Renowned Economist Peter Schiff has warned about an imminent fall within the US Dollar and the nation’s economic system. If his warning is something to go by, then a case may very well be made for cryptocurrencies and Bitcoin in particular.

US Dollar On Verge Of Historic Crash

In a post shared on his X (previously Twitter), Peter Schiff said that the US greenback is on the verge of a historic crash. He highlighted how this might have an effect on the nation’s economic system as inflation, rates of interest, and unemployment would soar. The economist appears to imagine that the autumn within the forex will likely be catastrophic as he says, “It’s crash and burn.”

Schiff went on to again up his level in a subsequent post. He said that the US economic system is already in recession. He famous that though the nation’s GDP grew by 5.2% in Q3, the federal government’s spending contributed 5.5% to this. He additionally alluded to the truth that this cash spent was borrowed cash and didn’t mirror “real economic growth.”

He sounded a observe of warning to those that could also be seeking to put money into bonds to hedge towards this financial downturn. According to him, the economic system is weaker than the Feds assume, and this may end in bigger funds deficits and higher inflation. This, he believes, is bearish for bonds.

BTC bulls maintain above $37,000 | Source: BTCUSD on Tradingview.com

Bitcoin Could Be The Most Viable Alternative

In all of this, Schiff gave the impression to be making a case for Gold as he said the world would flip to it because the “most viable alternative” to keep away from getting burned. However, cryptocurrencies (Bitcoin specifically) can argued to be a greater various. In one in every of his posts, he hinted at how Gold was underperforming, and one might take a cue from that as to why crypto tokens could also be higher.

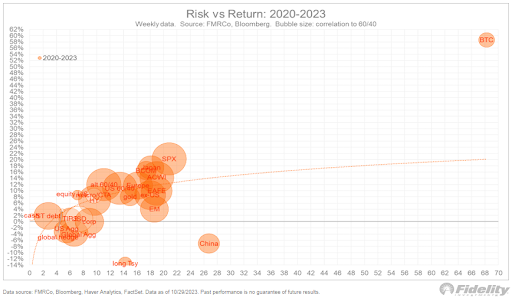

Despite being in a bear market, Bitcoin is among the best-performing assets of the 12 months. The Director of Global Macro at Fidelity Investments, Jurrien Timmer, not too long ago made case for Bitcoin. Timmer highlighted how Bitcoin’s options permit it to be a “high-powered hedge towards financial shenanigans.

In comparability to different asset lessons, Timer additionally famous how Bitcoin stood out. The flagship cryptocurrency provided the best risk-reward with a 58% return based mostly on information starting from 2020 to this 12 months. In phrases of drawdowns and rallies, Bitcoin additionally stood out with an 84% acquire from its 2-year low.

Source: Fidelity Investments

Specifically, Timmer said that Government bonds “can’t hold a candle” to Bitcoin’s risk-reward math. In comparability to Gold, the Fidelity Director additionally steered that Bitcoin was higher than Gold, contemplating that he labeled it as “exponential gold.”

Featured picture from E-Commerce Times, chart from Tradingview.com