A crypto analyst, Elja on X, predicts that Ethereum (ETH) will attain a staggering $15,000 by 2025 based mostly on technical evaluation. The analyst argues that the present bearish sentiment within the crypto market is “temporary.”

Moreover, Elja notes that the second most precious coin by market cap follows the same fractal sample that fueled its earlier main worth rally in 2021.

Is Ethereum Ready To Rip Despite The Current Consolidation?

Sharing a display screen seize of the present ETH worth motion, Elja says most individuals in crypto are “short-sighted” and solely concentrate on quick worth actions. In the analyst’s evaluation, merchants ought to take a look at the long-term to grasp the general worth sample.

Thus far, Ethereum, like Bitcoin (BTC), stays underneath strain and struggling to interrupt above quick resistance ranges. Looking on the growth within the day by day chart, ETH is again at a crucial help stage of round $2,200. Notably, the coin is down 20% from January 2024 highs of about $2,700.

ETH is underneath strain, at the very least within the brief to medium time period. As it’s, the coin follows the technical candlestick association seen in Bitcoin.

The altcoin downtrend seems to have been triggered by occasions following the approval of spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC). As an illustration, Bitcoin fell from round $47,000 to under $40,000 this week, weighing down altcoins, together with Ethereum.

On-chain knowledge exhibits that Grayscale Investments has been unloading hundreds of cash behind Grayscale Bitcoin Trust (GBTC). Subsequently, there was a sell-off in Bitcoin and throughout the altcoin scene. The scenario has been made worse for Ethereum following the United States SEC’s determination to postpone the approval of spot Ethereum ETFs.

While these developments have negatively impacted sentiment, Elja believes they won’t derail Ethereum’s long-term progress trajectory. Specifically, the analyst notes that ETH is consolidating, a “healthy sign.”

ETH To $15,000: Will Fundamental And Technical Factors Help?

Elja added that when crypto costs consolidate, it might recommend that whales are accumulating their place. Once this ends, ETH costs might pattern increased. From the analyst’s chart, the coin will break above $5,000 to $15,000 within the coming classes.

When making this prediction, the analyst in contrast the Ethereum worth motion to the fractal sample that propelled ETH from round $200 to $4,800 in 15 months from 2019 to 2021. Extrapolating from previous worth motion, Elja believes Ethereum is on the same path. Based on evaluation, the coin will probably break above November 2021 peaks.

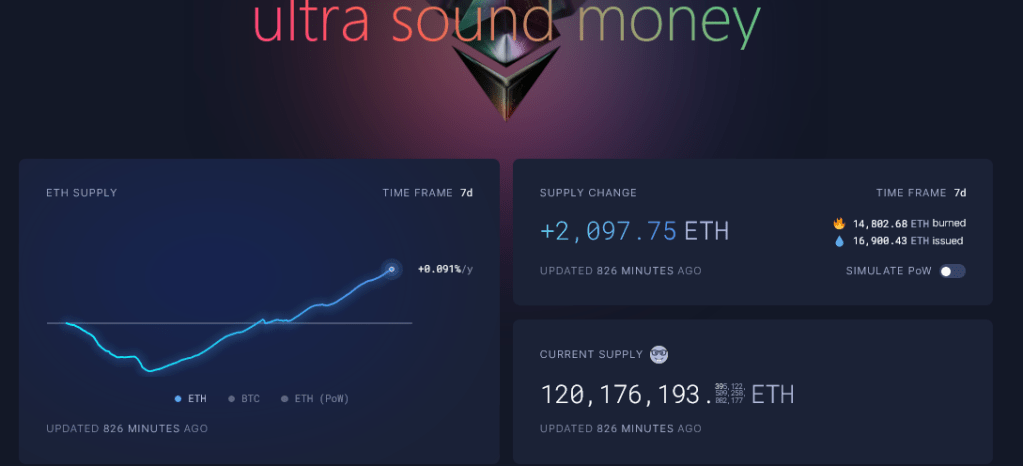

Beyond technical elements, ETH supporters cite the reducing issuance price. According to Ultrasound Money data, the community has been burning hundreds of ETH, lowering provide. Additionally, Larry Fink, the CEO of BlackRock, believes Ethereum would be the selection community for tokenizing real-world belongings (RWAs) within the years forward.

Feature picture from Canva, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site fully at your individual danger.