numerous property. By enabling seamless worth trade throughout totally different currencies, the XRP Ledger contributes to improved market liquidity, simplifying the method of shopping for, promoting, and buying and selling property for customers. This heightened liquidity has the capability to foster extra environment friendly markets and improve the method of value discovery.

XRP Distribution And Price Dynamics

The distribution of XRP tokens by Ripple Labs is a nuanced course of that goes past a easy month-to-month launch schedule. Currently, nearly all of XRP is held in 16 escrow contracts, and their launch is influenced by a number of components, resembling market circumstances and ecosystem adoption. The unique 55-month distribution projection was an estimate, and Ripple has the flexibility to regulate the tempo based mostly on their evaluation.

Certainly, this distribution technique impacts the value of XRP. A big inflow of XRP may probably exert downward stress on its worth. However, attributing value fluctuations solely to this issue can be narrow-minded. The total market sentiment in the direction of cryptocurrencies, demand from monetary establishments, regulatory developments, and information associated to Ripple all contribute considerably. To actually perceive the value motion of XRP, a complete evaluation of those intertwined components is important, recognizing the intricate interaction between Ripple’s distribution technique and the dynamic cryptocurrency panorama.

Tokenomics Of XRP Supply

XRP has a hard and fast provide of 100 billion tokens, making it a pre-mined cryptocurrency with no chance of further token creation. Only a fraction of the tokens are actively traded, whereas 20 billion went to the founders. The distribution entails 55 good contracts that launch 1 billion tokens month-to-month over 55 months, leading to a month-to-month increment of 1 billion tokens. The circulating provide is round 53.7 billion tokens, with the remaining held in escrow.

Source: Messari on X

Over 60% of the whole provide is concentrated within the prime 100 wallets, elevating decentralization considerations. Ripple owns 6.5 billion XRP, adjusting the circulating provide to roughly 47 billion tokens.

XRP displays a light deflationary pattern from burning charges, lowering the whole provide to about 99,988,221,902 XRP.

Buying XRP Coins

Purchasing XRP cash could be a comparatively simple process; nevertheless, the accessible decisions cater to numerous ranges of expertise and luxury. Here is a breakdown of various approaches tailor-made to fulfill your particular necessities:

Beginner-Friendly Exchanges

Coinbase and Binance are user-friendly platforms appropriate for newcomers. They present intuitive interfaces, clear directions, and buyer assist to help customers all through the method.

Peer-to-Peer (P2P) Exchanges

Platforms like Paxful are P2P exchanges that allow direct XRP purchases from different people. This decentralized strategy affords privateness and adaptability however requires warning when evaluating counterparties and following security measures.

Decentralized Exchanges (DEX)

Uniswap is an instance of a DEX platform that operates on blockchains. They facilitate direct peer-to-peer buying and selling with out intermediaries, offering enhanced safety and management over funds. However, utilizing DEX platforms would require appropriate wallets.

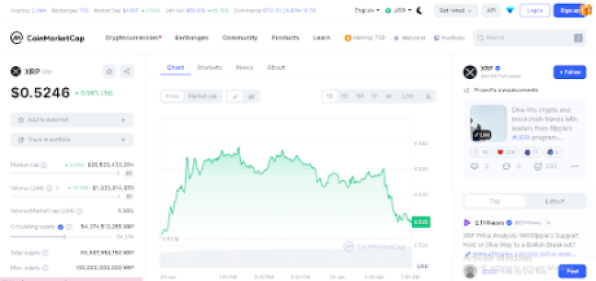

Tracking Prices of XRP Ledger (XRP)

To successfully monitor the costs of XRP Ledger (XRP), the digital asset native to the XRP Ledger, and keep updated with its market actions and fluctuations, there are a number of dependable strategies and platforms which you could make the most of, resembling widely known cryptocurrency monitoring platforms like CoinMarketCap

CoinMarketCap is a extremely regarded platform for monitoring cryptocurrencies, providing in depth knowledge on a various vary of digital property, resembling XRP Ledger (XRP). Users can discover the XRP web page on CoinMarketCap to entry up-to-the-minute value updates, historic knowledge, market traits, and different pertinent data regarding XRP. CoinMarketCap serves as a trusted useful resource for people looking for to trace and analyze the efficiency of XRP Ledger inside the international cryptocurrency market.

Ripple Lawsuit With Securities And Exchange Commission (SEC)

The Ripple vs. SEC authorized dispute, which started in December 2020, has a profound affect on XRP. The SEC accuses Ripple of conducting an unregistered securities providing by means of XRP gross sales, whereas Ripple argues that XRP is a utility token for cross-border funds and never a safety. This ongoing battle has induced turbulence for XRP, leading to value volatility and adoption uncertainty. The consequence of the case could have important implications for XRP and the broader cryptocurrency trade.

The lawsuit has led to a hesitant market as companies and people are cautious about embracing XRP because of the uncertainty surrounding its classification. The decision will decide whether or not XRP’s utility as a token will prevail or if the SEC’s classification as a safety will forged an extended shadow over its future. As the market awaits a definitive reply, the trajectory of Ripple’s digital creation stays unsure.

Conclusion

XRP Ledger (XRP) boasts a longtime title, a decentralized community, and lightning-fast, low-cost transactions. This has cemented its position as a most popular bridge foreign money for cross-border funds.

Despite going through authorized challenges, XRP has a formidable monitor report as one of many pioneering cryptocurrencies, gaining widespread adoption amongst main monetary establishments by means of RippleNet. The group’s dedication and the mission’s foundational strengths present a stable foundation for potential success. However, the result of the SEC lawsuit will likely be a vital determinant in shaping the way forward for XRP, whether or not it is going to be optimistic or detrimental.

Nevertheless, navigating the world of XRP necessitates cautious consideration. While some might prioritize user-friendly platforms for entry, skilled merchants may search superior options provided by decentralized exchanges (DEXs).

Regardless of your expertise stage, keep in mind that cryptocurrencies stay unstable, and accountable investing practices are paramount. Consider these components, analysis, and select the trail that aligns together with your private monetary targets and danger tolerance.

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site completely at your individual danger.