A current evaluation by crypto professional CryptoCon, specializing in the Ichimoku Cloud indicator, suggests a bullish outlook for Bitcoin, with a possible rally to $48,000 by early January.

CryptoCon, in his newest analysis, highlighted the reliability of the Weekly Ichimoku Cloud, stating, “The Weekly Ichimoku cloud called our last Bitcoin rise to $38,000 2 months in advance with the cross projected in the future.”

The analyst’s confidence stems from the indicator’s historic efficiency, which has reportedly signaled earlier worth actions with appreciable accuracy – 11 weeks, 7 weeks, and 13 weeks upfront.

Bitcoin Rally To $48,000 Ahead?

The chart by CryptoCon’s assertion delineates 4 distinct cycles, every marked by important worth occasions and the Ichimoku Cloud’s predictive crosses. The present cycle, known as Cycle 4 spanning from 2023 to 2026, exhibits a Leading Span Cross – an important sign inside the Ichimoku Cloud methodology – pointing in direction of an upward trajectory.

CryptoCon explains, “Now we wait for it to fill its next calls, the completion of our rise and the first target of 43k.” This anticipation relies on the noticed durations from the Leading Span Cross to the respective native tops, starting from 7 to 11 weeks, with a mean of 10 weeks. If the sample holds, the advised timeline locations the completion of this rise in early January.

The evaluation additional emphasizes the potential for Bitcoin to achieve the higher limits of the pink part of the Ichimoku Cloud, often known as the “Leading Span B.” According to CryptoCon, “The most conservative level here is 43.2k, but the true top of the red cloud could be labeled as high as 48k.”

It’s value noting that the Ichimoku Cloud is a complete indicator that gives insights into market momentum, development course, and assist and resistance ranges. The instrument is very regarded for its forward-looking capabilities, particularly the “clouds,” that are projected 26 intervals forward of the present worth to recommend future potential assist or resistance zones.

BTC Price Floor Could Be $41.200 Post Halving

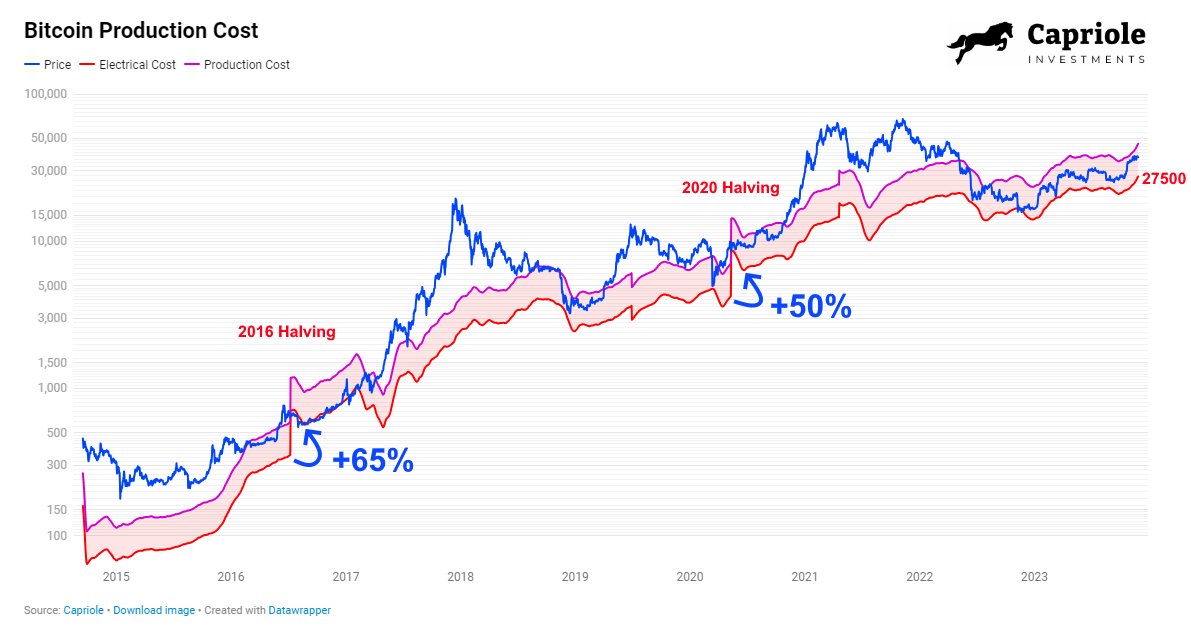

On a associated note, Charles Edwards, the founding father of Capriole Investments, supplied a data-driven perspective on the way forward for Bitcoin’s worth ground. With the next Bitcoin Halving occasion scheduled in April 2024, Edwards tasks important adjustments within the mining economics of the main cryptocurrency.

“In April 2024, Bitcoin’s Electrical Cost, the raw energy cost of mining Bitcoin, will double overnight. This is a certainty,” Edwards declared, drawing consideration to the predictable nature of the Halving occasion which slashes the reward for mining Bitcoin transactions in half. This systemic shift will doubtless push inefficient mining operations out of the market, as they grapple with all of a sudden halved income in opposition to a backdrop of static bills.

Edwards’ evaluation of previous Halving occasions reveals a development the place the Electrical Cost—basically the ground for Bitcoin’s worth—settles at a considerably greater degree post-Halving.

“In the last two Halvings, Electrical Cost bottomed at +65% and +50% of the pre-Halving values,” he notes. If this sample holds true, and the Electrical Cost bottoms at +50% this time round, it’s estimated that “the historic price floor of Bitcoin will be $41.2K in just 5 months’ time.”

At press time, BTC was buying and selling in the midst of the vary at $37,146. Even although BTC has damaged out of the development channel to the draw back, the worth is making additional greater lows.

Featured picture from Shutterstock, chart from TradingView.com