The crypto business went by a interval of evolution in 2023 to reiterate its place within the international market. This evolution was notably spearheaded by Bitcoin’s dominance, with the crypto registering positive aspects within the final quarter that have been virtually absent within the earlier elements of the yr.

All the signs are there; curiosity is selecting up, large money from institutions is sniffing round once more, a number of necessary technical and on-chain pricing fashions this yr have been confirmed, and the mud appears to have lastly settled from the extended bear market in 2022.

Total market cap at $1.59 trillion | Source: Crypto Total Market Cap on Tradingview.com

The Crypto Winter Thaws: Signs of Life in 2023

2023 was majorly a yr of correction for the prolonged bear market in 2022 which noticed Bitcoin fall 76% from its all-time excessive to commerce at a backside of $15,883. According to a report from Glassnode, main market construction shifts are actually going down inside the crypto business to mirror rising optimism.

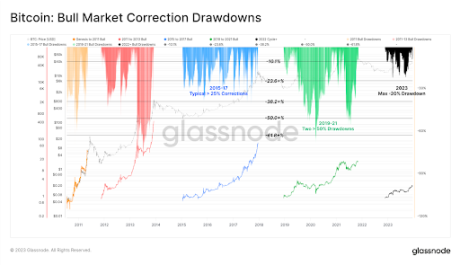

Bitcoin, for one, is displaying a robust curiosity from its long-term holders, because the business awaits the launch of spot Bitcoin ETFs within the US. One specific characteristic of the yr that indicated a robust bullish momentum was the shallow depth of market correction, indicating the business is maturing right into a extra secure market by way of value volatility.

Bitcoin’s deepest correction in 2023 closed simply -20% under the native excessive, higher than historic pullbacks of least -25% to -50%.

Source: Glassnode

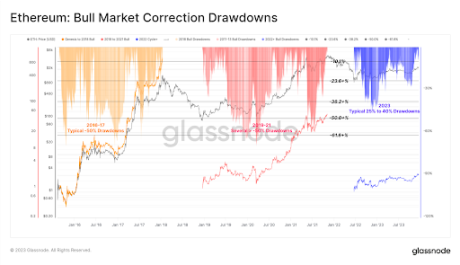

Ethereum additionally noticed shallow corrections, with the deepest reaching -40% in early January.

Source: Glassnode

From an on-chain perspective, the realized cap within the 2022 bear marketplace for each property confirmed a web capital outflow of -18% for BTC and -30% for ETH. The momentum kickstarted in October, because the information of assorted functions of spot Bitcoin ETFs turned the crypto market on its heels. As a outcome, Bitcoin lastly broke above the $30,000 degree which it had traded under for almost all of the yr.

This cascaded into the altcoin market, with Solana, Cardano, and Ethereum all seeing renewed curiosity and development in costs and DeFi TVL. According to Glassnode, the whole worth locked into Ethereum’s layer-2 blockchains elevated by 60%, with over $12 billion now locked into bridges.

According to CoinShares, the bullish sentiment has additionally flowed into establishments. October’s rally sparked an 11-week run of inflows into digital asset funding funds. At the time of writing, the year-to-date inflows now sit at $1.86 billion.

The crypto business, particularly Bitcoin, is primed for astounding development in 2024, with varied value catalysts just like the SEC’s approval of spot Bitcoin and Ethereum ETFs within the US, and the following Bitcoin halving. The altcoin market must also comply with, spearheaded by Ethereum.

At the time of writing, Bitcoin is up by 159% this yr, outperforming different asset courses. On the opposite hand, Ethereum and Solana have dominated the altcoin market, up by 82% and 616% respectively.

Featured picture from CNBC, chart from Tradingview.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site solely at your individual threat.