In a powerful turnaround from yesterday’s flash crash, the Bitcoin (BTC) worth has staged a restoration, breaching the $43,000 mark. This surge comes after yesterday’s intense volatility, the place the cryptocurrency big witnessed an over 11% flash crash following a controversial report from Matrixport.

The report advised a possible rejection by the US Securities and Exchange Commission (SEC) of the much-anticipated spot Exchange Traded Funds (ETFs), triggering the second-largest liquidation of lengthy positions prior to now 12 months. Bitcoin’s worth plummeted to as little as $41,500.

However, Bitcoin is immediately stabilizing above $43,000, influenced by a mixture of things. Notably, a number of specialists have disputed the Matrixport report’s validity. Adding to the optimistic sentiment, a major SEC associated replace has caught the market’s consideration.

Bitcoin ETF Tomorrow?

According to a report by Fox Business, SEC employees attorneys from the Division of Trading and Markets had been partaking in essential discussions with representatives from main exchanges such because the New York Stock Exchange, Nasdaq, and the Chicago Board Options Exchange on Wednesday. This engagement is important because it pertains to the approval of a number of Bitcoin ETF functions.

The conferences are seen as a optimistic signal that the SEC is nearing approval of some or all the dozen functions by main cash managers and crypto companies for the product. An nameless supply conversant in these developments said, “While the final decision has not been made, sources close to the proceedings say the SEC could begin notifying issuers of approval on Friday with trading beginning as early as next week.”

Bloomberg ETF analyst James Seyffart commented on Eleanor Terrett’s report from Fox Business by way of X, stating: “My view is in line with Eleanor Terrett’s reporting. I think the SEC could begin signaling to issuers to expect approvals tho I’m still expecting official approvals Jan 8 – 10. I also think the gap between approval orders and actual trading will be measured in days — not weeks.”

Echoing Seyffart’s views, Eric Balchunas, his colleague at Bloomberg, commented, “Things you prob don’t do if you going to deny or delay. Hearing similar btw, and why why when we see updated (final) 19b-4s roll in that is sign approval imminent as SEC has been doing back and forth w issuers offline to perfect their 19b-4s vs doing numerous refilings a la S-1s.”

Scott Johnsson, a finance lawyer at Davis Polk, weighed in on Balchunas’ assertion: “In every past ETF wave, the SEC did not do this. Why? Because (1) this takes up a ton of SEC resources and (2) makes it MUCH harder to successfully survive judicial scrutiny (and after Grayscale, this is like drawing blood from a stone). If you intend to deny, you just deny.”

BTC Price Remains Ultra Bullish

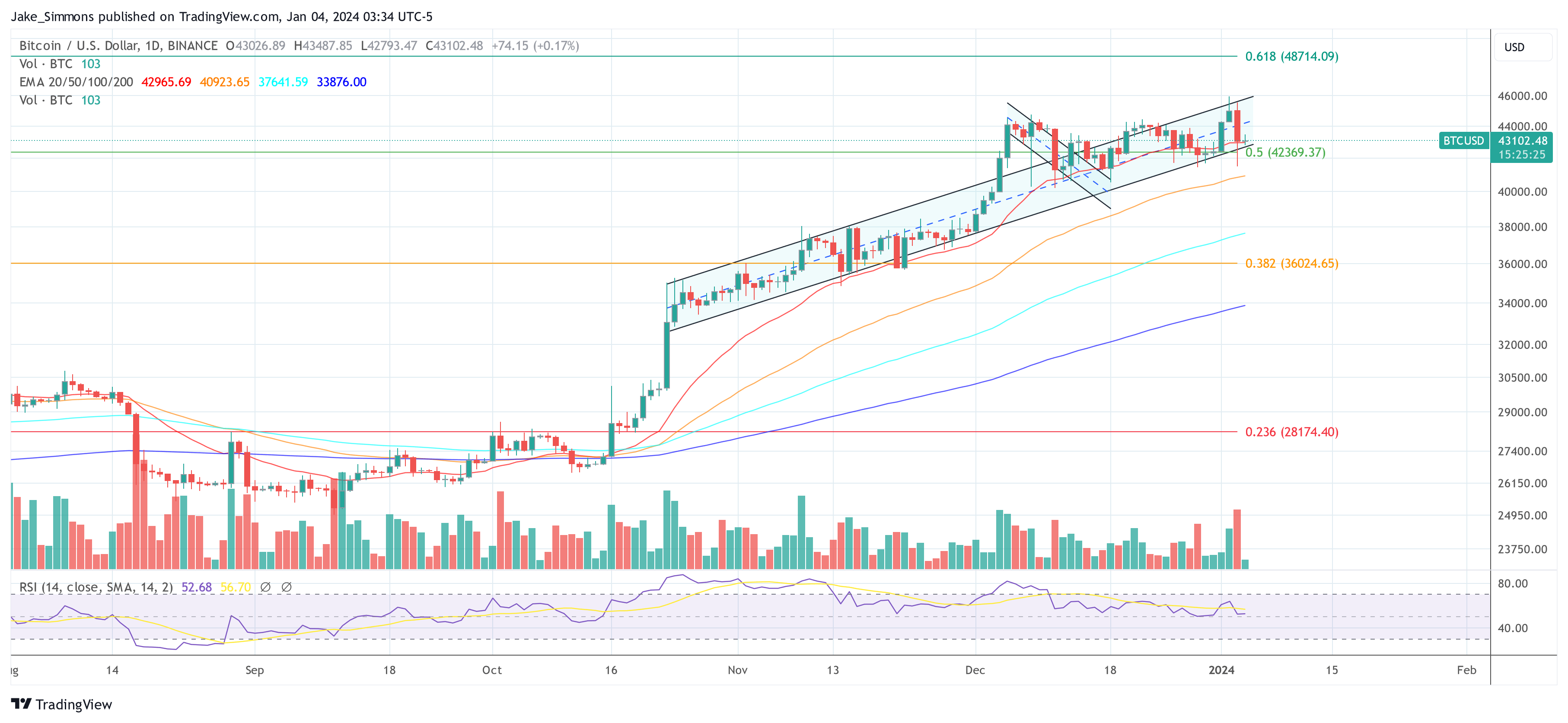

In mild of those developments, the cryptocurrency market stays cautiously optimistic, with indicators strongly pointing in the direction of an ETF approval by January 10, probably whilst early as January 5. Notably, the Bitcoin worth has closed its every day candle throughout the uptrend channel, established in mid-October. At press time, BTC traded at $43,102.

Featured picture from Shutterstock chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal threat.