On Tuesday, the crypto market was taken by storm when a tweet emerged from the official X (previously Twitter) account of the United States Securities and Exchange Commission (SEC) saying all Spot Bitcoin ETF functions had been accredited. This had been initially adopted by a surge in worth however this was short-lived as the worth would crash shortly after. The cause for this was as a result of Gary Gensler, chairman of the Commission, revealed that the tweet was pretend and the regulator’s social media account had been compromised.

SEC Hack Triggers $220 Million In Liquidations

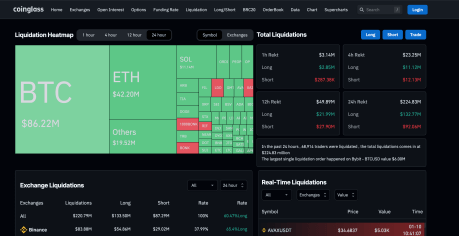

In the wake of the wild Bitcoin worth fluctuations that have been triggered by the SEC’s hack, a lot of crypto merchants discovered themselves with large losses on their palms. According to data from CoinGlass, over $220 million have been liquidated within the final 24 hours, resulting in the second-largest liquidation occasion thus far in 2024.

The web site additionally notes that over 70,000 merchants have been victims of this liquidation occasion as properly. Also, provided that the worth of Bitcoin and other assets in the crypto market had seen worth fluctuations in each instructions, each lengthy and quick merchants have been affected.

Source: Coinglass

However, provided that the crash to the draw back has persevered for longer, lengthy merchants have come out because the group with essentially the most liquidations throughout this time. Out of the greater than $220 million in liquidations recorded, lengthy trades made up 60.47% with $133.5 million, whereas the amount of quick liquidations got here out to $87.29 million for a similar time interval.

Bitcoin noticed the most important single liquidation order throughout this time as properly which happened on the ByBit trade. A single commerce value $6 million was liquidated throughout the BTCUSD trading pair, with complete liquidations on the crypto trade popping out to $36.66 million. This falls behind market chief Binance with $83.88 million and OKX with $73.97 million.

BTC bears wrestle for management | Source: BTCUSD on Tradingview.com

Spot Bitcoin ETF Is A Sell The News Event?

The debate of whether or not the Spot Bitcoin ETF approval has already been priced in and if an announcement will result in a decline in worth has been waxing stronger over the previous few weeks. Experts have chimed in to offer their ideas on what’s going to comply with an approval.

Crypto analyst Andrew Kang believes that approval would lead to a scramble amongst candidates to seize as a lot as potential from the $10 billion to $20 billion anticipated to come back from charges. As such, they may all be on the forefront of marketing to push their ETFs.

On the flip facet, famend economist, Peter Schiff, believes that a spot ETF would actually not be good for the asset. Apparently, the appearance of a spot Bitcoin ETF would imply that there isn’t a longer any excellent news to set off a worth rally. As such, it might flip right into a ‘sell the news’ occasion.

However, if the efficiency from Tuesday is something to go by, it might imply that the ETF is already priced in provided that there was a decline in worth, even earlier than the SEC dismissed the tweet from the hacked account.

Featured picture from SoFi, chart from Tradingview.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site fully at your individual danger.