Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, has seen a big exodus from centralized exchanges in current weeks, with information suggesting a rising choice for holding the asset exterior of buying and selling platforms.

At the time of writing, ETH was trading at $2,289, down 0.7% within the final 24 hours, however managed to realize 1.6% within the final week, information from Coingecko exhibits.

Ethereum Outflow Hits $1.2 Billion

According to blockchain analytics agency IntoTheBlock, a staggering $500 million price of ETH exited exchanges final week, contributing to a complete outflow of $1.2 billion for all the month of January. This represents a significant shift in comparison with earlier months, elevating questions concerning the motivations behind this development.

$500M in $ETH was withdrawn from CEXs this week, including to a complete of over $1.2B in outflows within the final month pic.twitter.com/e8NFOGtrDV

— IntoTheBlock (@intotheblock) February 2, 2024

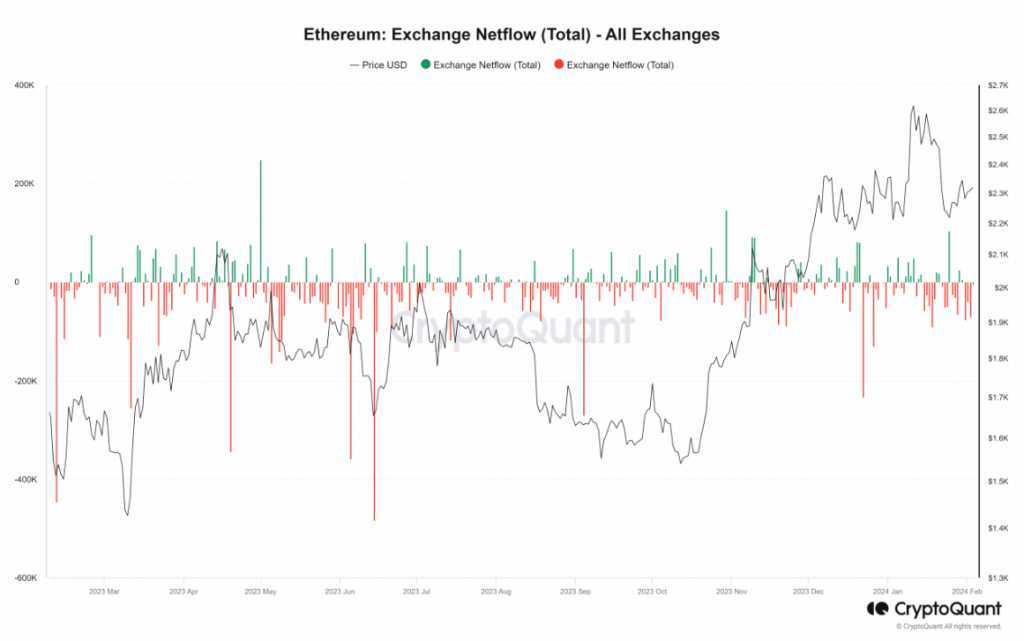

CryptoQuant information paints a fair starker image, showcasing a dominant sample of outflows because the starting of January. The chart reveals a persistent decline in trade holdings, with the final influx recorded on January thirtieth. At the time of writing, the outflow continues unabated, with over 3,000 ETH leaving exchanges each hour.

However, the influence on total trade provide just isn’t fully uniform. While the overall quantity of ETH held on exchanges initially elevated in January, reaching round 10.7 million by mid-month, it subsequently dipped to 10.3 million by January twenty eighth. Currently, the availability has resumed an upward development, sitting at round 10.6 million.

Binance ETH Exodus: Investors’ Strategic Moves

Interestingly, the historic stability of ETH on Binance, the world’s largest cryptocurrency trade, tells a special story. Despite the general uptick in trade holdings, Binance has witnessed a constant decline in its ETH stability all through January. From a peak of over 3.9 million ETH on January twenty third, the stability has shrunk to round 3.7 million, indicating that customers are actively withdrawing their Ethereum from the platform.

Ethereum at present buying and selling at $2,288.5 on the every day chart: TradingView.com

While the precise causes behind this development stay unclear, a number of doable interpretations emerge:

- Increased Investor Confidence: Moving ETH off exchanges may sign a rising sentiment amongst traders to carry the asset for the long run, probably pushed by confidence in its future potential. Additionally, some traders is likely to be transferring their ETH to DeFi platforms for staking or yield farming alternatives.

- Market Uncertainty: The current outflows may additionally mirror broader issues about market volatility or potential regulatory modifications, prompting traders to hunt safer storage for his or her holdings.

- Binance-Specific Dynamics: The decline on Binance is likely to be attributable to elements particular to the trade, reminiscent of consumer preferences for different platforms or modifications in its buying and selling charges or insurance policies.

Featured picture from Adobe Stock, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site fully at your individual threat.