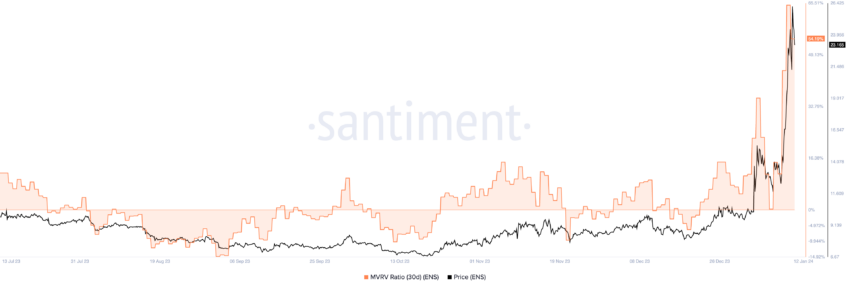

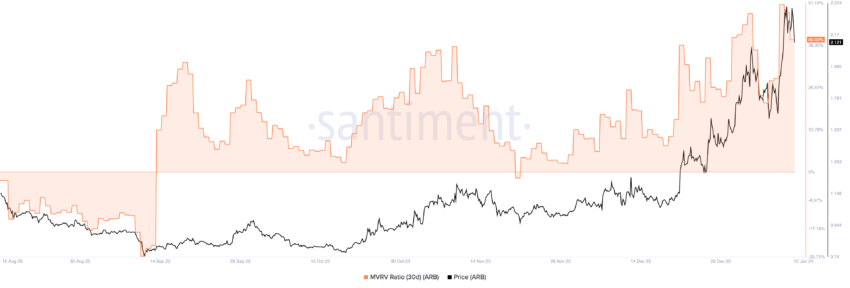

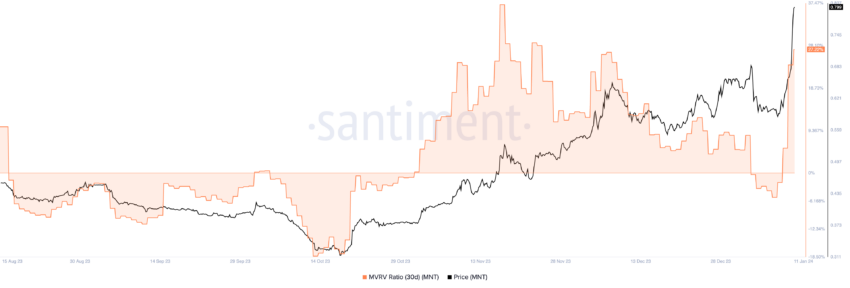

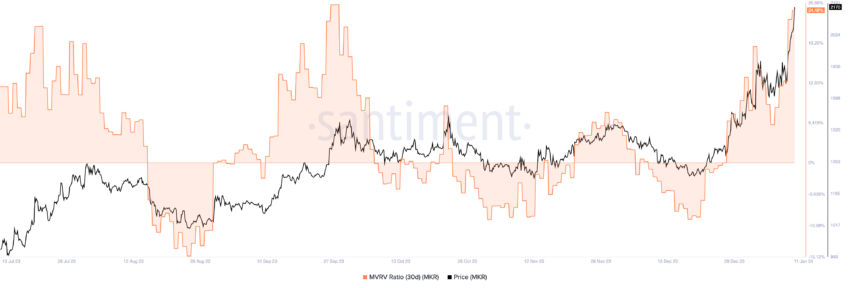

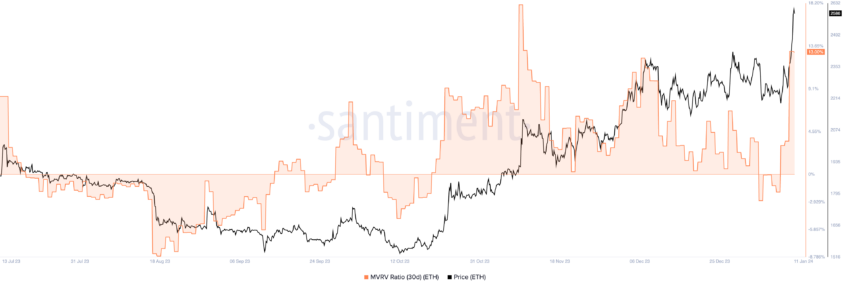

Savvy buyers keenly monitor market indicators to gauge potential shifts preemptively. One such metric, the MVRV (market-value-to-realized-value) ratio, has not too long ago highlighted a curious development amongst 5 altcoins.

Currently exhibiting excessive MVRV values, these digital property could also be poised for a worth adjustment because of a spike in profit-taking actions.

The Most Overbought Altcoins

The MVRV ratio, evaluating an asset’s market capitalization to its realized capitalization, affords a window into whether or not an altcoin’s worth aligns with its “fair value.”

When the market cap overtakes the realized cap, it indicators that unrealized earnings are peaking. This situation sometimes suggests an impending sell-off as buyers look to capitalize on beneficial properties. Conversely, a decrease market cap relative to the realized cap may sign undervaluation or tepid demand.

Read extra: Top 10 Cheapest Cryptocurrencies to Invest in January 2024

At current, these 5 altcoins exhibit elevated 30-day MVRV values, which suggests they commerce at overbought territory:

These figures point out that a good portion of the holdings in these property are in revenue, a traditional marker of market exuberance. This atmosphere usually tempts buyers to liquidate holdings, aiming to maximise returns.

Is It Time to Sell Cryptos?

The determination to promote shouldn’t be taken flippantly. Indeed, cryptocurrency markets are notoriously risky, and what at present seems as an overbought asset may proceed to understand in worth.

The MVRV ratio, whereas insightful, just isn’t the one issue buyers ought to think about. The broader market development, world financial circumstances, and particular cryptocurrency information additionally play pivotal roles in shaping an asset’s future worth. For occasion, updates in know-how, regulatory shifts, or changes in investor sentiment can dramatically sway crypto costs.

Read extra: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

Ethereum Name Service, Arbitrum, Mantle, Maker, and Ethereum every have distinctive traits and narratives influencing their market positions. For this purpose, buyers ought to weigh these alongside the MVRV ratio to type a holistic market view. This balanced strategy, tailor-made to at least one’s personal investment strategy and risk tolerance, is essential in navigating the market.

The present situation, marked by these altcoins’ excessive MVRV values, presents a vital juncture for buyers. While it might appear opportune to money in on the value beneficial properties, a hasty determination may result in missed alternatives ought to the asset’s worth climb additional.

The crypto market’s inherent volatility calls for a measured strategy, mixing analytical insights with a sound understanding of market dynamics.

Disclaimer

In line with the Trust Project tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. Always conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Terms and Conditions, Privacy Policy, and (*5*) have been up to date.