In this exploration, we sort out the important query: Will Ethereum get well? We’ll take a look at Ethereums future and analyze ETH’s current market standing, potential for resurgence, the anticipated influence of the progress on Ethereum 2.0, and share knowledgeable worth predictions.

Will Ethereum Recover? Analysis

The query “Will Ethereum recover?” will depend on quite a few components. As of November 2023, Ethereum has proven indicators of rebounding from its 2022 lows, suggesting a possible bottoming out. Key developments just like the transition to Proof-of-Stake and the introduction of EIP (Ethereum Improvement Proposal) 1559, launched all the best way again in August 2021, which brings deflationary strain on Ethereum’s provide, making it a extra engaging funding.

Additionally, Layer 2 (L2) applied sciences are enhancing Ethereum’s scalability, addressing earlier challenges of excessive transaction charges and gradual speeds. Ethereum’s dominance within the sensible contracts sector and its substantial function within the decentralized finance ecosystem additional strengthen its restoration prospects. However, predicting the precise trajectory of Ethereum’s restoration stays complicated, with various forecasts suggesting each potential ups and downs within the close to future.

Ethereums Future: Top-10 Factors Impacting ETH Price

These ten components might be essential for answering the query “Will Ethereum get well?“:

#1 Future Upgrades:

Ethereum’s growth roadmap contains important upgrades like Proto-Danksharding, also referred to as EIP-4844, and Full Danksharding, which might enormously influence its scalability and performance. The profitable implementation of those upgrades can increase confidence within the community and the Ethereums future worth.

#2 Regulatory Approvals:

Regulatory selections, such because the approval of a spot Ethereum Exchange Traded Fund (ETF) within the United States by the Securities and Exchange Commission (SEC), can have a considerable influence on Ethereum’s standing as a digital asset. BlackRock filed for a spot ETH ETF in mid-November 2023.

#3 Overall Crypto Market Trends:

Ethereum’s efficiency is intently tied to the broader cryptocurrency market. A normal uptrend within the crypto market, catalyzed by occasions just like the Bitcoin halving, can positively affect Ethereum’s worth.

#4 ETH Burn Rate:

Ethereum’s transition to a proof-of-stake (PoS) consensus mechanism features a mechanism referred to as EIP-1559, which introduces a fee-burning mechanism. The extra ETH is burned in transactions, the scarcer it turns into, probably rising its worth.

#5 Layer-2 Solutions:

The adoption and success of Ethereum layer-2 scaling options, similar to Optimistic Rollups and zk-Rollups, can considerably enhance the community’s scalability and scale back transaction charges. This might entice extra customers and builders.

#6 DeFi And NFT Activity:

Ethereum’s ecosystem closely depends on DeFi (Decentralized Finance) and NFT (Non-Fungible Token) functions. Increased adoption and exercise in these sectors can drive demand for ETH and positively influence its worth.

#7 Competition:

Ethereum faces competitors from different blockchain platforms like Solana and Cardano. The success or failure of those rivals can have an effect on Ethereum’s market place.

#8 Macroeconomic Factors:

Economic occasions, similar to inflation, financial coverage selections, and international monetary crises, can affect traders’ selections. Cryptocurrencies like Ethereum are typically seen as a hedge in opposition to conventional monetary instability.

#9 Network Security:

The safety of the Ethereum community is essential. High-profile hacks or vulnerabilities can undermine belief within the platform and result in worth declines.

#10 Ecosystem Development:

The development of the Ethereum ecosystem, together with the variety of dApps, customers, and builders, can have an effect on its adoption and worth.

EIP-1559: Understanding The Ethereum Burn Rate

Ethereum’s burn fee is a key side of its economics, influencing each its provide dynamics and long-term valuation. To grasp the Ethereum burn launched with EIP-1559, analyzing the most recent information and understanding how this mechanism operates inside the Ethereum ecosystem is essential.

Ethereum Is “Ultra Sound Money”

EIP-1559 was a proposal that basically restructured Ethereum’s charge market. Before this proposal, miners acquired the whole transaction charge. With activation on August 5, 2021, EIP-1559 launched a base charge for transactions, which is burned (completely faraway from circulation), and solely an non-compulsory tip is given to miners. This mechanism goals to make transaction charges extra predictable and the community extra environment friendly.

The “ultra sound money” meme emerged from the neighborhood in response to EIP-1559. It performs on the idea of “sound money,” a time period historically used to explain cash that isn’t vulnerable to depreciation and is a dependable retailer of worth, like gold.

