Samson Mow, the CEO of JAN3, has identified a collection of essential indicators that would form Bitcoin’s trajectory within the coming months. Among the various, Mow lists how capital flows to Bitcoin through spot ETF issuers, actual inflation, hash charge evolution, and others.

Spot Bitcoin ETF Inflows Is A Metric To Monitor Closely

Taking to X on January 28, Mow believes that the inflow of capital into Bitcoin-linked exchange-traded funds (ETFs) might play a pivotal function in driving adoption and worth within the coming weeks and months. Specifically, the CEO emphasizes the significance of the spot Bitcoin ETF influx metric. The United States Securities and Exchange Commission (SEC) not too long ago authorized a number of spot Bitcoin ETFs for the primary time in over ten years.

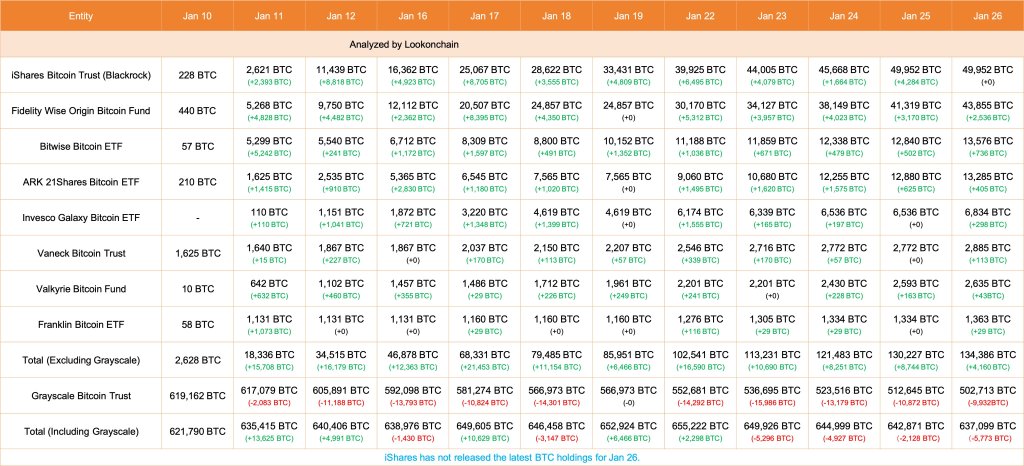

Some of the highest Wall Street gamers, together with BlackRock and Fidelity Investments, have been main the desk, shopping for extra cash up to now three weeks. According to Lookonchain data, eight spot Bitcoin ETFs purchased 4,160 BTC as of January 26. At the identical time, Grayscale Investments, the issuer of Grayscale Bitcoin Trust (GBTC) shares, offloaded 9,932 BTC.

Prices may enhance as extra institutional traders achieve publicity to Bitcoin by way of regulated ETFs. However, for now, merchants are watching out for how briskly Grayscale Investments is shedding their GBTC shares, recouping BTC, and even distributing them to identify Bitcoin ETF issuers. GBTC conversion to BTC may affect costs, heaping extra promoting strain and negating the final optimism amongst holders.

Hash Rate Is Rising Even As Miners Dump BTC

Ahead of the Bitcoin halving occasion set for early April 2024, Mow additionally watches the community’s hash charge. The hash charge measures the computing energy channeled to the community, securing the blockchain.

Usually, the upper it’s, the extra wholesome the mining ecosystem is. In flip, this might increase investor confidence, signaling that miners, although anticipating a drastic income drop within the subsequent three months, are nonetheless bullish on the community’s prospects. So far, the Bitcoin hash charge stands at over 559 EH/s, a slight lower from the all-time excessive of round 632 EH/s recorded in January 2024, information from YCharts on January 29 reveals.

Even so, regardless of the rising hash charge, CryptoQuant data reveals that miners have been offloading their cash, promoting them at spot charges. During the previous week, miners bought hundreds of BTC, contributing to the downtrend.

It stays to be seen whether or not this liquidation will proceed within the weeks forward. Usually, the extra miners offload their cash through main crypto exchanges, the extra costs turn into depressed, impacting sentiment.

Beyond these, the CEO additionally tracks macro indicators just like the United States M3 cash provide, how briskly international locations undertake Bitcoin, and real inflation on the planet’s main financial powerhouse.

In the United States, cash provide and actual inflation have fallen reasonably as a result of comparatively high-interest charge. However, this might change if the Federal Reserve slashes rates of interest within the months forward.

Feature picture from Canva, chart from TradingView