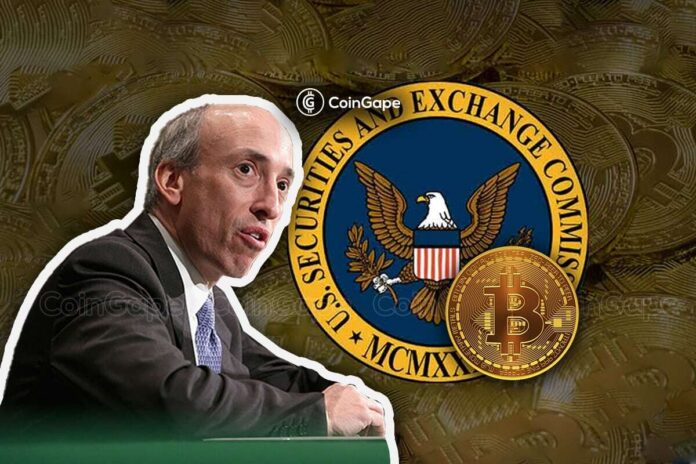

Under the management of Gary Gensler, the Securities and Exchange Commission (SEC) is revising its stance on spot bitcoin ETF functions. This shift follows latest court docket rulings that problem the company’s earlier choices. For years, the SEC has constantly denied these functions. However, a major judicial intervention is prompting a reevaluation.

Judicial Influence on SEC’s Decision-Making

A notable case involving Grayscale Investments has turn into pivotal on this regulatory turnaround. In August, the U.S. Court of Appeals for the D.C. Circuit dominated that the SEC should rethink Grayscale’s utility for a spot bitcoin ETF.

This choice got here after Grayscale sued the SEC after rejecting its plan to transform its flagship GBTC fund. The court docket highlighted the SEC’s totally different remedy of spot bitcoin ETFs in comparison with these primarily based on futures contracts, which obtained approval.

SEC’s Renewed Approach

Responding to those developments, Gensler said in an interview with CNBC,

“We had in the past denied a number of these applications, but the courts here in the District of Columbia weighed in on that. So we’re taking a new look at this based upon those court rulings.”

This assertion signifies a possible change within the regulatory panorama for cryptocurrencies, significantly concerning spot bitcoin ETFs.

Crypto Industry’s Compliance Challenges

Gensler additionally emphasized the continuing problems with noncompliance and fraudulent actions inside the crypto business. He expressed issues in regards to the sector’s adherence to securities legal guidelines and different regulatory frameworks, together with anti-money laundering measures. These points have drawn consideration from Congress and the Treasury Department, with the latter just lately recommending enhanced authority and instruments to deal with illicit actions within the crypto house.

The SEC’s reconsideration of spot bitcoin ETF applications marks an important second in crypto regulation. It displays the company’s responsiveness to judicial opinions and its ongoing efforts to steadiness regulatory oversight with the evolving panorama of digital belongings. This growth might pave the best way for extra mainstream acceptance and integration of cryptocurrencies within the monetary markets, doubtlessly reshaping the way forward for digital asset funding.

Read Also: Tether Freezes Attacker’s Wallet in Ledger Library Exploit

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.