Bitcoin value loses steam after the spot Bitcoin ETFs’ approval and itemizing on exchanges, falling over 15% from $48,969 to $40,297. In a paradigm shift, buying and selling volumes dropped considerably on crypto exchanges.

Moreover, there’s a story out there over Grayscale Bitcoin Trust (GBTC) promoting Bitcoin holdings, however CryptoQuant group asserts it’s not truly the case. They additionally predict a short-term correction.

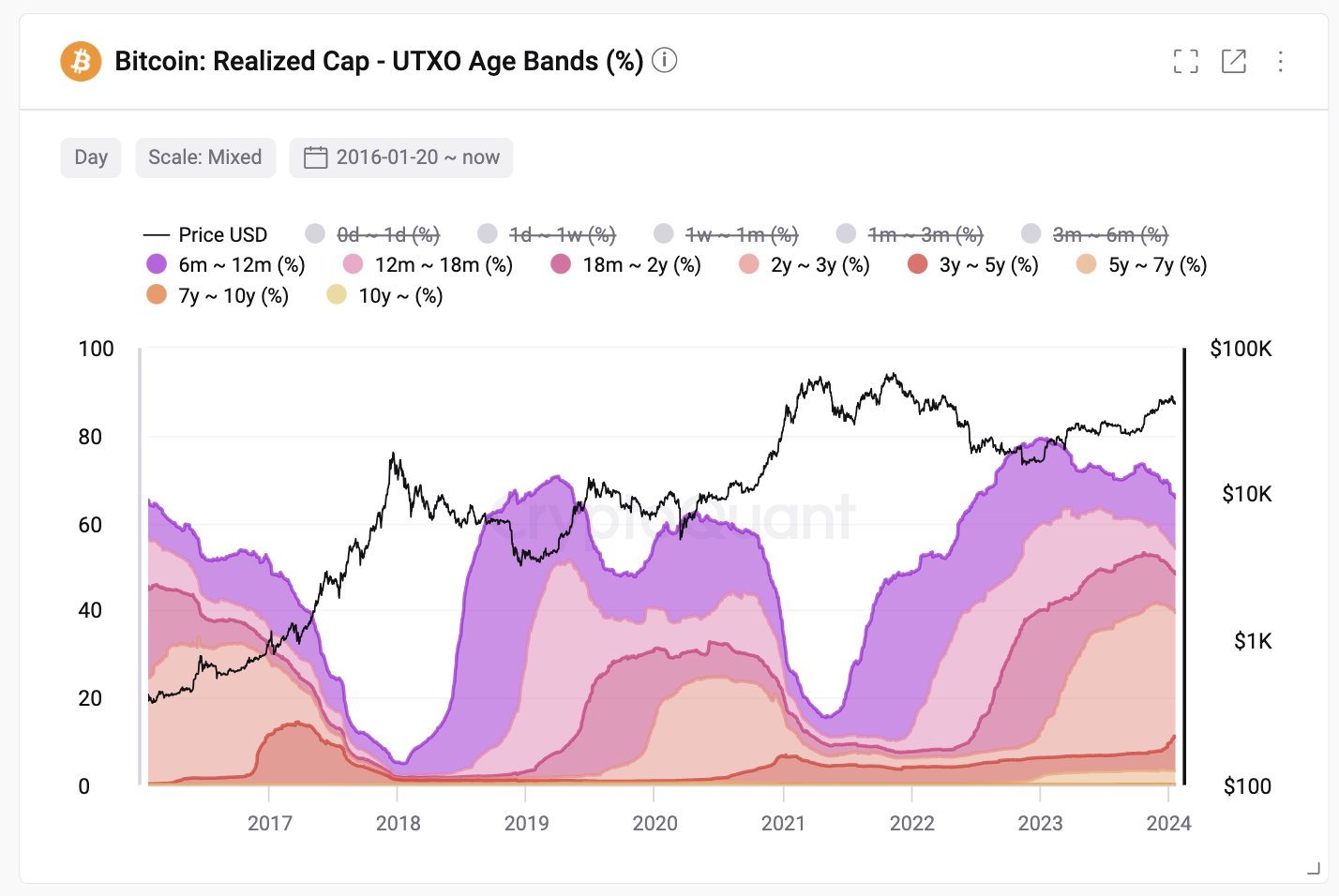

Bitcoin Selling By Holders

CryptoQuant head of analysis Julio Moreno, stated it’s a improper narrative circulating out there that the present Bitcoin value correction is because of GBTC promoting Bitcoin holdings.

Grayscale Bitcoin Trust (GBTC) offered about 60K bitcoins, however different 10 spot Bitcoin ETFs comparable to BlackRock, Fidelity, Bitwise have a mixed internet buy of about 72K bitcoins. It signifies that the influx is certainly rising, with buying and selling volumes exceeding billions.

The Bitcoin selloff has come from holders together with short-term merchants and whales. They capitalized on the “sell-the-news” occasion to e book revenue of the current rally.

“Several On-chain metrics and indicators still suggest the price correction may not be over or at least that a new rally is still not on the cards. Short-term traders and large Bitcoin holders are still doing significant selling in the context of a risk-off attitude. Additionally, unrealized profit margins have not fallen enough for sellers to be exhausted,” as per CryptoQuant insights.

Popular analyst CredibleCrypto famous that definitive information is proving that ETF flows are internet constructive at +5,000 Bitcoin purchased per day since launch, which is 10 occasions the impact of the upcoming halving. However, current “PA doesn’t seem to reflect that. This literally proves that there are other, more significant factors at play that have a greater influence on PA in the short/mid term.”

Read More: Spot Bitcoin ETFs See Inflows of $33.1 Million on Day 6

BTC Price To Witness Short-Term Correction

CryptoQuant founder and CEO Ki Young Ju in a publish on January 20 revealed that Bitcoin in distribution part just isn’t absolutely distributed to retailers. He warns a couple of short-term correction in BTC value, after a 15% correction in the previous couple of days.

However, he added that this long-term bull market cycle will proceed till Bitcoin is absolutely distributed to retailers. The long-term outlook stays constructive.

BTC price jumped 1% prior to now 24 hours, with the worth presently buying and selling at $41,659. The 24-hour high and low are $40,297 and $42,134, respectively. Furthermore, the buying and selling quantity has decreased by 16% within the final 24 hours, indicating a decline in curiosity amongst merchants.

Also Read:

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.