Ethereum has been making a recent try at restoration just lately. Here’s what on-chain knowledge suggests concerning if this run might be sustainable or not.

Ethereum Network Growth And Utility Have Both Gone Up Recently

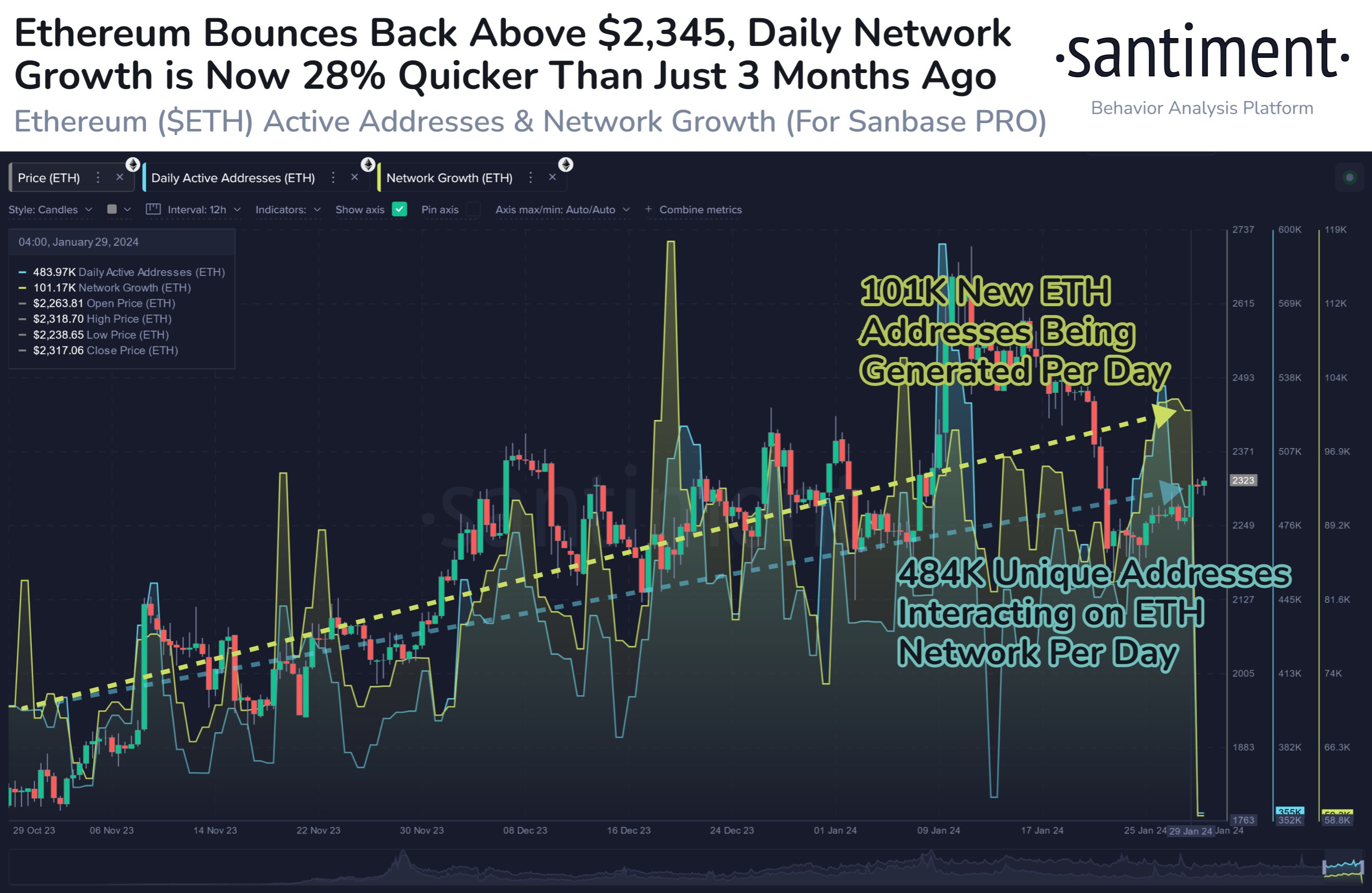

According to knowledge from the on-chain analytics agency Santiment, the ETH blockchain has displayed an encouraging pattern in Daily Active Addresses and Network Growth just lately. These two indicators are used to trace the utility and progress of the chain.

The “Daily Active Addresses,” the primary of those, measures the distinctive variety of addresses which can be participating in some form of transaction exercise on the blockchain on daily basis.

This distinctive variety of addresses might be thought of analogous to the distinctive variety of customers taking part on the community, so the indicator’s worth can present hints concerning the power of site visitors Ethereum is witnessing in the meanwhile.

The different indicator of curiosity right here, “Network Growth,” tells us concerning the each day variety of addresses making a transaction on the blockchain for the primary time.

Generally, such new addresses correspond to recent buyers coming into the cryptocurrency, so the Network Growth’s worth can present hints about how the adoption of the asset is coming alongside.

Now, here’s a chart that reveals the pattern within the Ethereum Daily Active Addresses and Network Growth over the previous few months:

Looks like each of those metrics have seen progress in latest weeks | Source: Santiment on X

From the graph, it’s seen that each the Daily Active Addresses and Network Growth have steadily been going up for Ethereum just lately. After the rise, the chain is now observing 101,000 new addresses popping up each day and 484,000 distinctive addresses making transactions per day.

This means that not solely is the cryptocurrency observing vital curiosity from the present customers (as they’re making strikes on the community), but in addition from recent buyers. “Increased utility is a primary pillar to justify an increasing ETH market cap,” notes Santiment.

The on-chain analytics agency Glassnode has mentioned the exercise occurring on the Bitcoin blockchain in its newest weekly report. Here is the chart shared by Glassnode that reveals the pattern within the 7-day shifting common (MA) variety of lively entities for the unique cryptocurrency:

The worth of the metric seems to have been comparatively low in latest days | Source: Glassnode's The Week Onchain - Week 5, 2024

This metric is much like the Daily Active Addresses, besides it retains observe of the “active entities” as an alternative of the addresses. An entity refers to a gaggle of addresses that Glassnode has deemed to belong to the identical investor.

As is clear from the chart, the lively entities have plunged to cyclical lows for Bitcoin just lately. This is not like what Ethereum has been observing, the place the utility has seemed to be on the rise.

The analytics agency explains, nonetheless, “at face value, this might suggest that despite the significant price appreciation, growth in Bitcoin users has not followed suit.”

“This is largely a result of the uptick in activity related to Ordinals and Inscriptions, where many participants are re-using Bitcoin addresses, and reducing the number of measured ‘active entities’ (does not double count).”

ETH Price

Ethereum has been attempting at restoration just lately, however the coin has plunged throughout the previous day, bringing the asset’s worth right down to round $2,300. Given the robust community exercise, although, it’s potential the rally may nonetheless have hopes of continuous.

The worth of the coin seems to have plummeted throughout the previous 24 hours | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com, Santiment.internet