Crypto asset administration agency Hashdex met with the U.S. Securities and Exchange Commission (SEC) relating to the required modifications to the Hashdex spot Bitcoin ETF software, based on the most recent memorandum. The transfer comes because the SEC is obliged to contemplate approving the United States’ first spot Bitcoin ETF monitoring BTC value.

Hashdex Met With the SEC Before Deadline

After a constructive assembly between the U.S. SEC and spot Bitcoin ETF issuers final week to make the required modifications, Hashdex met once more with the SEC on Tuesday, December 26.

However, it appears the assembly was completely different from current conferences as Hashdex met with SEC Chair Gary Gensler’s workplace, elevating hypothesis throughout the markets. Bitcoin ETF issuers have had conferences and calls with the SEC’s buying and selling and markets division and company finance division.

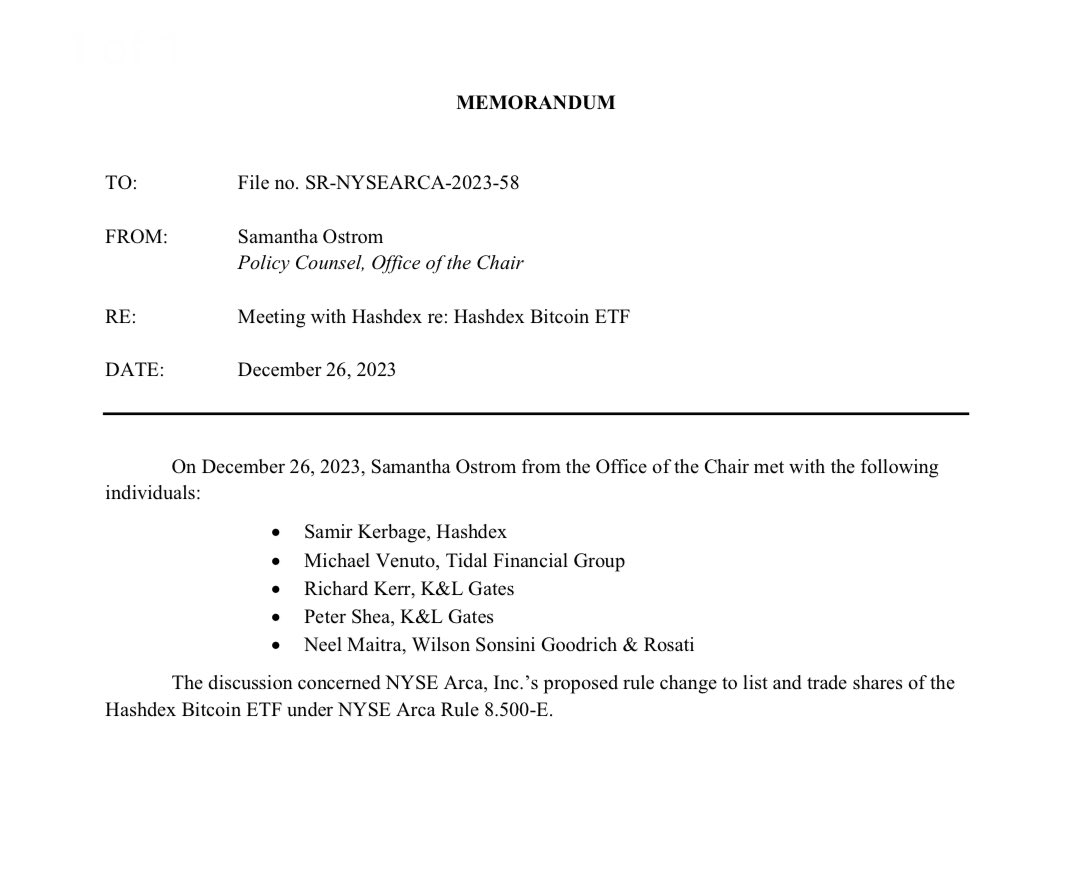

Bloomberg analyst James Seyffart additionally famous Hashdex executives assembly Samantha Ostrom from the SEC Office of Chair. Ostrom met with Hashdex chief funding officer Samir Kerbage, Tidal Financial Group’s Michael Venuto, Ok&L Gates’ Richard Kerr and Peter Shea, and Neel Maitra from regulation agency Wilson Sonsini Goodrich & Rosati.

The dialogue was relating to NYSE Arca’s proposed rule change to listing and commerce shares of Hashdex Bitcoin ETF below the Rule 8.500-E.

Also Read: Grayscale Makes Amended Bitcoin ETF Filing After Silbert’s Exit

Spot Bitcoin ETF Gains Ground

Stock and crypto markets await approval of a spot Bitcoin ETF by the US SEC amid constructive talks. Spot Bitcoin ETF points are making ultimate modifications to the prospectus relating to ‘cash creates’, with the SEC prone to approve solely cash-only redemptions.

Meanwhile, Grayscale has made one other amended S-3 filing with the securities regulator to transform GBTC to identify Bitcoin ETF. It follows Grayscale Investments chairman Barry Silbert stepping down from the place.

BlackRock, Pando Asset, and Hashdex not too long ago submitted up to date S-1 filings with the SEC. Hashdex has named BitGo as Bitcoin ETF custodian.

Also Read:

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.