The U.S. Bureau of Economic Analysis to announce the non-public consumption expenditures (PCE) inflation knowledge for November as we speak. The annual PCE inflation is predicted to additional cool to 2.8% from 3 final month, with no rise within the month-to-month fee. Also, the Core PCE, the Fed’s most well-liked gauge to measure inflation, is predicted to rise 0.2% month-on-month whereas the annual fee is predicted to say no to three.3%, marking its lowest degree since 2021.

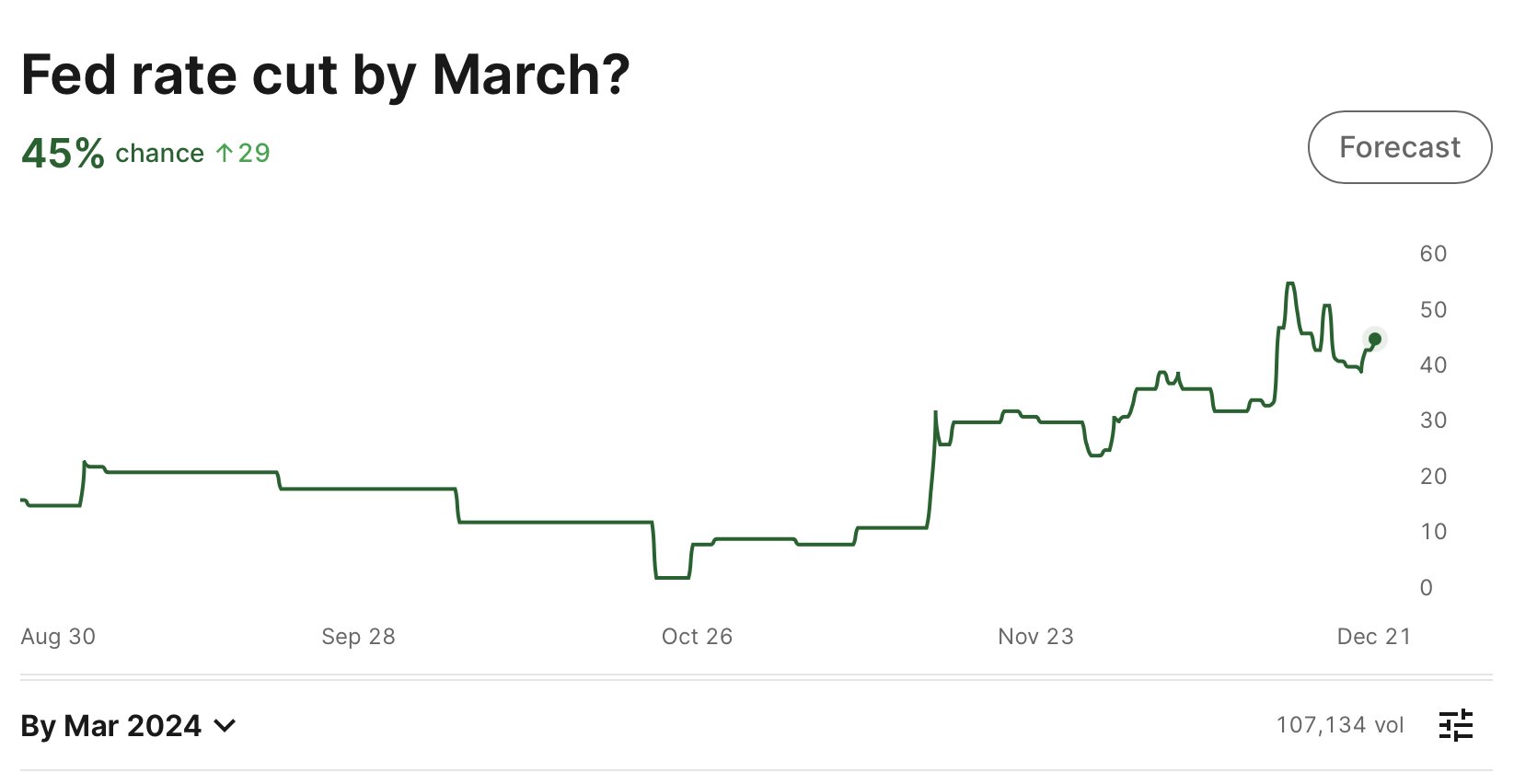

Wall Street estimates are principally in keeping with market consensus in response to current Fed Chair Jerome Powell’s projecting three rate cuts in 2024. The market at the moment has a forty five% probability that the Fed will begin fee cuts in March. Moreover, the CME FedWatch shows a 71% chance of a 25 bps fee lower in March.

The financial coverage outlook stays dovish because the US Dollar Index (DXY) steadied round 101.8 on Friday however continues to be set to say no for the second straight week in anticipation of the Fed fee cuts.

Furthermore, the US 10-year Treasury yield continues to fall after dropping beneath 4% final week. It is now at 3.89%, barely up as merchants brace for inflation knowledge.

The Fed fee cuts and different macro components verify an additional restoration in Bitcoin worth and the crypto market. Traders and buyers additionally take into account spot Bitcoin ETF approval and Bitcoin halving components in anticipation of a significant bullish rally.

Also Read: Bloomberg Analyst Says Spot Bitcoin ETF Approvals To Begin By End Of 2023?

Bitcoin and Crypto Market Rally

Bitcoin, Ethereum, and high altcoins similar to Solana (SOL), BNB, XRP, Cardano (ADA), Avalanche (AVAX) and others are up as we speak in anticipation of a Santa Claus rally.

Since everyone seems to be bullish, I attempted to seek out some bearish components however could not discover any.

— Ki Young Ju (@ki_young_ju) December 22, 2023

BTC price is up 1% during the last 24 hours and buying and selling above $44,000, with its buying and selling quantity declining 18%. Meanwhile, during the last 24 hours, the BTC worth has touched a low of $43,387 and a excessive of $44,367.

However, the market can see some revenue reserving due to Friday’s expiry. 25,000 BTC choices of a notional worth of $1.11 billion are set to run out with a put name ratio of 0.70, a max ache level of $42,000. 217,000 ETH choices of a notional worth of $490 million are about to run out with a put name ratio of 0.60, and a max ache level of $2,200.

Also Read: BitMEX’s Arthur Hayes Dumps Solana & Predicts Ethereum To Hit $5000

The offered content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.