With EIP-1559, Ethereum’s provide turns into extra predictable and probably deflationary—if the quantity of ETH burned exceeds the brand new ETH issued, the whole provide will lower over time, therefore the time period “ultra sound money.” This is seen as an enhancement over “sound money,” with Ethereum not simply sustaining its worth however probably rising it because of the lowering provide.

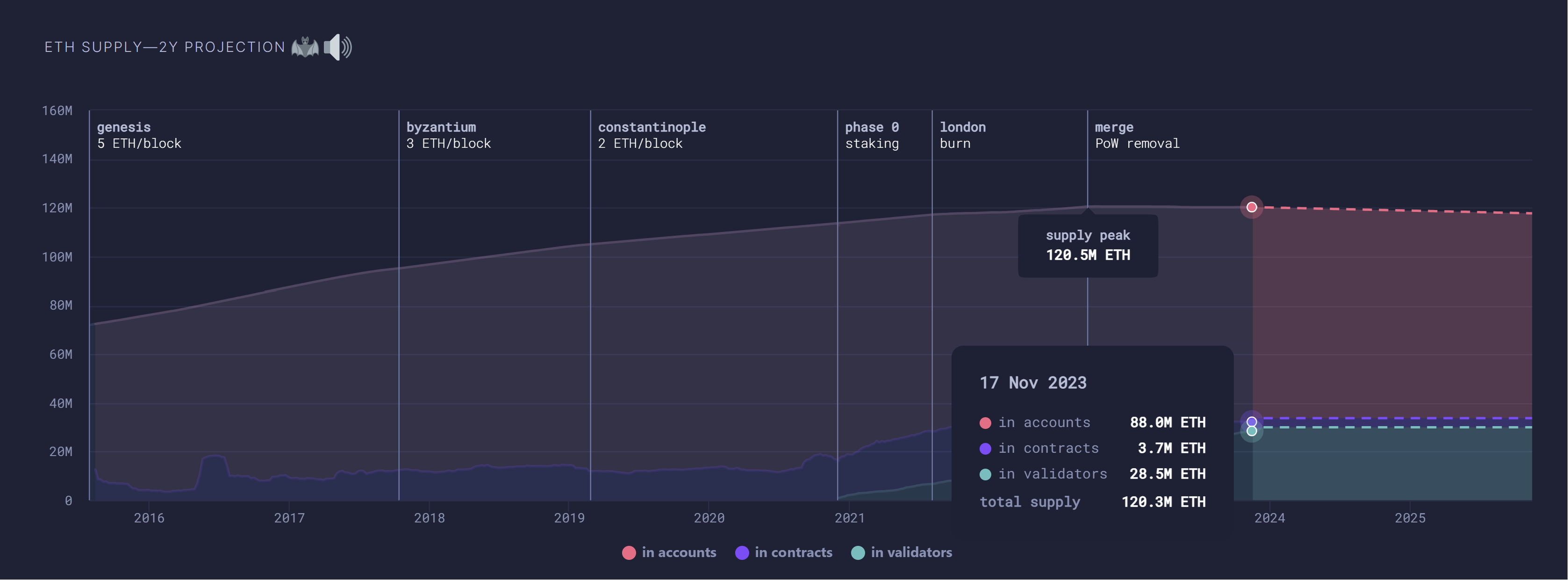

Ethereum Burn Rate Projections

The connected chart underscores the influence of those modifications on Ethereum’s provide, particularly post-EIP-1559, the place the provision curve begins to flatten, suggesting a discount within the development of Ethereum’s whole provide. This aligns with the idea of Ethereum changing into a deflationary asset post-EIP-1559, contributing to the narrative that Ethereum’s future might be as an “ultra sound” type of cash.

On November 17, 2023, the Ethereum provide stood at 88 million ETH in accounts, 3.7 million ETH in contracts, and 28.5 million ETH in validators, totaling 120.3 million ETH. The dotted line signifies Ethereums future lower in whole provide because of the burning of ETH and the issuance modifications post-Merge. The chart initiatives that the ETH provide will shrink to 117.7 million ETH in November 2025.

Ethereum’s Future: Will Ethereum Go Back Up?

In the realm of cryptocurrency, technical evaluation serves as a navigational device to gauge market sentiment and potential worth actions. Examining the 1-week ETH/USD chart offers perception into Ethereum’s worth motion and helps tackle the burning query: “will Ethereum recover?”

Fibonacci Levels And Price Targets

The chart showcases a number of Fibonacci retracement ranges, that are essential in figuring out potential assist and resistance zones based mostly on earlier worth actions. Here are the important thing Fibonacci retracement ranges highlighted:

- 0.236: At $1,847, this degree acts as a possible assist zone.

- 0.382: $2,441 is the following key Fib degree, displaying the following resistance.

