Bitcoin, Ethereum, and XRP led the crypto funds’ inflows final week as spot Bitcoin ETFs made their Wall Street debut on January 11, a day after the U.S. Securities and Exchange Commission (SEC) authorized all 11 spot Bitcoin ETFs on the similar time. CoinShares head of analysis James Butterfill says it failed to interrupt all-time excessive information.

Massive Crypto Funds Inflows

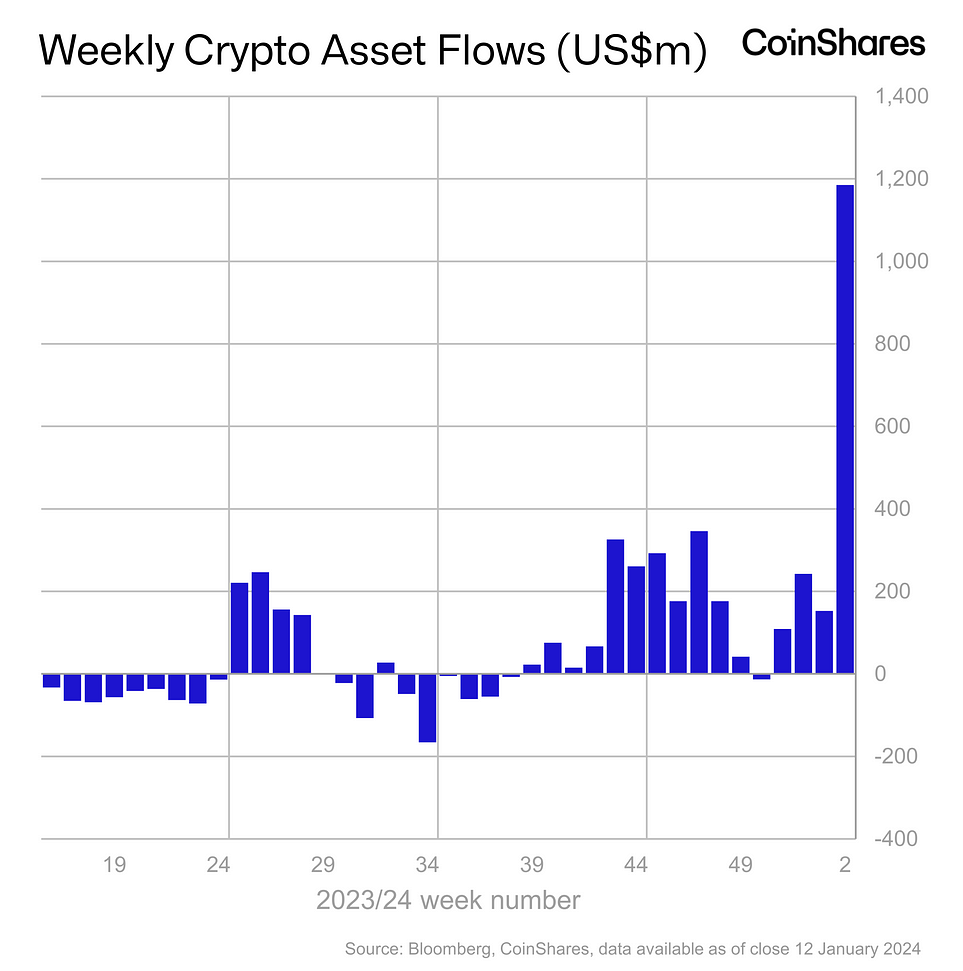

Crypto asset funding merchandise noticed $1.18 billion inflows (topic to T+2 settlement), in line with CoinShares weekly report on January 15. Despite the large spot Bitcoin ETF hype, it fails to interrupt the $1.5 billion file of futures-based Bitcoin ETFs in October 2021.

However, crypto funds buying and selling volumes soared file excessive of $17.5 billion final week. The common buying and selling quantity is $2 billion per week.

Bitcoin recorded a $1.16 billion inflows, representing 3% of whole belongings beneath administration. Short-bitcoin additionally noticed inflows of $4.1 million, with month-to-date inflows of $3.2 million. Experts anticipated a long-term revenue of spot Bitcoin ETFs as some stay skeptical about spot Bitcoin ETFs regardless of bringing a reimbursement into the market.

Ethereum additionally noticed inflows of $26 million indicating higher funding fundamentals and excessive demand for its staking yield. XRP noticed $2.2. million inflows in every week and $3.1 million in inflows month-to-date, the most important amongst altcoins.

However, Cardano and Solana inflows declined to only $1.4 million and $0.5 million. Altcoins reminiscent of Avalanche and Polkadot additionally recorded mere inflows as buyers seemed to different crypto belongings.

The U.S. noticed $1.24 billion of inflows final week, whereas Switzerland noticed $21 million inflows. Germany, Canada, and Sweden recorded vital crypto asset funds’ outflows.

Also Read: Binance Files Joint Response To US SEC’s Terra Lawsuit Supplemental Authority

Crypto Performance Today

BTC worth fell 1% up to now 24 hours, with the value at the moment buying and selling at $42,592. Furthermore, the buying and selling quantity has elevated by 40% within the final 24 hours, indicating an increase in curiosity amongst merchants.

In distinction to Bitcoin, Ethereum noticed costs rising above $2500. ETH worth at the moment trades at $2537, with a 24-hour high and low of $2,470 and $2,545, respectively.

XRP worth jumped 1% up to now 24 hours, with the value at the moment buying and selling at $0.57. The 24-hour high and low are $0.574 and $0.592, respectively. Furthermore, the buying and selling quantity has elevated by 90% within the final 24 hours.

Also Read: Cosmos Ecosystem Chains Affected By CosmWasm Vulnerability

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.