Polkadot (DOT), one of many distinguished blockchain networks within the crypto house, skilled a 16% decline in market capitalization within the third quarter (Q3) of 2023, based on a current report from Messari.

This decline got here after a reasonable downturn within the total cryptocurrency market throughout Q3, regardless of favorable court docket rulings for XRP and Grayscale. The complete crypto market capitalization declined by 5.8%, with Bitcoin (BTC) and Ethereum (ETH) falling by 7.5% and 10.0%, respectively.

Polkadot Closes Q3 With $5.2 Billion Market Cap

As reported by Messari, Polkadot’s market capitalization closed at $5.2 billion, positioning it because the thirteenth largest crypto asset by market cap in Q3 2023 (at present fifteenth).

Polkadot’s monetary construction is predicated on a weight-based charge mannequin, which differs from the gas-metering mannequin in different networks, similar to Ethereum.

Transaction charges in Polkadot are decided and charged earlier than execution, with the calculation comprising a weight charge reflecting computational assets, a size charge based mostly on transaction measurement, and an optionally available tip to incentivize block authors.

In Q3 2023, Polkadot generated revenue amounting to $94,000, representing a 3% lower in comparison with the earlier quarter. Messari means that Polkadot’s income tends to be comparatively decrease in comparison with its rivals as a result of community’s structural design.

On the opposite hand, the native token of Polkadot, DOT, serves three major functions: governance, staking, and parachain bonding. During Q3 2023, the staking share of DOT rose by 12% in comparison with the earlier quarter, reaching 49%.

This improve led to lowered staking rewards and a 12% decline within the annualized nominal yield to fifteen%. According to Messari, the shut alignment of Polkadot’s staking fee with the best fee demonstrates the effectiveness of its mechanism.

Polkadot’s OpenGov Milestone

The Polkadot treasury supported varied initiatives in Q3, together with software program improvement, bounties, shopper upgrades, and group occasions like meetups and hackerspaces.

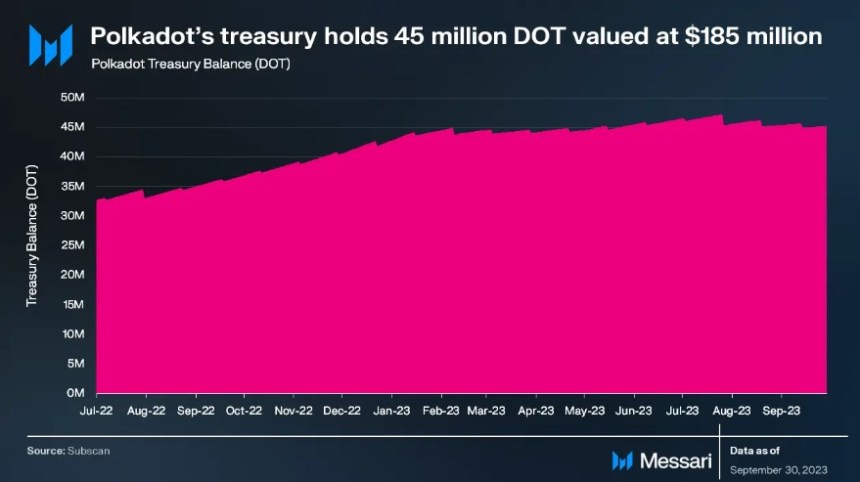

According to Messari, the implementation of OpenGov on June 15 marked a big milestone, revolutionizing treasury administration and enabling concurrent proposals with distinct necessities. At the top of the quarter, the Polkadot treasury held roughly 45 million DOT ($185 million).

Furthermore, Polkadot has not too long ago accomplished the official launch of Polkadot 1.0, marking the achievement of a big milestone outlined within the Polkadot whitepaper.

The community’s codebase has been absolutely transitioned to a repository managed by the group via Polkadot OpenGov and the Technical Fellowship. The roadmap for the following iteration, Polkadot 2.0, shall be decided via group discussions and consensus.

Founder Gavin Wood has proposed concepts for extra mechanisms to allocate Polkadot’s block house and for creating treaty-like agreements between a number of blockchains referred to as “accords.”

As of this writing, the DOT token has exhibited a noteworthy upward pattern since October 19, carefully following Bitcoin’s lead. Presently, the token is buying and selling at $4,839, reflecting a notable improve of over 16% throughout the previous fourteen days.

Featured picture from Shutterstock, chart from TradingView.com