- 0.5: The $2,922 degree represents a psychological midpoint.

- 0.618: At $3,402, this degree is usually thought of the ‘golden ratio,’ a big reversal level.

- 0.786: $4,085 is a deeper retracement degree that may sign power within the prevailing pattern.

- 1: The full retracement degree at $4,956 marks a whole return to all-time excessive.

- 1.618: At $7,471, this prolonged Fib degree might be the primary long-term bullish goal.

- 2.618: $11,540 represents an optimistic projection in a powerful Ethereum bull run.

- 3.618: This degree at $15,609 could be a unprecedented goal for a sustained bull run.

- 4.236: The $18,123 Fib degree is the best projected goal on the chart, indicating an excessive bull case state of affairs.

Trend Lines, Resistance Zones And RSI

The chart exhibits a black ascending pattern line, tracing the lows and signifying a possible space of assist that Ethereum’s worth might respect. If the value maintains above this line, it could point out continued bullish sentiment.

The crimson field, or resistance zone, across the Year-To-Date (YTD) excessive at $2,137 underscores a area the place sellers have beforehand entered the market. Overcoming this zone is important for Ethereum to proceed its upward trajectory.

The Relative Strength Index (RSI), sitting at 48.07, exhibits Ethereum is neither within the overbought nor oversold territory. This signifies a impartial momentum, which might precede a transfer in both course.

Conclusion: Will Ethereum Recover?

While the chart presents robust arguments for an Ethereum bull run, with ETH worth sustaining above important assist ranges and difficult notable resistance zones, the longer term worth motion will rely on how the market interacts with these technical indicators. If Ethereum can break by the resistance encapsulated by the YTD excessive, we might see an affirmative reply to “Will Ethereum recover?” However, it’s crucial for traders to watch these ranges intently, as they function a roadmap, not a crystal ball.

