Yearn.finance (YFI) worth tumbles 45% inside a couple of hours, falling from $14,500 to $8,300. The crypto market units eyes on it as one of many largest platforms within the DeFi ecosystem witnessing a large selloff, inflicting individuals to take a position whether or not any suspicious issues are occurring with yearn.finance.

Yearn.finance (YFI) Tumbles 45%

In a stunning transfer on November 18, Yearn.finance (YFI) fell 45% inside hours, dropping most of its latest positive aspects. The transfer comes as buyers liquidated their YFI holdings amid the recent selloff within the border crypto market.

YFI worth has rallied greater than 160% in November, touching a excessive of $15,591. In the final 24 hours, the value tumbled from $15,591 to $8,421. Over $250 million in market cap vanished in hours, down from $525 million to $275 million. The market cap is once more rising, however buyers have misplaced confidence as a result of sudden fall.

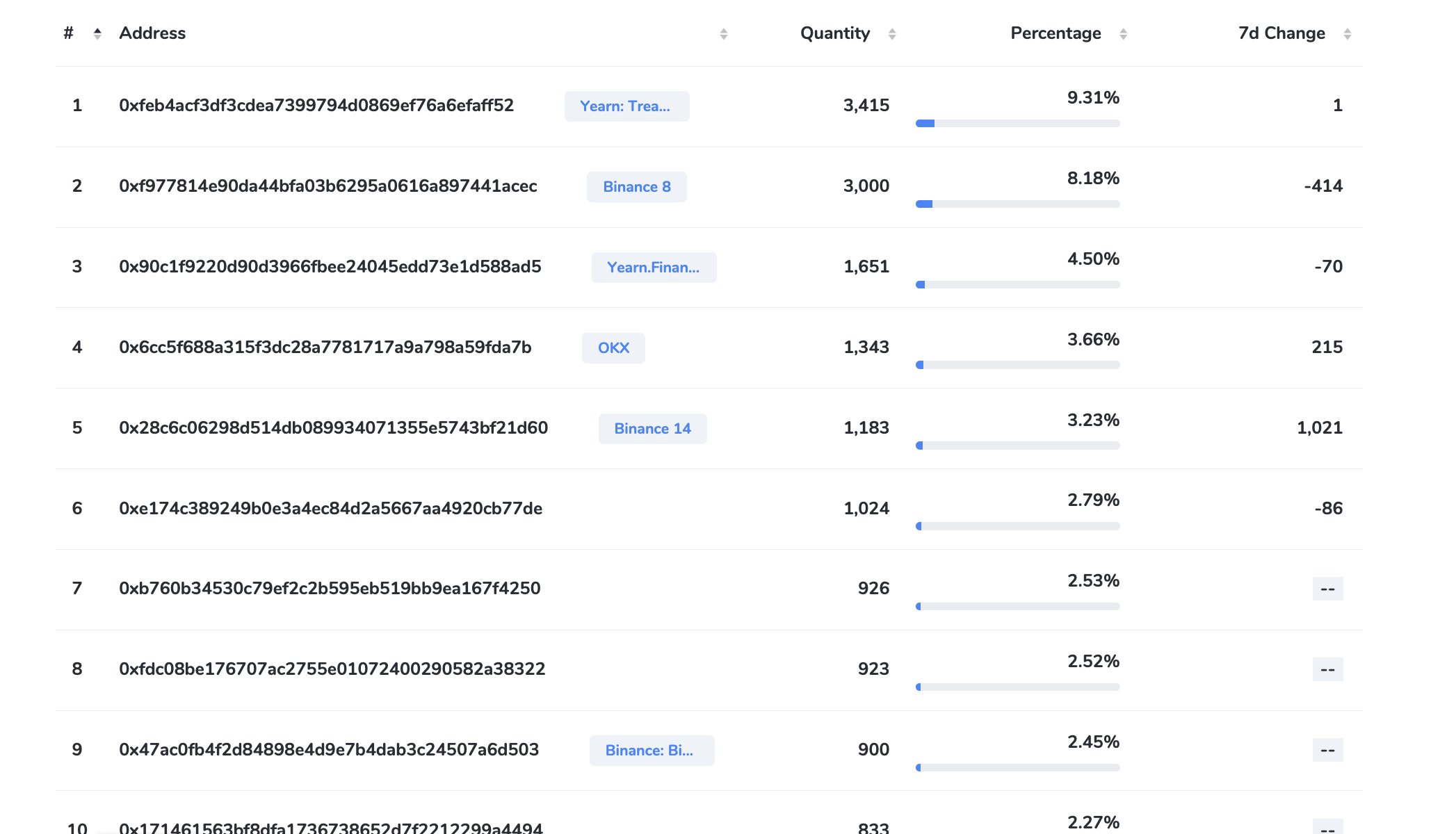

Some consider it’s an obvious exit rip-off by insiders as practically half of the complete provide for YFI is held in 10 wallets. These embody crypto exchanges’ pockets addresses.

According to Coinglass knowledge, YFI noticed greater than $5 million in liquidation within the final 24 hours. YFI contract positions as soon as reached as excessive as $162 million. Currently, YFI positions on main platforms have dropped. Furthermore, YFI open curiosity (OI) has elevated considerably, indicating that merchants are making brief positions on YFI.

Also Read: Bloomberg Analysts Expect Delays In All ETFs As US SEC Defers Two Spot Bitcoin ETF

Altcoins Continue to Pull Back

Major altcoins stay beneath strain amid the broader market selloff, with Bitcoin slowly regaining dominance. The market cap has fallen by nearly $25 billion in 2 days. Analysts count on extra pullbacks earlier than one other capital influx again into altcoins.

ETH, XRP, SOL, ADA, and different main altcoins fell practically 3% within the final 24 hours. DeFi tokens are taking successful and dragging the worldwide market cap additional decrease.

Also Read: Greg Brockman And Sam Altman Shocked On OpenAI’s Board Decision, Shared Views

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.