In a current safety lapse, the U.S. Securities and Exchange Commission’s (SEC) official X (previously Twitter) account fell sufferer to unauthorized entry. This incident led to the dissemination of false info concerning the approval of Bitcoin ETFs, an assertion that the SEC has since firmly denied.

Hacked Account Spreads False Bitcoin ETF Approval

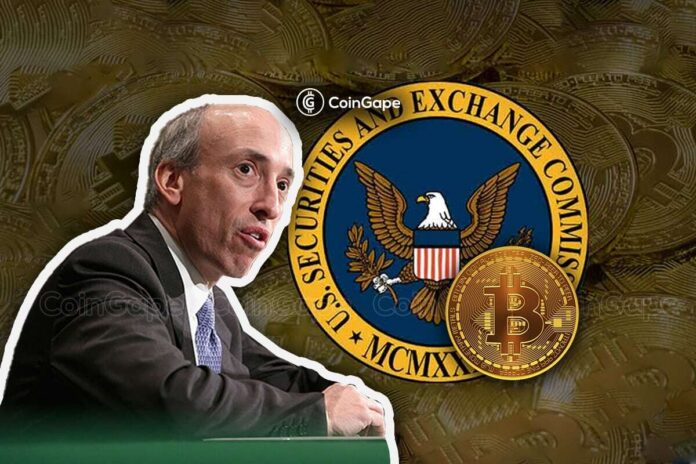

On Tuesday, the compromised SEC X account launched a tweet claiming the approval of Bitcoin ETFs for itemizing on registered nationwide securities exchanges. This message, full with an elaborate graphic and a supposed quote from SEC Chair Gary Gensler, rapidly unfold misinformation. However, the SEC, via Gensler’s personal X account and an SEC spokesperson, confirmed the account’s breach and clarified that no such approvals have been granted.

The @SECGov twitter account was compromised, and an unauthorized tweet was posted. The SEC has not permitted the itemizing and buying and selling of spot bitcoin exchange-traded merchandise.

— Gary Gensler (@GaryGensler) January 9, 2024

SEC Chair Responds to Security Breach

The SEC’s swift response to the safety breach concerned denying the false info and reiterating their dedication to investor safety. Gensler emphasised the continuing scrutiny and compliance measures in place for any future Bitcoin ETFs. The SEC’s dedication to sustaining the integrity of knowledge and investor security grew to become a focus of their communication following this incident.

Should have listened to the SEC in regards to the SEC https://t.co/BphLK1AJfA

— James Seyffart (@JSeyff) January 9, 2024

Regulatory Outlook Remains Unchanged

Despite the deceptive tweet, the regulatory stance of the SEC stays unchanged. Currently, the SEC has not permitted any spot bitcoin ETF functions. This incident serves as a reminder of the unstable nature of knowledge within the digital age, notably within the ever-evolving panorama of cryptocurrency and digital belongings. The SEC’s dedication to thorough analysis and regulation on this sector stands agency, specializing in guaranteeing transparency and investor safety in all its endeavors.

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.