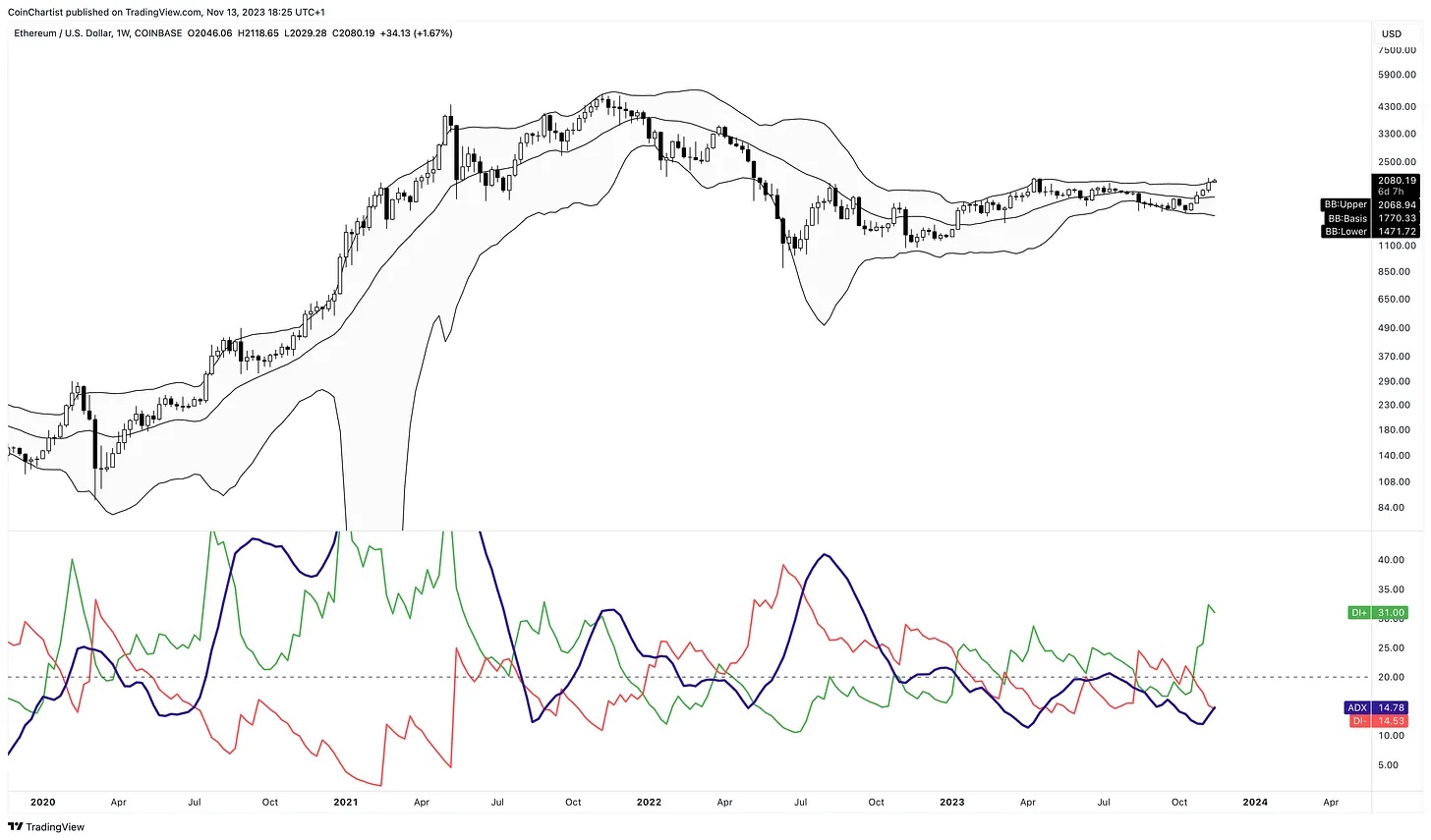

Ethereum Price Prediction By NewsBTC’s Head Of Research

Tony “The Bull” Severino, NewsBTC’s Head of Research, has supplied an in-depth evaluation of Ethereum’s market habits in his newest version of Coin Chartist. He observes, “Ethereum has yet to begin trending with a reading above 20 on the ADX, nor has it broken above the upper Bollinger Band. But these signals are likely coming soon.” This suggests Ethereum’s important uptrend is perhaps on the horizon.

Comparing Ethereum with Bitcoin, Severino notes, “ETHUSD is much lower within the Ichimoku Cloud than BTCUSD,” indicating Ethereum is presently lagging behind Bitcoin. However, he anticipates Ethereum will quickly “switch to over-performance.”

Highlighting a constructive growth, Severino states, “ETHUSD 1W was finally able to crack above its TDST downtrend resistance.” Yet, Ethereum must type a perfected TD9 collection for additional bullish affirmation. On the month-to-month chart, Ethereum’s overbought standing on the Stochastic indicator suggests a powerful pattern, as Severino factors out, “Each time the Stochastic has confirmed a 1M above 80 on the Stock, there was a massive push higher.”

Looking forward, Severino underscores the significance of Ethereum’s efficiency in opposition to Bitcoin, “But if ETHBTC can push back above 20 this will generate a buy signal on the 1M Stochastic and kickstart Ether’s over-performance above Bitcoin.” This evaluation offers an in depth perspective on Ethereum’s potential future trajectory within the crypto market.

Ethereum 2.0 Price Prediction

The steady evolution of Ethereum by its 2.0 upgrades units the stage for an optimistic worth prediction. As the community turns into extra scalable, safe, and sustainable, the intrinsic worth of Ethereum is prone to improve.

The profitable completion of the Shanghai/Capella improve, which launched staking, is already a big milestone that demonstrates the community’s dedication to its roadmap. Such developments are anticipated to bolster investor confidence and will catalyze a bullish outlook for Ethereums future worth.

Ethereum 2.0 Roadmap

Ethereum 2.0 represents a collection of upgrades geared toward enhancing the community’s scalability, safety, and sustainability. Contrary to the earlier time period ‘ETH2’, the roadmap is now outlined by extra particular improve milestones:

Past and Completed Upgrades

The Merge: This important improve on September 15, 2022 marked Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoS) and was a foundational step within the Ethereum 2.0 roadmap, eliminating the necessity for energy-intensive mining.

Another key function, staking withdrawals has already been enabled with the Shanghai/Capella improve, which went dwell on April 12, 2023

Future Ethereum Upgrades

- The Surge: The subsequent section includes scalability enhancements by rollups and information sharding. Danksharding, a key element, goals to make layer 2 rollups cheaper by incorporating “blobs” of information into Ethereum blocks.

- The Scourge: This section focuses on making certain censorship resistance, decentralization, and addressing protocol dangers, similar to these arising from miner extractable worth (MEV).

- The Verge: It is designed to make verifying blocks simpler.

- The Purge: This stage goals to cut back computational prices and simplify the protocol, making operating nodes extra environment friendly.

- The Splurge: This contains miscellaneous upgrades that don’t match into the opposite classes however are important for the community’s development and enhancement.

The Ethereum neighborhood has changed the time period “Ethereum 2.0” with extra particular names for every improve, offering clearer perception into the community’s transition and enhancements. These upgrades purpose to show Ethereum into a totally scaled, resilient platform, able to supporting a world decentralized software system. As implementation of those phases progresses, Ethereum’s rising enchantment as an funding might positively affect its worth predictions.

