The world crypto market cap fell greater than 6% to $1.63 trillion at this time. Top cryptocurrencies Bitcoin, Ethereum, Solana, XRP, Cardano, and others tumble over 6% in simply an hour. BTC value fell 7% to under the $41,000 degree, erasing the positive factors after New Year’s Day. On the opposite hand, Ethereum (ETH) value fell 8% to successful a low of $2,113.

The crypto market noticed over $600 million in liquidation within the final 24 hours, with $500 liquidated in simply an hour. Coinglass knowledge point out huge longs liquidation of over $$561 million at this time, January 3. More than 176K merchants have been liquidated within the final 24 hours, with the biggest single liquidation order on Huobi’s BTCUSDT price $14.26 million.

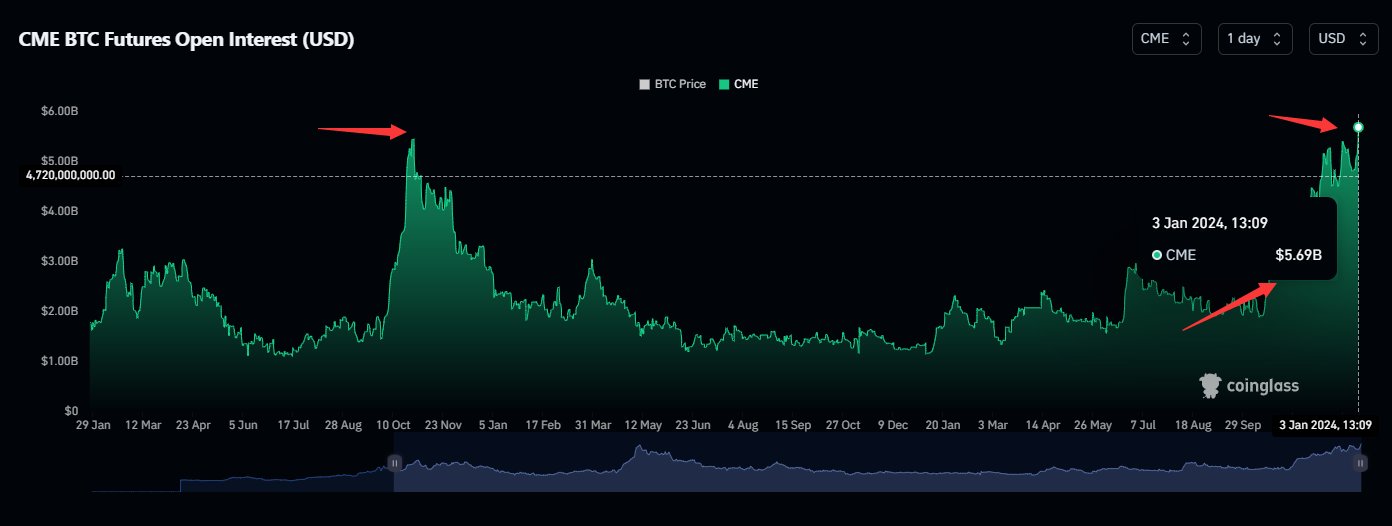

CME Bitcoin Futures OI Slips From Record High

CME Bitcoin futures open curiosity (OI) hit a report excessive on Wednesday amid spot Bitcoin ETF approval hype and FOMO after BTC value.

Coinglass on January 3 reported Bitcoin futures open curiosity (OI) on CME hitting a brand new excessive of $5.69 billion. The final time CME Bitcoin futures open curiosity hit an all-time excessive was in October 2021 when BTC value was buying and selling above $60,000. In the following two months, BTC value tumbled under $40,000.

Additionally, the whole Bitcoin futures OI on all exchanges dropped by 9% to $18.17 billion from $20.23 billion. In the final 4 hours, BTC OI fell by 6% on CME and 16% on Binance. Also, BTC choices knowledge signifies that places are regularly rising within the final 24 hours, indicating selloff by choices merchants.

Meanwhile, Matrixport has shaken the crypto group with a daring forecast on Bitcoin value and SEC’s resolution on Bitcoin Spot ETF. According to the most recent report, the U.S. Securities and Exchange Commission (SEC) is anticipated to reject all Bitcoin spot ETFs in January, probably triggering a pointy decline in Bitcoin’s worth to as a lot as $36,000.

Macro Makes An Impact

The US Dollar Index (DXY) soars 0.29% to maneuver over 102.50 at this time. It has continued to rise since final week after hitting a low of 100.99 final week.

Moreover, U.S. Treasury yields rose on Wednesday as traders search for contemporary financial knowledge due this week that might present insights. 10-year Treasury yield jumps to three.973%, making a rebound in the previous few days.

ISM Manufacturing PMI, JOLTS Job openings, and FOMC assembly minutes are due at this time whereas the roles reviews and providers PMI’s are anticipated on Friday.

These macro elements are including further hindrance to additional upside momentum in Bitcoin.

Also Read: Bitcoin Bull Cathie Wood’s Ark Invest Extends Coinbase And Robinhood Selling Spree

The offered content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.