Proto-Danksharding: EIP-4844

EIP-4844 introduces “shard blob transactions” to reinforce Ethereum’s information availability in a manner that aligns with future full sharding plans. This proposal creates a brand new transaction format containing “blobs” – giant information segments important for rollups, a Layer 2 resolution, however inaccessible for EVM execution. It serves as a short lived scaling resolution, bridging the hole till full sharding implementation.

Notably, rollups have grow to be more and more essential for scaling Ethereum, as they provide a strategy to execute transactions outdoors the principle Ethereum chain (Layer 1) after which submit the info again to Layer 1. EIP-4844’s format is anticipated to enormously scale back transaction charges for rollups by providing a less expensive information storage mechanism in comparison with present strategies.

Full Danksharding

Full Danksharding, which advances from Proto-Danksharding, will seemingly additional scale back prices for Layer 2 rollups. It introduces “blobs” in a format slated to be used within the last sharding design. This features a new transaction kind and an impartial charge marketplace for these blobs.

Full Danksharding will construct on Proto-Danksharding and goals to additional minimize Layer 2 rollups’ prices. It will comprehensively implement information availability sampling and important parts for a totally sharded Ethereum community, together with proposer-builder separation and proof of custody. This strategy goals to assign solely a portion of the info to validators, lowering the community’s load and enhancing scalability.

Ethereum 2.0 Price Predictions: Will Ethereum Recover?

As Ethereum continues to progress with its 2.0 upgrades, the monetary neighborhood has been actively speculating on its future worth. Here are some Ethereum worth predictions from famend establishments and analysts, answering the query “will Ethereum recover”:

VanEck: The funding administration agency predicts that Ethereum’s worth might attain as excessive as $11.8k by 2030. This projection is predicated on their evaluation that Ethereum’s community revenues might rise from $2.6 billion to $51 billion in 2030, assuming Ethereum captures a 70% market share amongst sensible contract platforms.

Standard Chartered: Analysts at Standard Chartered are bullish on Ethereum’s long-term potential. They forecast that the value of ETH might hit $4,000 by the tip of 2024 and double to $8,000 by the tip of 2026. Their Ethereum bull run prediction is predicated on Ethereum’s established dominance in sensible contract platforms and the potential for rising makes use of in areas like gaming and tokenization. Moreover, they recommend that the upcoming Bitcoin halving in April 2024 might positively influence the broader crypto market, particularly Ethereum.

Also, the potential approval of a spot Ethereum ETF within the US might considerably influence Ethereum’s worth. BlackRock, the world’s largest asset supervisor, filed for a spot Ethereum ETF in mid-November 2023. The approval of this ETF would mark a significant milestone for Ethereum, probably attracting extra institutional and retail investments and considerably boosting Ethereum’s market worth.

FAQ: Ethereums Future

Will Ethereum get well?

Ethereum’s restoration will depend on numerous components together with market tendencies, technological developments, and broader financial situations. With ongoing upgrades like Ethereum 2.0, many analysts stay optimistic about its long-term potential.

Will Ethereum Go Back Up?

Many market specialists predict Ethereum will return up. They are citing enhancements from Ethereum 2.0 and rising adoption in DeFi, NFTs and conventional finance.

Where Is Ethereum Going?

Ethereum is transitioning to a extra scalable, safe, and sustainable community with Ethereum 2.0. This is probably resulting in elevated adoption and worth.

What Is The Ethereum Burn?

The Ethereum burn, launched in EIP-1559, completely destroys part of transaction charges, probably creating deflationary strain on Ethereum’s provide.

Is Ethereum Going Back Up?

Current market predictions and the event roadmap recommend potential for Ethereum’s worth to extend. But the precise trajectory will rely on a number of components.

How Many Ethereum Burned So Far?

When Will The Ethereum Bull Run Start?

The begin of a bull run for Ethereum is speculative. It will depend on market cycles, investor sentiment, and important catalysts like upgrades and regulatory developments.

Will Ethereum Go Down?

Market volatility is inherent to cryptocurrencies. While Ethereum might expertise downturns, its basic growth goals to mitigate such dangers and foster development.

What Will Be The Future Price Of Ethereum?

Various predictions exist, starting from reasonable will increase to excessive valuations by 2030. Standard Chartered predicts $8,000 per ETH by the tip of 2026.

Is Ethereum Going To Go Back Up?

The normal consensus amongst many analysts is constructive. The worth of Ethereum is anticipated to rise because it develops and turns into extra widespread within the blockchain sector.

Featured picture from Shutterstock, charts from TradingView.com